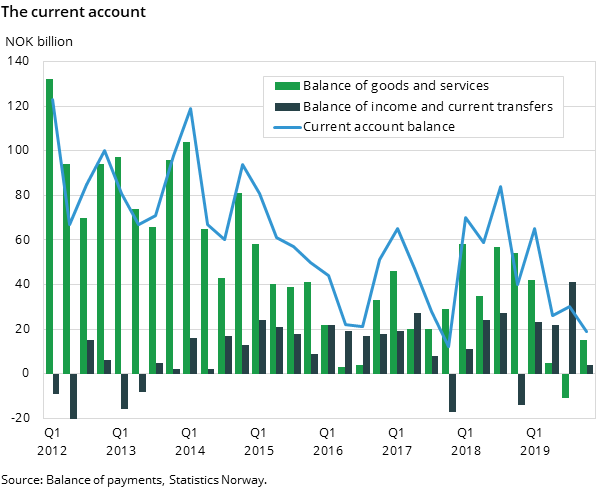

Weak current account balance

Published:

The current account balance is estimated at NOK 19 billion in the preliminary figures for 2019. We need to go back to 4th quarter of 2017 to find equally low figures.

- Full set of figures

- International accounts

- Series archive

- Balance of payments (archive)

Preliminary figures for 4th quarter 2019 show a surplus on the current account balance of NOK 19 billion. This is more than NOK 10 billion lower than the previous quarter, and NOK 21 billion lower than the current account balance in 4th quarter 2018. Still, this indicates that the current account balance is again developing in a more negative direction. We need to go back to 4th quarter 2017 to find lower figures for the current account balance. Both balance of goods and services and the balance of income and current transfers are contributing to the low current account balance.

Export and imports

Exports of goods and services in the fourth quarter of 2019 ended at NOK 338 billion. This is NOK 29 billion more compared to the previous quarter, but NOK 16 billion less compared to the same quarter last year. The income from crude oil and natural gas counts for 36 percent of the total export value.

The preliminary figures of total import in 4th quarter last year ended at NOK 323 billion, which is about NOK 23 billion more than the same quarter in 2018. From the 3rd to the 4th quarter in 2019 it was a rise in both exports and imports of goods, while exports and imports of services for the same period declined.

For more information about exports and imports, including price and volume considerations and seasonal adjustments, please see the quarterly national accounts.

The balance of income and current transfers

Preliminary figures for the balance of income and current transfers in the fourth quarter ended at NOK 4 billion, just above

zero. This is almost NOK 19 billion more than the same quarter previous year, but NOK 37 billion lower than 3rd quarter in 2019. For the year 2019 the balance of income and current transfers is preliminary calculated at almost NOK 90

billion, which is historically high. The growth from 2018 is more than 90 percent.

The financial account

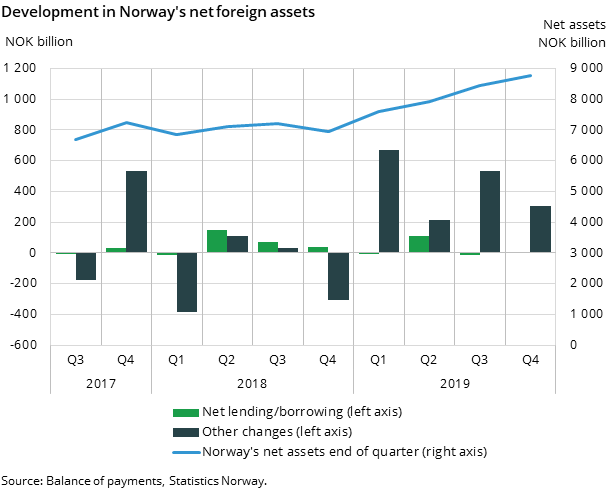

At the end of the 4th quarter of 2019, Norway’s net foreign assets amounted to NOK 8 750 billion. This was an increase of NOK 306 billion from the previous quarter.

Altogether, 2019 was a very good year for Norway’s international investment position. The net foreign assets saw a rise of NOK 1 808 billion during the year, up from NOK 6 942 billion at year end 2018. As shown in figure 2, the rise was mainly driven by other changes.

Other changes

During 2019 the global stock markets had a great upswing, the rice in market prices highly contributed to the increase in Norway’s assets abroad. This applied especially for Norwegian portfolio investment, at the end of 2019 4th quarter, portfolio investment abroad amounted to NOK 12 032 billion. This was a rise of NOK 442 billion from the previous quarter, and an annual rise of total NOK 2 018 billion from 2018. Of this, other changes amounted to NOK 1 730 billion, consisting mostly of revaluations due to market price changes.

The Norwegian krone appreciated against several foreign currencies during the last quarter of the year, other changes were therefor affected negatively due to exchange rate changes. However, for the year 2019 in total, the effect of exchange rate changes where positive, although not as significant as the effect from market price changes.

Financial transactions

Net lending had very little impact on the rise of net foreign assets in the 4th quarter, amounting to only NOK 2 billion. During this last quarter of the year, Norwegians invested NOK 108 billion abroad, highly driven by Portfolio investment, where the Pension Fund Global (GPFG) was the main contributor, investing in debt securities and equity.

At the same time, Norwegians incurred liabilities towards the rest of the world of NOK 106 billion. Here also, the GPFG was the main contributor, incurring debt in the form of repurchase agreements, or so-called secured borrowing.

Contact

-

Håvard Sjølie

-

Linda Wietfeldt

-

Mats Kristoffersen

-

Statistics Norway's Information Centre