Content

Published:

This is an archived release.

More debt due to fall in exchange rate

In the 3rd quarter of 2015, moderate values were registered of new debt securities issued by Norwegian entities. Nevertheless, Norwegian entities’ outstanding amounts from debt securities rose by 10 per cent compared with the same quarter last year due to a fall in the exchange rate.

| Long-term debt securities issued in Norway | Long-term debt securities issued in Norway | Short-term debt securities issued in Norway | Short-term debt securities issued in Norway | Debt securities issued abroad | Debt securities issued abroad | |

|---|---|---|---|---|---|---|

| Number | Amount | Number | Amount | Number | Amount | |

| Corrected 30 November 2015. | ||||||

| September 2015 | 91 | 28 633 | 129 | 37 473 | 67 | 67 068 |

| August 2015 | 63 | 20 723 | 79 | 17 102 | 89 | 36 658 |

| July 2015 | 37 | 12 678 | 47 | 7 651 | 65 | 47 016 |

| June 2015 | 101 | 37 572 | 96 | 36 506 | 87 | 37 632 |

| May 2015 | 83 | 35 230 | 84 | 18 140 | 96 | 63 971 |

| April 2015 | 66 | 22 488 | 77 | 18 383 | 67 | 60 003 |

| March 2015 | 90 | 47 606 | 120 | 35 615 | 125 | 73 636 |

| February 2015 | 70 | 32 510 | 84 | 17 147 | 101 | 89 554 |

| January 2015 | 67 | 29 518 | 80 | 24 437 | 95 | 68 900 |

| December 2014 | 66 | 20 310 | 84 | 26 462 | 58 | 21 124 |

| November 2014 | 91 | 26 634 | 97 | 17 782 | 76 | 75 737 |

| October 2014 | 70 | 32 236 | 85 | 15 205 | 112 | 68 205 |

| September 2014 | 104 | 32 266 | 107 | 35 821 | 119 | 83 620 |

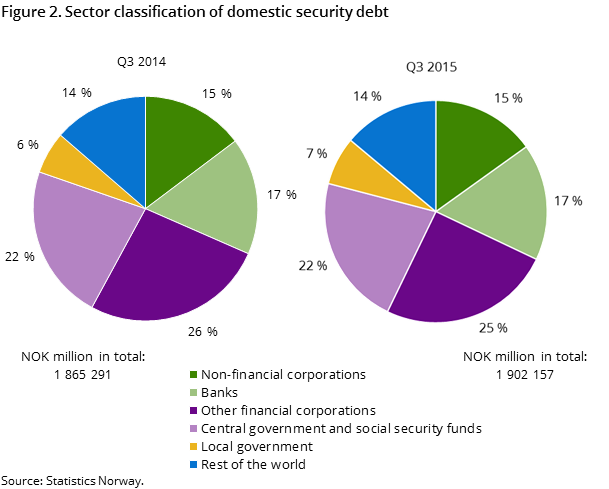

The nominal value of outstanding amounts from debt securities referring to issues in Norway amounted to NOK 1 902 billion at the end of September 2015. This is a growth of 2 per cent compared to the end of September 2014. The growth of these outstanding debts is partly due to a depreciation of NOK, as 8 per cent of the debts are raised in other currencies.

