Content

Published:

This is an archived release.

Decreasing petroleum-related tax income

During the period January through October, total tax payments amounted to NOK 718.4 billion. This is a modest increase of only 3.2 per cent compared to the same period last year. Declining tax revenues from petroleum extraction explain the low October figures.

| Distributed taxes. Accumulated figures so far this year | Change in per cent compared to same period previous year | |||

|---|---|---|---|---|

| October 2012 | October 2013 | October 2012 | October 2013 | |

| Total | 696 200 | 718 417 | 8.6 | 3.2 |

| Ordinary taxes to central government | 23 754 | 25 002 | 25.7 | 5.3 |

| Ordinary taxes on extraction of petroleum | 71 952 | 68 648 | 13.5 | -4.6 |

| Special income tax on extraction of petroleum | 119 135 | 113 745 | 14.7 | -4.5 |

| Tax equalization tax to central government | 160 110 | 168 344 | 3.0 | 5.1 |

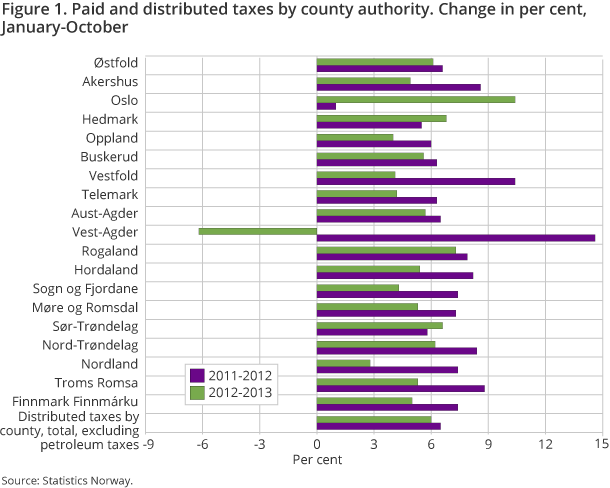

| Ordinary taxes to county authority (incl. Oslo) | 20 608 | 21 964 | 8.0 | 6.6 |

| Ordinary taxes to municipalities | 96 720 | 103 492 | 7.2 | 7.0 |

| Member contributions to the National Insurance Scheme | 85 231 | 89 862 | 7.4 | 5.4 |

| Employer contributions to the National Insurance Scheme | 115 980 | 124 689 | 6.5 | 7.5 |

| Taxes on dividends to foreign shareholders | 2 712 | 2 670 | 27.4 | -1.5 |

Petroleum-related tax revenues totalled NOK 182.4 billion. This is 4.5 per cent, or NOK 8.7 billion, lower than the corresponding period last year. Of the NOK 182.4 billion, NOK 113.7 billion was generated from the special income tax on extraction of petroleum, while the remaining NOK 68.7 billion was from ordinary taxes on petroleum extraction. The reduction in tax payments from the oil-producing sector is partly due to lower estimated instalments on the 2013 tax on income.

NOK 536 billion was generated through mainland Norway. This represents a 6.1 per cent increase, or NOK 30.9 billion, compared to the same period last year. NOK 193.3 billion was received by the central government. The member and employer contributions to the National Insurance Scheme amounted to NOK 214.6 billion, while NOK 125.4 billion was paid to the local government through ordinary taxes on income and wealth. NOK 2.7 billion was received from taxes on dividends to foreign shareholders.

Contact

-

June Solås

E-mail: june.solas@ssb.no

tel.: (+47) 98 87 46 76

-

Bjørn Gran-Henriksen

E-mail: bjorn.gran-henriksen@ssb.no

tel.: (+47) 41 40 20 71