Content

Published:

This is an archived release.

Slight increase in tax payments

A total of NOK 85.5 billion was paid in taxes in Norway in January. This is an increase of 0.2 per cent from January of 2015.

| Distributed taxes. Accumulated figures so far this year | Change in per cent compared to same period previous year | |||

|---|---|---|---|---|

| January 2015 | January 2016 | January 2015 | January 2016 | |

| Distributed taxes, total | 85 296 | 85 460 | 3.1 | 0.2 |

| Ordinary taxes on income and wealth, central government | 3 223 | 2 961 | -3.5 | -8.1 |

| Ordinary taxes on extraction of petroleum | 615 | -4 | 204.5 | -100.7 |

| Special income tax on extraction of petroleum | 1 024 | -6 | 213.1 | -100.6 |

| Tax equalization contributions to the central government | 17 296 | 18 533 | -6.9 | 7.2 |

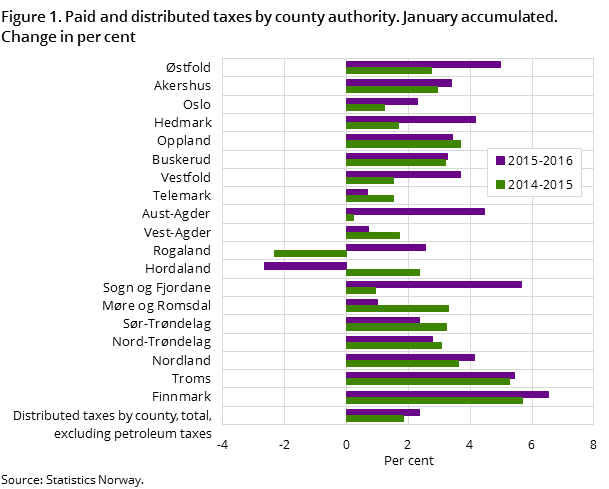

| Ordinary taxes to county authorities (incl. Oslo) | 3 528 | 3 616 | 3.3 | 2.5 |

| Ordinary taxes to municipalities | 16 316 | 16 848 | 1.7 | 3.3 |

| Member contributions to the National Insurance Scheme | 15 307 | 16 085 | 8.4 | 5.1 |

| Employer contributions to the National Insurance Scheme | 27 763 | 26 967 | 4.4 | -2.9 |

| Taxes on dividends to foreign shareholders | 222 | 460 | 158.1 | 107.2 |

Most of the taxes paid in January – NOK 85.1 billion – were paid through the advance tax arrangement. This is an increase of NOK 1.4 billion, or 1.7 per cent, from January 2015. Payments through the non-personal taxpaying arrangement, including petroleum taxes, totalled NOK 220 million, and NOK 100 million was paid in interest and other income.

Of the total tax payments, NOK 21.7 billion was paid to the central government, NOK 20.4 billion to municipalities and county authorities and NOK 43 billion was paid in contributions to the National Insurance Scheme (NIS). Payments to central and local governments have increased by 4.8 and 3.1 per cent respectively, while contributions to the NIS are at the same level as last year.

When are the payments of taxes received?Open and readClose

The payments for all taxes excluding petroleum taxes are mainly received in odd months. Income from petroleum taxes are mainly received in even months.

Contact

-

June Solås

E-mail: june.solas@ssb.no

tel.: (+47) 98 87 46 76

-

Bjørn Gran-Henriksen

E-mail: bjorn.gran-henriksen@ssb.no

tel.: (+47) 41 40 20 71