Content

Published:

This is an archived release.

Reduced tax payments

Total taxes paid amount to NOK 744 billion at the end of November 2016, which equals a decline of 6 per cent from last year.

| Distributed taxes. Accumulated figures so far this year | Change in per cent compared to same period previous year | |||

|---|---|---|---|---|

| November 2015 | November 2016 | November 2015 | November 2016 | |

| Distributed taxes, total | 790 647 | 743 528 | -3.1 | -6.0 |

| Ordinary taxes on income and wealth, central government | 28 794 | 39 266 | -6.9 | 36.4 |

| Ordinary taxes on extraction of petroleum | 39 711 | 13 074 | -30.1 | -67.1 |

| Special income tax on extraction of petroleum | 64 732 | 20 235 | -30.7 | -68.7 |

| Tax equalization contributions to the central government | 206 163 | 196 739 | 1.3 | -4.6 |

| Ordinary taxes to county authorities (incl. Oslo) | 28 936 | 31 151 | 5.0 | 7.7 |

| Ordinary taxes to municipalities | 134 965 | 148 702 | 5.5 | 10.2 |

| Member contributions to the National Insurance Scheme | 127 121 | 131 369 | 7.7 | 3.3 |

| Employer contributions to the National Insurance Scheme | 159 275 | 160 564 | 3.5 | 0.8 |

| Taxes on dividends to foreign shareholders | 949 | 2 428 | ||

Throughout 2016, total tax payments have been lowered compared to earlier years by reductions in taxes paid on petroleum extraction. Since mid-2013, petroleum tax payments have consistently declined, and at the end of November 2016 these payments are 68 per cent lower than last year’s receipts. Accumulated petroleum taxes are lower in November than in October due to refunds of overpaid taxes.

Increased payments from both personal and non-personal taxpayers

Payments made through the advance taxpaying arrangement total NOK 641 billion so far, equal to an increase of NOK 23 billion compared to the same period in 2015. Personal taxpayers have increased their capital and income tax payments by NOK 27 billion since last year. Equalisation taxes have been reduced by NOK 13 billion. This altered distribution between ordinary taxes and tax equalisation contributions to the central government results from changes in the tax system, which have been in effect as of 2016. Non-personal taxpayers also have increased their tax payments. By the end of November these total NOK 68 billion, equal to an increase of NOK 1.4 billion.

Larger receipts in both central and local government

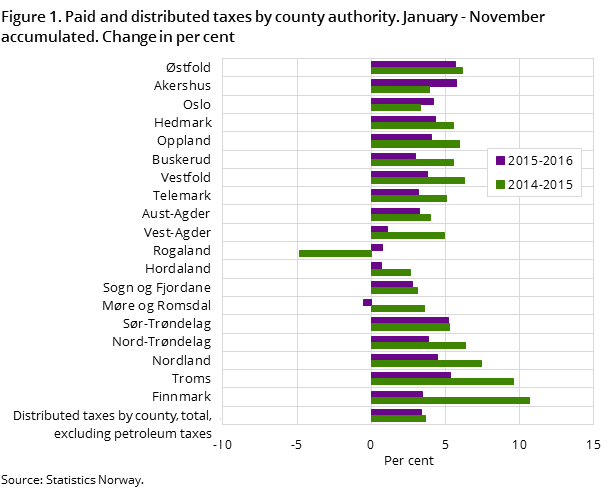

So far this year local government has received NOK 180 billion in tax payments. This amounts to an increase of NOK 16 billion compared to last year. Payments to central government total NOK 236 billion, which is about the same amount as last year. Payments to the National Insurance Scheme total NOK 292 billion, compared to NOK 286 billion last year.

Changes in the tax systemOpen and readClose

From 2016, changes in the tax system alter the distribution between ordinary taxes and tax equalization contributions to the central government. Lower rates on ordinary income reduce the equalization tax, while a new system for surtax from personal taxpayers increases the ordinary tax to the central government.

Contact

-

June Solås

E-mail: june.solas@ssb.no

tel.: (+47) 98 87 46 76

-

Bjørn Gran-Henriksen

E-mail: bjorn.gran-henriksen@ssb.no

tel.: (+47) 41 40 20 71