Sharp increase in Norwegian entities’ debts caused by a fall in exchange rate

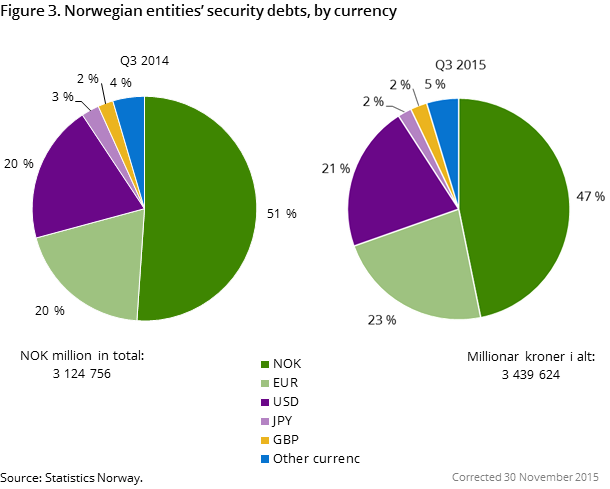

Eighty-six per cent of the outstanding amounts from debt securities issued in Norway referred to Norwegian issuers at the end of September 2015. At the same time, outstanding amounts from debt securities issued by Norwegian entities abroad amounted to NOK 1 802 billion; an increase of 19 per cent compared with the end of September last year1. As a result of this, outstanding amounts from Norwegian entities’ issues of debt securities in Norway and abroad amounted to NOK 3 440 billion at the end of September 20151. While a major part of debt securities in Norway are issued in NOK, debt securities are issued by Norwegian entities abroad in other currencies. A depreciation of NOK had an impact on Norwegian entities’ debts especially in USD, EUR, GBP and JPY, from September 2014, which continued into the 3rd quarter of 2015. This led to 10 per cent growth in Norwegian entities’ outstanding amounts from debt securities issued in Norway and abroad in the same period.

Financial corporations have a dominant share of the domestic debts

The largest share of the outstanding amounts from debt securities issued in Norway, 42 per cent, referred to financial corporations. The second largest share of the debts, 29 per cent, referred to the general government. The average market value of outstanding amounts from issues of long-term debt securities in Norway was 2.7 per cent higher than the face value, while the market value of outstanding amounts from issues of short-term debt securities was 0.4 per cent lower than the face value.

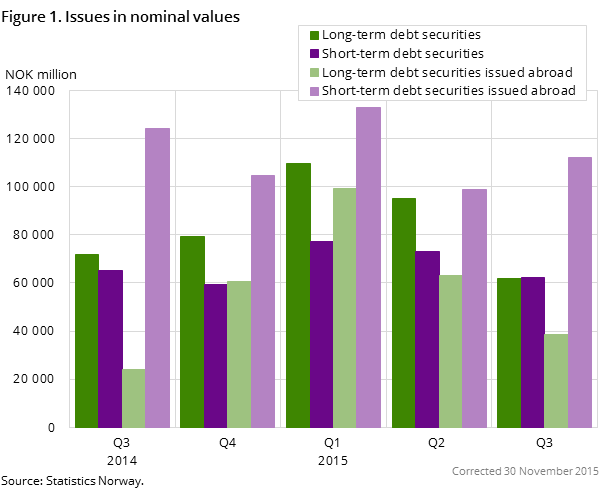

Moderate volumes of new debt securities in the 3rd quarter of 2015

In Norway, 191 issues of long-term securities and 256 issues of short-term securities valued at NOK 124 billion were registered in the 3rd quarter of 2015. The volumes for new long-term securities and new short-term securities were equal.

Compared to the 3rd quarter of 2014, the number and amount of issues in Norway were reduced by 7 per cent and 9 per cent respectively. This is caused by a decline in issues by “the general government” and financial corporations other than banks. In the same period, Norwegian entities also issued 221 debt securities abroad, valued at NOK 151 billion. Compared to the 3rd quarter of 2014, the number of these issues was reduced by 18 per cent, while their value rose by 2 per cent1.

The general government has a dominant share of new debt securities in Norway

The share of the volume of issues by the general government in Norway was reduced from 49 per cent in the 3rd quarter of 2014 to 46 per cent in the 3rd quarter of 2015. In the same period, financial corporations’ share of the volume of issues rose from 28 per cent to 31 per cent. ‘Rest of the world’ and non-financial corporations’ shares of the volume were marginally changed.

Increase in the general government’s issues of debt securities abroad

The share of the volume of issues by the general government in Norway rose from 9 per cent in the 3rd quarter of 2014 to 15 per cent in the 3rd quarter of 2015. The share of the volume of issues by banks was on the other hand reduced from 74 per cent to 68 per cent in the same period.

1 Due to a lack of an exchange rate, figures for Norwegian entities' issues and debts abroad have been corrected in the statistics from Q2 2015 and onwards.

Statistics updated from 2012Open and readClose

Due to a non-response error which has been discovered, figures for Norwegian entities' issues abroad have been corrected in the statistics from 2012 onwards.

The statistics is now published as Securities.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42