Content

Published:

This is an archived release.

Decline in petroleum taxes

Total taxes paid amount to NOK 630 billion at the end of October 2016, which equals a decline of 5.4 per cent from last year.

| Distributed taxes. Accumulated figures so far this year | Change in per cent compared to same period previous year | |||

|---|---|---|---|---|

| October 2015 | October 2016 | October 2015 | October 2016 | |

| Distributed taxes, total | 666 014 | 630 034 | -4.2 | -5.4 |

| Ordinary taxes on income and wealth, central government | 23 264 | 32 694 | -2.1 | 40.5 |

| Ordinary taxes on extraction of petroleum | 39 711 | 19 862 | -30.3 | -50.0 |

| Special income tax on extraction of petroleum | 64 732 | 30 824 | -30.4 | -52.4 |

| Tax equalization contributions to the central government | 164 919 | 154 763 | 0.0 | -6.2 |

| Ordinary taxes to county authorities (incl. Oslo) | 23 758 | 25 353 | 4.9 | 6.7 |

| Ordinary taxes to municipalities | 110 819 | 120 082 | 5.2 | 8.4 |

| Member contributions to the National Insurance Scheme | 103 773 | 109 505 | 8.0 | 5.5 |

| Employer contributions to the National Insurance Scheme | 134 084 | 134 770 | 3.8 | 0.5 |

| Taxes on dividends to foreign shareholders | 953 | 2 182 | ||

The reduction in taxes on petroleum extraction has lowered total tax payments. Throughout 2016, this decline has been the main contributor to the decline in the tax account. Petroleum tax payments have consistently been half of last year’s receipts. Accumulated petroleum taxes paid in 2016 total NOK 51 billion, compared to NOK 104 billion in the same period in 2015.

Increase in personal taxpayers’ payments, decrease in non-personal taxpayers’ payments

Payments made through the advance taxpaying arrangement total NOK 528 billion so far, equal to an increase of NOK 18 billion compared to the same period one year ago. Personal taxpayers’ capital and income tax payments have increased by NOK 20 billion since last year. In the same period, payments made through the non-personal taxpaying arrangement, excluding petroleum taxes, have been reduced by NOK 338 million from NOK 51.4 billion. Capital and income tax paid by non-personal taxpayers have fallen by NOK 1 billion.

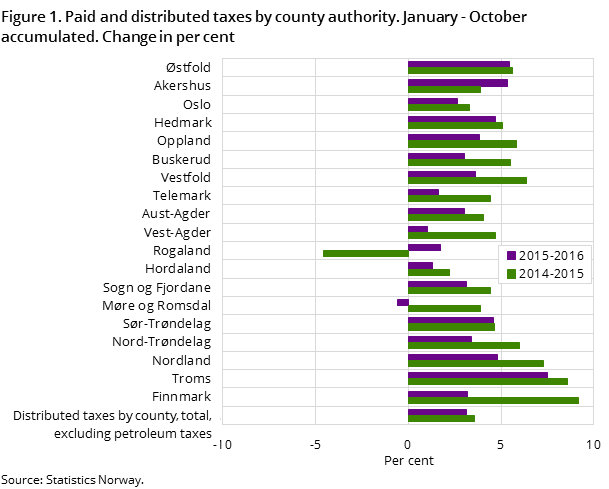

Increased payments to local government

Local government has so far this year received NOK 145 billion in tax payments. This amounts to an increase of NOK 11 billion compared to the same period last year. Accumulated payments to the central government total NOK 187 billion, which is about the same as the amount received in the first ten months of 2015. Payments to the National Insurance Scheme total NOK 244 billion, compared to NOK 238 billion last year.

Changes in the tax systemOpen and readClose

From 2016, changes in the tax system alter the distribution between ordinary taxes and tax equalization contributions to the central government. Lower rates on ordinary income reduce the equalization tax, while a new system for surtax from personal taxpayers increases the ordinary tax to the central government.

Contact

-

June Solås

E-mail: june.solas@ssb.no

tel.: (+47) 98 87 46 76

-

Bjørn Gran-Henriksen

E-mail: bjorn.gran-henriksen@ssb.no

tel.: (+47) 41 40 20 71