Content

Published:

This is an archived release.

Stability in net assets abroad

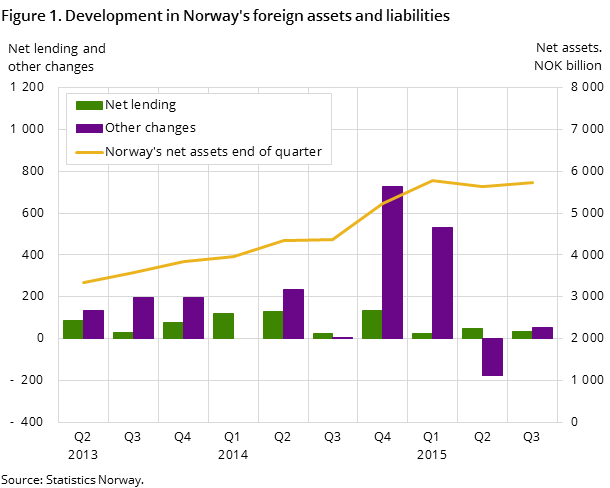

Norwegian foreign net assets increased between the 2nd quarter and the 3rd quarter of 2015 by NOK 82 billion. After the increase of net assets in 2013 and 2014, the figures are relatively stable in the three quarters of 2015.

| Opening balance | Transactions | Other changes | Closing balance | |

|---|---|---|---|---|

| Foreign assets | 12 255 556 | 227 492 | 194 427 | 12 677 475 |

| Direct investment | 1 758 592 | 4 280 | 18 824 | 1 781 696 |

| Portofolio investment | 8 342 989 | 86 978 | 71 517 | 8 501 484 |

| Other investments | 1 639 112 | 160 257 | 73 586 | 1 872 955 |

| Reserve assets (IMF breakdown) | 514 863 | -24 023 | 30 500 | 521 340 |

| Liabilities | 6 608 873 | 196 123 | 143 339 | 6 948 335 |

| Direct investment | 1 697 682 | -38 641 | 43 122 | 1 702 163 |

| Portofolio investment | 2 817 362 | 48 985 | 31 464 | 2 897 811 |

| Other investments | 2 093 829 | 185 779 | 68 753 | 2 348 361 |

| NET ASSETS | 5 646 683 | 31 369 | 51 088 | 5 729 140 |

In total, Norwegian assets abroad amounted to NOK 12 677 billion in the 3rd quarter of 2015. The foreign liabilities in the same period amounted to NOK 6 948 billion. This gives a net assets balance of NOK 5 729 billion. Changes in assets and liabilities positions are split into transactions and other changes. The transactions are published in the balance of payments.

Net other changes amounted to NOK 51 billion in the 3rd quarter. Gross other changes were positive both on the asset and liability side this quarter. This can largely be explained by currency changes during the period.

Net portfolio investment showed an increase in the positions of NOK 78 billion between the 2nd and 3rd quarter. The reduction of equity and investment fund shares was driven by negative market prices, and net positions decreased by NOK 85 billion. The increase in debt securities was mainly due to positive exchange rates, and the net position increased by NOK 163 billion.

RevisionsOpen and readClose

Revision of household assets abroad. The use of new data sources has led to a revision of household assets abroad dating back to the 1st quarter of 2012. This mainly affects foreign direct investment negatively, whilst there is a positive effect on portfolio investment.

Due to new deposit codes reported for the sector deposit-taking corporations, there has been a revision of short-term and long-term deposits. Data are revised dating back to the 1st quarter of 2012.

The statistics is now published as International accounts.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42