Content

Published:

This is an archived release.

As from 23 September, all of Statistics Norway’s statistics will be released at 8 am.

Continued decrease in tax payments

A total of NOK 497 billion has been paid in taxes in Norway in the first seven months of 2016. This is a decrease of 4.9 per cent from 2015.

| Distributed taxes. Accumulated figures so far this year | Change in per cent compared to same period previous year | |||

|---|---|---|---|---|

| July 2015 | July 2016 | July 2015 | July 2016 | |

| Distributed taxes, total | 523 007 | 497 340 | -3.2 | -4.9 |

| Ordinary taxes on income and wealth, central government | 18 662 | 25 153 | -2.8 | 34.8 |

| Ordinary taxes on extraction of petroleum | 26 345 | 13 058 | -27.2 | -50.4 |

| Special income tax on extraction of petroleum | 43 842 | 20 394 | -25.0 | -53.5 |

| Tax equalization contributions to the central government | 143 631 | 135 794 | -2.3 | -5.5 |

| Ordinary taxes to county authorities (incl. Oslo) | 18 037 | 19 119 | 3.9 | 6.0 |

| Ordinary taxes to municipalities | 84 169 | 90 567 | 4.1 | 7.6 |

| Member contributions to the National Insurance Scheme | 78 397 | 82 295 | 7.1 | 5.0 |

| Employer contributions to the National Insurance Scheme | 108 645 | 108 720 | 3.9 | 0.1 |

| Taxes on dividends to foreign shareholders | 1 280 | 2 239 | ||

The decrease in total taxes is mainly due to reduced payments of petroleum taxes. In July, payments amounted to NOK 33.5 billion, less than half of the accumulated petroleum tax payments by July 2015.

Increase in payments through the advance taxpaying arrangement

So far this year, payments through the advance taxpaying arrangement amount to NOK 405 billion; a 3 per cent increase from the same period in 2015. Payments made through the non-personal taxpaying arrangement, excluding petroleum taxes, decreased by NOK 723 million from the same period last year.

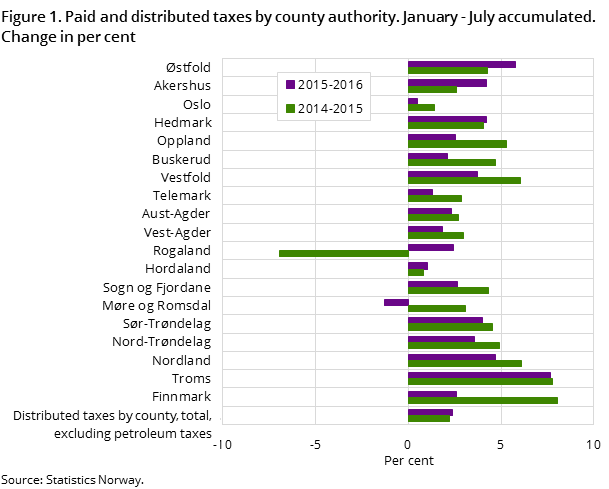

Increased payments to local government

Tax payments to local government have increased by NOK 7.5 billion compared to last year, while payments to central government have been reduced by NOK 1.3 billion. As of July 2016, payments amounted to NOK 110 billion and NOK 161 billion to local and central government respectively. Compared to last year, payments to the National Insurance Scheme have increased by NOK 4 billion, equal to an increase of 2.1 per cent. So far this year, the payments total NOK 191 billion.

Changes in the tax systemOpen and readClose

From 2016, changes in the tax system alter the distribution between ordinary taxes and tax equalization contributions to the central government. Lower rates on ordinary income reduce the equalization tax, while a new system for surtax from personal taxpayers increases the ordinary tax to the central government.

Contact

-

June Solås

E-mail: june.solas@ssb.no

tel.: (+47) 98 87 46 76

-

Bjørn Gran-Henriksen

E-mail: bjorn.gran-henriksen@ssb.no

tel.: (+47) 41 40 20 71