Content

Published:

This is an archived release.

Increased contributions to the National Insurance Scheme

From January to May 2015, a total of NOK 409 billion was paid in taxes in Norway. This is NOK 12 billion, or 3 per cent, less than in the corresponding period of 2014.

| Distributed taxes. Accumulated figures so far this year | Change in per cent compared to same period previous year | |||

|---|---|---|---|---|

| May 2014 | May 2015 | May 2014 | May 2015 | |

| Total | 421 545 | 409 195 | -2.9 | -2.9 |

| Ordinary taxes to central government | 15 964 | 15 544 | -5.1 | -2.6 |

| Ordinary taxes on extraction of petroleum | 24 682 | 17 235 | -21.2 | -30.2 |

| Special income tax on extraction of petroleum | 39 875 | 28 710 | -24.2 | -28.0 |

| Tax equalization tax to central government | 127 568 | 125 246 | 0.6 | -1.8 |

| Ordinary taxes to county authority (incl. Oslo) | 13 866 | 14 323 | 2.8 | 3.3 |

| Ordinary taxes to municipalities | 64 660 | 66 854 | 1.6 | 3.4 |

| Member contributions to the National Insurance Scheme | 58 101 | 61 980 | 6.1 | 6.7 |

| Employer contributions to the National Insurance Scheme | 76 173 | 79 284 | 2.6 | 4.1 |

| Taxes on dividends to foreign shareholders | 657 | 18 | 70.2 | -97.3 |

Despite the decrease in tax payments so far this year, the tax payments in the month of May 2015 increased by 2.2 per cent compared to May 2014. Contributions to the National Insurance Scheme increased the most, by 5 per cent since last year.

Contributions to National Insurance Scheme largest source of tax income

Of the total payments of NOK 409 billion so far this year, 34.5 per cent came from contributions to the National Insurance Scheme, while 34.4 per cent came from other tax payments to the central government except petroleum taxes. The tax payments to local government were 20 per cent of the total, and the petroleum taxes made up 11 per cent of the total.

It is the first time that the contributions to the National Insurance Scheme have the largest share of the total tax payments. The payments towards the different tax types have changed over the years. For instance, the National Insurance Scheme contributions as a share of the total have increased by 5 percentage points in the last three years. On the other hand, the petroleum tax payments were 20 per cent of the total from January to May 2013, compared to this year’s 11 per cent of the total.

Increase in payment of taxes from individuals and decrease in payment from businesses

Proceeds from individuals and employer fees increased from NOK 292 billion in the first five months last year to NOK 303 billion in the same period this year. Proceeds from businesses declined: oil taxes from NOK 64 billion to NOK 46 billion, and taxes from other businesses than oil from NOK 64 billion to NOK 60 billion.

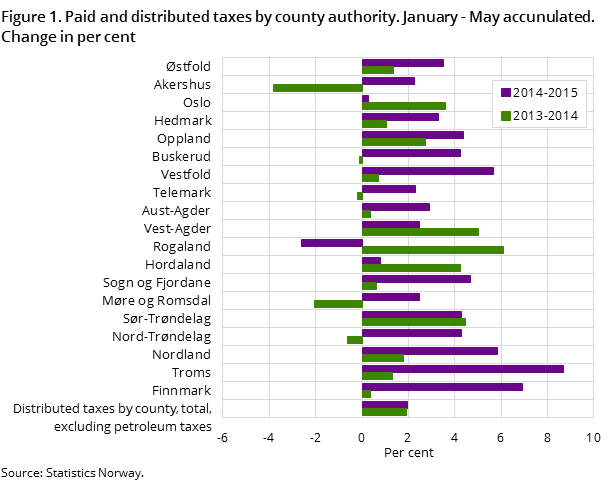

High increase in payment of taxes in Northern Norway

The highest increase in income from taxes in the first five months was in the Northern counties. Rogaland is the only county with a decrease compared to last year, while Oslo and Hordaland had a marginal increase. Overall tax revenues to municipalities/counties so far this year are about 2 per cent higher compared to the same period last year, which is the same percentage as from 2013 to 2014.

Taxes on dividends to foreign shareholders adjustedOpen and readClose

From January 2015, the sum of taxes on dividends to foreign shareholders is adjusted to account for repayments to shareholders exempted from this tax. So far this year, the sum of repayments is about NOK 637 million.

Contact

-

June Solås

E-mail: june.solas@ssb.no

tel.: (+47) 98 87 46 76

-

Bjørn Gran-Henriksen

E-mail: bjorn.gran-henriksen@ssb.no

tel.: (+47) 41 40 20 71