Higher earned premiums for non-life insurance

Published:

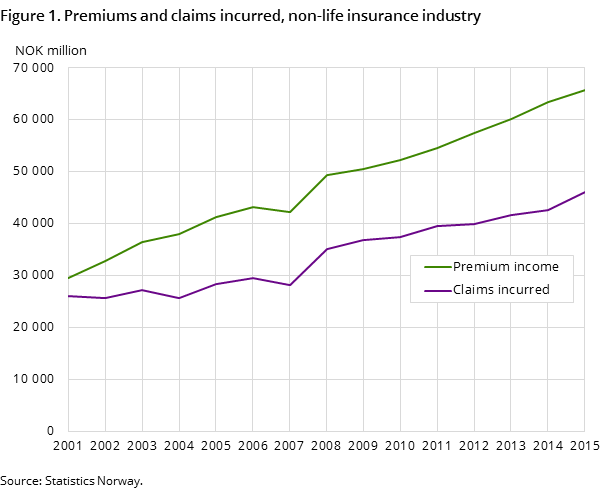

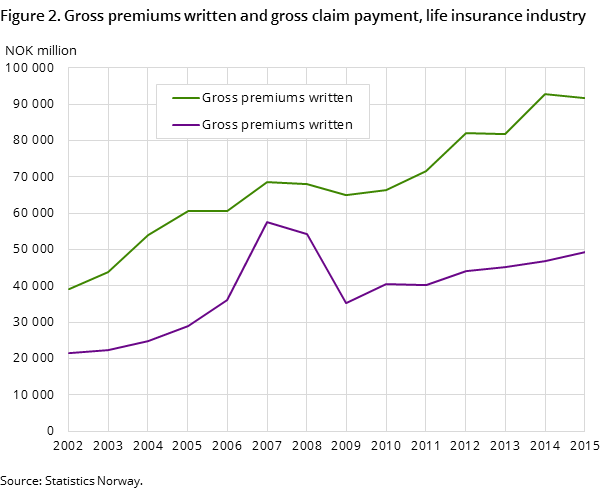

In 2015, non-life insurance companies had a 3.5 per cent increase in their earned premiums compared to the year before. Life insurance companies had a decrease in their gross premium income of 1.1 per cent.

- Full set of figures

- Life and non-life insurance companies, accounts

- Series archive

- Life and non-life insurance companies, accounts (archive)

The nominal growth in premium income for the non-life insurance industry was NOK 2.2 billion in 2015. During the same period, the growth in claims incurred was NOK 3.4 billion, an increase of 8 per cent compare to 2014.

Motor vehicle; decrease in earned premiums

Motor vehicle insurance services had a decrease of 1.1 per cent in 2015, while claims incurred decreased by 3.8 per cent.

Decrease in premiums written for life insurance

Premiums written for life insurance decreased by 1.1 per cent from 2014 to 2015. During the same period, gross claim payments increased by 5.3 per cent and amounted to NOK 49.2 billion.

Decrease in premiums written for defined contribution pension schemes

Defined contribution pension schemes have the largest share of the premiums written and gross claim payments for life insurance. From 2014 to 2015, premiums written for defined contribution schemes decreased by 4.7 per cent, while gross claim payments increased by 3.2 per cent. Individual life insurance services had the greatest increase in premiums written of 21.1 per cent. During the same period, gross claim payments increased by 18.8 per cent.

Contact

-

Kjell Hammer

-

Ola Tveita

-

Heidi Vegsund

-

Statistics Norway's Information Centre