Content

Published:

This is an archived release.

Increased net assets abroad at year end

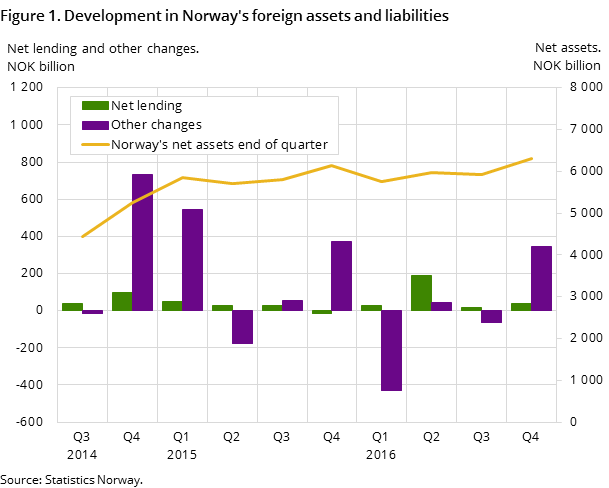

Norwegian foreign net assets increased between the 3rd quarter of 2016 and the 4th quarter of 2016 by NOK 380 billion. Net assets ended at NOK 6 315 billion after the 4th quarter of 2016. After a small decrease in net assets in the 3rd quarter, they increased again in the year’s last quarter.

| Opening balance | Transactions | Other changes | Closing balance | |

|---|---|---|---|---|

| Foreign assets | 12 863 773 | -150 737 | 464 931 | 13 177 967 |

| Direct investment | 1 933 226 | -87 131 | 3 013 | 1 849 108 |

| Portofolio investment | 8 683 123 | 20 040 | 424 902 | 9 128 065 |

| Other investments | 1 740 714 | -70 613 | 9 673 | 1 679 774 |

| Reserve assets (IMF breakdown) | 506 710 | -13 033 | 27 343 | 521 020 |

| Liabilities | 6 928 499 | -186 407 | 121 351 | 6 863 443 |

| Direct investment | 1 799 734 | -189 382 | 36 499 | 1 646 851 |

| Portofolio investment | 2 925 155 | 16 567 | 69 766 | 3 011 488 |

| Other investments | 2 203 610 | -13 592 | 15 086 | 2 205 104 |

| NET ASSETS | 5 935 274 | 35 670 | 343 580 | 6 314 524 |

In total, Norwegian assets abroad amounted to NOK 13 178 billion at the end of the 4th quarter of 2016. The foreign liabilities in the same period amounted to NOK 6 863 billion. This gives a net assets balance of NOK 6 315 billion. Changes in assets and liabilities’ positions are split into transactions and other changes. The transactions are published in the balance of payments. Net lending was NOK 36 billion in the 4th quarter.

Net other changes amounted to NOK 344 billion in the 4th quarter. The Norwegian krone depreciated this quarter against most foreign currencies in contrast to the appreciation of the preceding quarter. Net other changes were therefore affected positively by the exchange rate. The financial markets ended the year altogether in a positive way. So both exchange rates and market prices influenced net other changes positively this quarter. In total, net other changes contributed largely to the increase in the net assets in the 4th quarter.

Higher portfolio investment abroad

At the end of the 4th quarter of 2016, the Norwegian assets of portfolio investments amounted to NOK 9 128 billion. This was an increase of NOK 445 billion from the 3rd quarter, and NOK 61 billion higher than the year end of 2015. The increase in 2016 can be divided into NOK 93 billion in financial transactions and minus NOK 32 billion in other changes.

Distributed between instruments, it is equity securities that have the highest financial transactions, with NOK 92 billion in 2016. Investment fund shares and debt securities experienced smaller financial transactions during the last year. Other changes have affected debt securities the most in 2016. More precisely, the stock of debt securities has decreased by NOK 90 billion the last year because of other changes. By comparison, equity securities and investment fund shares are affected positively by other changes in the same period with NOK 48 and 9 billion respectively.

RevisionsOpen and readClose

This publication includes revisions dating back to the 1st quarter of 2015.

The statistics is now published as International accounts.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42