Content

Published:

This is an archived release.

Reduced tax payments in 2014

In 2014, Norway received a total of NOK 839.6 billion in taxes. This is NOK 18.6 billion, or 2.2 per cent, less than in 2013. The reason for the decline is reduced petroleum tax payments.

| Distributed taxes. Accumulated figures so far this year | Change in per cent compared to same period previous year | |||

|---|---|---|---|---|

| December 2013 | December 2014 | December 2013 | December 2014 | |

| Total | 858 235 | 839 602 | 1.0 | -2.2 |

| Ordinary taxes to central government | 31 152 | 31 229 | 4.2 | 0.2 |

| Ordinary taxes on extraction of petroleum | 76 118 | 64 212 | -11.3 | -15.6 |

| Special income tax on extraction of petroleum | 125 386 | 105 837 | -12.2 | -15.6 |

| Tax equalization tax to central government | 210 198 | 204 823 | 4.5 | -2.6 |

| Ordinary taxes to county authority (incl. Oslo) | 26 958 | 27 758 | 5.6 | 3.0 |

| Ordinary taxes to municipalities | 126 440 | 128 915 | 5.7 | 2.0 |

| Member contributions to the National Insurance Scheme | 110 675 | 118 846 | 7.2 | 7.4 |

| Employer contributions to the National Insurance Scheme | 148 589 | 154 392 | 7.1 | 3.9 |

| Taxes on dividends to foreign shareholders | 2 719 | 3 590 | -0.7 | 32.0 |

Since the second quarter of 2014, the tax payments in Norway have decreased compared to the previous year. The main reason for the decline is reduced tax payments on the extraction of petroleum, which gives a negative effect on the total tax payments. Ordinary and special taxes on petroleum extraction made up NOK 170 billion of the total tax payments in 2014. This is NOK 31.4 billion, or 15.6 per cent, less than in 2013.

Increased payments through the advance tax arrangement

The payments through the advance tax arrangement in 2014 increased by 2.5 per cent compared to 2013. In total, the payments through the advance tax arrangement were NOK 594.9 billion, which is NOK 14.5 billion more than the previous year. The non-personal taxpaying arrangement, excluding petroleum taxes, contributed NOK 73.8 billion in taxes in 2014, which is 2.5 per cent less than in 2013.

More tax payments to the local government

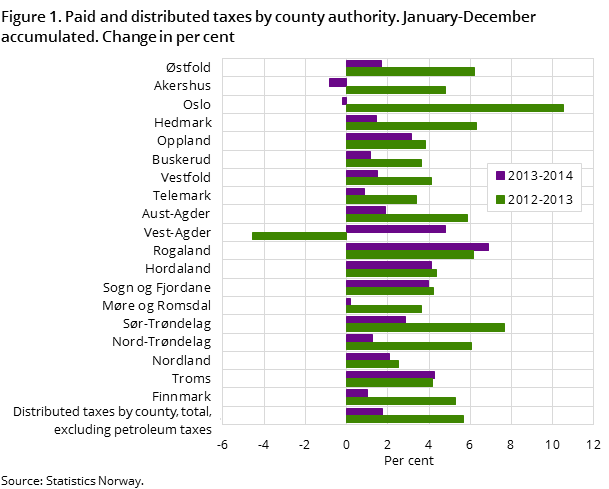

The tax payments to the local government totalled NOK 156.7 billion in 2014; an increase of 2.1 per cent from 2013. Out of the total, NOK 129 billion was paid to the municipalities, while NOK 27.7 billion went to the counties. The central government received NOK 236.1 billion in tax payments, which is a decrease of 2.2 per cent from the previous year.

Contact

-

June Solås

E-mail: june.solas@ssb.no

tel.: (+47) 98 87 46 76

-

Bjørn Gran-Henriksen

E-mail: bjorn.gran-henriksen@ssb.no

tel.: (+47) 41 40 20 71