Direct investment concentrated towards OECD countries

Published:

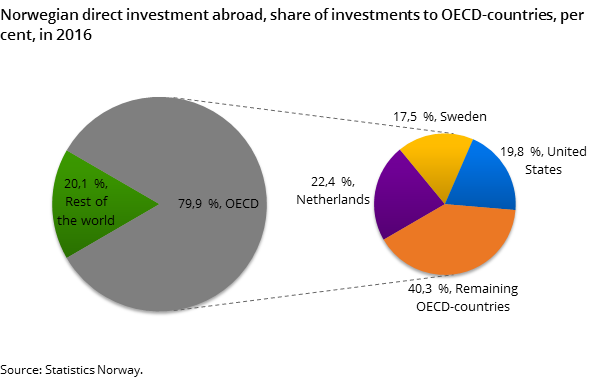

Norwegian direct investment abroad shows in an increasing extent a concentration in some industrialized countries. As a result, in 2016 OECD-countries stood for 80 per cent of Norwegian direct investment abroad. This share has increased by just below 3 per cent since 2015.

- Full set of figures

- Foreign direct investment

- Series archive

- Foreign direct investment (archive)

In total, Norwegian stock of direct investment abroad amounted to NOK 1 661 billion at the end of 2016. At the same time, foreign investors’ stock of direct investment in Norway equalled NOK 1 294 billion. The direct investment abroad rose by 3 per cent compared to 2015, while inward direct investment fell by 2 per cent in the same period.

As the title indicates, a large share of Norwegian direct investment abroad is placed in what can be called ‘modern economies’. It is therefore natural that the countries with the highest stock of Norwegian direct investment fall into this category. In 2016, the Netherlands, the United States and Sweden were the three countries with most direct investment from Norwegian investors. Each of them had a stock of Norwegian direct investment exceeding NOK 200 billion. As a comparison, the total direct investment from Norwegian investors to African countries equalled only NOK 45 billion. The same trend of favouring some modern economies is also seen in direct investment in Asia, shown in figure 1 below. Here NOK 123 billion of a total NOK 160 billion invested in Asian countries is invested in Singapore. This means that more than three quarters of all stock direct investment in Asia is to Singapore.

Figure 1. Norwegian direct investment in Asia, share in Singapore and other Asian countries, in 2016

| Norwegian direct investment in Asia | |

| Singapore 77% | 123289.0 |

| Other Asian countries23% | 37157.0 |

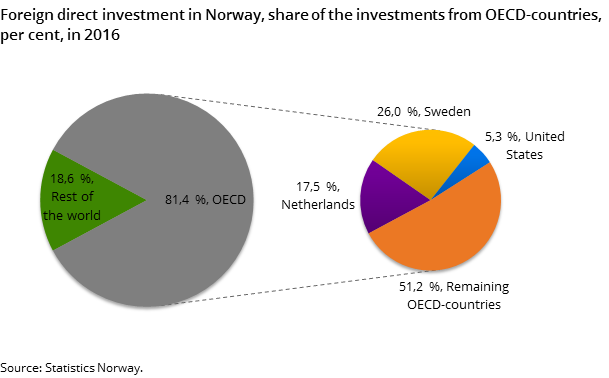

Looking at foreign direct investment in Norway, Sweden is by far the country with most direct investment. In total, Swedish investors have Norwegian direct investment worth NOK 274 billion. This corresponds to more than 20 per cent of all foreign direct investment in Norway. Some other countries with high stocks of direct investment in Norway are the Netherlands, Luxembourg and Germany. The pattern on the asset side with investment to modern economies is the same as on the liability side. Norway attracts investors from the same countries as invested in abroad. In 2016, the share of direct investment from other OECD countries in Norway was a little above 81 per cent. Irrespective of inward or outward direct investment, the figures below therefore show that as much as four fifths of all invested capital in direct investment is between Norway and other OECD countries.

Contact

-

Einar Goplen

-

Trond Lasse Larsen

-

Statistics Norway's Information Centre