Content

Published:

This is an archived release.

Increase in tax payments in January

In January 2013, NOK 79.1 billion was received in taxes. This is about NOK 5 billion, or 7.1 per cent more than in January of last year.

| Distributed taxes. Accumulated figures so far this year | Change in per cent compared to same period previous year | |||

|---|---|---|---|---|

| January 2012 | January 2013 | January 2012 | January 2013 | |

| Total | 73 879 | 79 123 | 4.2 | 7.1 |

| Ordinary taxes to central government | 2 946 | 3 152 | 5.0 | 7.0 |

| Ordinary taxes on extraction of petroleum | 29 | 24 | 33.6 | -17.2 |

| Special income tax on extraction of petroleum | 47 | 40 | 32.0 | -14.9 |

| Tax equalization tax to central government | 16 123 | 17 217 | 7.4 | 6.8 |

| Ordinary taxes to county authority (incl. Oslo) | 3 070 | 3 287 | 2.9 | 7.1 |

| Ordinary taxes to municipalities | 14 128 | 15 498 | -7.3 | 9.7 |

| Member contributions to the National Insurance Scheme | 13 132 | 13 707 | 10.0 | 4.4 |

| Employer contributions to the National Insurance Scheme | 23 876 | 26 169 | 5.2 | 9.6 |

| Taxes on dividends to foreign shareholders | 528 | 29 | 170.8 | -94.5 |

About NOK 40 billion was paid in taxes to the National Insurance Scheme in January. Compared to January 2012, this is an increase of 7.7 per cent or NOK 2.9 billion. Employer contributions increased by 9.6 per cent; about NOK 2.3 billion, to NOK 26.2 billion. The member contributions to the National Insurance Scheme totalled NOK 13.7 billion, which is an increase of 4.4 per cent compared to the same period last year.

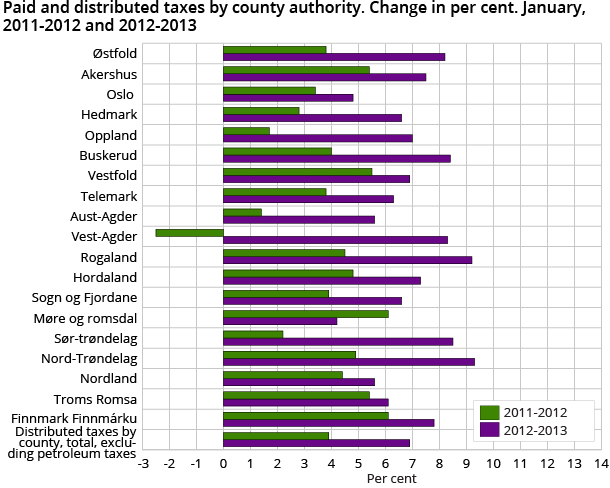

Increase in tax payments to the county and local authorities

The local and county authorities received NOK 18.8 billion in January. This is an increase of 9.2 per cent, or NOK 1.6 billion more than in January 2012. Of this amount, NOK 15.5 billion went to the local authorities, and the remaining NOK 3.3 billion went to the county authorities. This was an increase of 9.7 and 7.1 per cent respectively.

Over NOK 20 billion to central government

The ordinary tax and tax equalization contribution to the central government increased by 6.8 per cent from January 2012. The tax equalization contribution to the central government totalled NOK 17.2 billion, which is about NOK 1 billion more than the same period last year. This contribution to the central government is paid by everyone with an obligation to pay income tax to the local authorities, and is only generated through the advance tax arrangement. The ordinary tax to the central government is income and capital tax from both the advance tax arrangement and the non-personal taxpaying arrangement. In January 2013, NOK 3.1 billion was generated through the advance tax arrangement, and only NOK 15 million was from non-personal taxpaying arrangements.

The petroleum taxes received totalled NOK 64 million.

Merging of municipalitiesOpen and readClose

The municipalities of Harstad and Bjarkøy have been merged as Harstad. In table 3, the changes in per cent from last year are based on the sum of the two municipalities last year.

Contact

-

June Solås

E-mail: june.solas@ssb.no

tel.: (+47) 98 87 46 76

-

Bjørn Gran-Henriksen

E-mail: bjorn.gran-henriksen@ssb.no

tel.: (+47) 41 40 20 71