Content

Published:

This is an archived release.

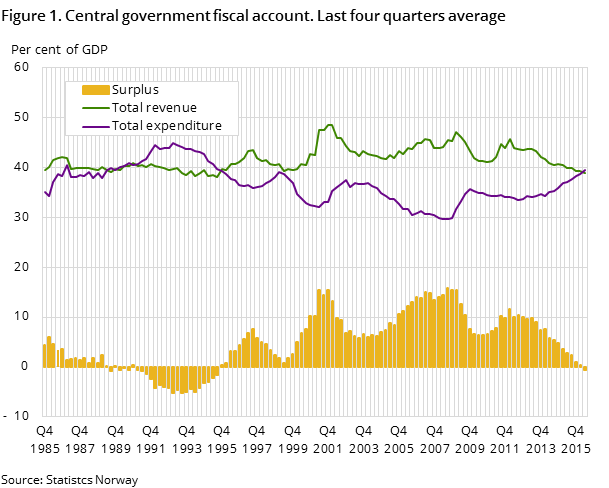

Continued decrease in government revenue

The central government’s fiscal account for Q2 2016 shows a decrease in revenue of NOK 8 billion and an increase in expenditure of NOK 25 billion.

| 2nd quarter 2015 | 2nd quarter 2016 | Change in per cent | |

|---|---|---|---|

| A. TOTAL REVENUE | 335 887 | 328 044 | -2.3 |

| Operating surplus extraction of petroleum | 24 738 | 17 193 | -30.5 |

| Tax revenue | 214 380 | 196 599 | -8.3 |

| Members' and employers' contribution to the National Insurance Scheme | 55 772 | 58 564 | 5.0 |

| Interest and dividends | 17 822 | 16 041 | -10.0 |

| Other revenue | 23 175 | 39 647 | 71.1 |

| B. TOTAL EXPENDITURE | 308 348 | 332 957 | 8.0 |

| Operating costs | 41 332 | 44 080 | 6.6 |

| Total fixed capital formation | 18 990 | 19 013 | 0.1 |

| Total transfers | 248 026 | 269 864 | 8.8 |

| C. SURPLUS BEFORE NET TRANSFERS TO THE GOVERNMENT PENSION FUND - GLOBAL | 27 539 | -4 913 |

The central government’s total revenue amounted to NOK 328 billion in the second quarter of 2016, equal to a decrease of 2.3 per cent compared to Q2 2015. Total expenditure increased by 8 per cent from NOK 308 billion in Q2 2015 to NOK 333 billion. The fiscal account thus shows a deficit of almost NOK 5 billion in the second quarter of 2016.

Reduced income from petroleum taxes and reduced surplus from the State’s Direct Financial Interest in petroleum activities (SDFI) account largely for the continued decrease in total revenue in Q2 2016. Tax revenue from petroleum has halved from NOK 46 billion in the second quarter of 2015 to NOK 23 billion in Q2 2016. Total tax revenues have been reduced by 8.3 per cent.

The central government’s operating costs have increased by NOK 3 billion from NOK 41 billion in Q2 2015, equal to an increase of 6.7 per cent. Wages and salaries, which make up about half of these operating costs, increased by 5.1 per cent. Transfers, making up about 80 per cent of total expenditure, have increased by almost 9 per cent from NOK 248 billion. This increase is largely accounted for by “Other transfers”, including foreign aid transfers and transfers to public health enterprises. However, the figures under this item are inflated in Q2 2016 because of recording practice inconsistencies in the public health enterprises between 2015 and 2016.

The quarterly figures are subject to random fluctuations, and must be interpreted with caution.

Contact

-

Bjørn Gran-Henriksen

E-mail: bjorn.gran-henriksen@ssb.no

tel.: (+47) 41 40 20 71

-

June Solås

E-mail: june.solas@ssb.no

tel.: (+47) 98 87 46 76