Immigration and public finances

The effects of more immigrants on public finances

Published:

This article was first published in Norwegian, in Statistics Norway’s journal Samfunnsspeilet: Holmøy, Erling og Birger Strøm (2013): Innvandring og offentlige finanser. Kostnaden for det offentlige av flere innvandrere. Samfunnsspeilet 5/2013. Statistisk sentralbyrå.

Depending on labour market participation, high levels of immigration may temporarily ease the pressure on the public finances caused by population aging. But the impact is not likely to be significant in the long run. Immigrants from Asia and Africa are more dependent than other groups on government welfare schemes. Since immigrants have children, the impacts of increased immigration on public finances will never fade away. Consequently, these effects should not be confused with how the average immigrant alone affects public finances during his life time.

Since 2004, net migration has accounted for almost two-thirds of a record population growth and employment growth. Migrant workers have primarily been from Eastern European countries that joined the EU in 2004.

Impact of immigration on the economy needs to be analysed

Hardly any other factors have affected the Norwegian economy as much as immigration in recent years. It would be remiss not to analyse the economic effects of immigration, even though this topic often generates heated debates. Holmøy and Strøm (2012) is an example of such an analysis. The results in this report have received a great deal of attention, especially since the newspaper Finansavisen presented them as “immigrant accounts” on 13 April 2013 and in subsequent articles.

Holmøy and Strøm (2012) primarily analyse the impact of immigration on public finances, i.e. the balance between public revenues and public spending. This is, of course, a limited perspective compared to a complete assessment of the advantages and disadvantages of immigration. The topic is, nevertheless, important enough to merit its own analysis. The choice of topic must be seen in light of the fact that Norway’s public finances will clearly be under much more strain in the decades ahead as a result of the increase in the elderly share of the population (Ministry of Finance (2013), Holmøy and Nielsen (2008) and Holmøy and Strøm (2013b)).

Will immigration ease or increase the pressure on public finances? Some believe that immigration will mitigate the aging population problem because immigrants are generally relatively young. It is even claimed that the Norwegian standard of living has become dependent on labour immigration, particularly in relation to the provision of practical assistance services to the elderly. Conversely, some argue that immigration means that politicians run a charity at the taxpayer’s expense - far beyond what most people want to contribute.

In order to make headway in this debate, more knowledge is needed about the impact of high levels of immigration on the welfare state’s funding needs. This motivated not only our project, but also the Welfare and Migration Committee’s NOU 2011: 7 and the analysis of immigrants’ labour force participation in Bratsberg, Raaum and Røed (2011).

Individuals or generations?

The debate over the past year has shown that the statement “the cost to the public purse of one more immigrant” can be interpreted in at least two interesting ways:

- The net expense that can be linked to the life cycle of a single immigrant. We give here a summary of the payments between the individual and the State for a single immigrant that does not emigrate, and who, from the time of immigration to death, has the same behaviour as the average person from the same group of countries (see textbox showing our country groupings).

- The net expense generated by a group that immigrates in a given year. The gender and age composition of this group equals the corresponding composition of the total immigration over the recent years. The additional immigrants share the age and gender specific average behaviour of the country grouping, but – unlike interpretation 1 - this also now includes births and re-emigration. The effects are measured per additional immigrant by dividing them by the number of additional immigrants. These effects do not describe the contribution to the net public spending for an average person as in interpretation 1. This is because the number of people behind the average increases or decreases as they are replaced over time. The point of interpretation 2 is precisely that of taking into account not just aging but also emigration, deaths and births, and changes in the size and composition of the population surplus that is created by the additional immigrants. In interpretation 2, the economic effects will not die out since the population surplus consists of relatives that follow the generations, all of which pay taxes and contribute to public spending. The impact of those who once immigrated decreases the farther ahead we calculate.

Accurate cost estimates based on one of the interpretations can thus be very misleading estimates of the effects that are based on the other interpretation. Holmøy and Strøm (2012) have only used interpretation 2 as a basis for the effects of non-recurring immigration. Calculations based on interpretation 1 will form part of the continuation of this work.

Impact of more relatives – conditions

The impact of more inhabitants can be almost anything if bold assumptions are made about the number of new fellow citizens with extreme behaviour. Instead for such exercises, residents in Norway are represented with average persons in population groups defined by gender, age, country group background, length of residence and main income.

The immigrants are from the country groups: R1 (Western Europe, North America, Australia and New Zealand), R2 (Eastern European EU countries) and R3 (rest of the world). The groups from R1 and R2 include large numbers of labour immigrants and family immigrants. Group R3 is very heterogeneous, partly because it includes most of the refugees. Many of these have low wages and receive relatively extensive assistance from the State in the form of benefits and services. Non-immigrants comprise of all Norwegian-born who have a Norwegian-born father and/or mother, and foreign-born with Norwegian-born parents.

Immigration increases relative to a so-called reference course, with 5,000 in 2015 alone. The gender and age composition of each group is the same as the average for the period 1991-2009 for the total immigration from the corresponding country group. The average behaviour of individuals in each group varies by gender, age and length of residence, and is estimated using 2006-data. When the analysis was carried out, this was the most recent year in which the relevant conditions were roughly normal. The behaviour of older immigrants is particularly uncertain since there are few elderly immigrants in the population.

Will the behaviour in 2006 (or another year) apply in future decades and for new immigrants? Probably not, but no one knows what changes will take place. We believe that many share our view that an extension of the current behaviour provides an interesting starting point for assessing the impact of migration on the Norwegian economy.

Government revenues and expenditures are projected using a macroeconomic model. The model ensures consistency when the behaviour in the different population groups is combined with the development in the number of persons in each population group and other economic factors. In particular, the model captures the most important relationships between employment and public finances. Population trends are taken from Brunborg and Texmon (2013). The assumptions about the immigrants’ distribution by age and gender, fertility and mortality in these projections are of significance to the results discussed below. There are three conditions in our analysis in particular that are disputable:

- In the calculations that are commented on below, the immigrants’ children are assumed to have the same economic behaviour as the non-immigrants. We considered this assumption to be more realistic than that where the descendants inherit their parents’ behaviour, partly based on Henriksen and Østby (2009), and other available averages. Holmøy and Strøm (2012) examine the importance of alternative assumptions about the immigrant children’s behaviour.

- In the absence of sufficient information, the use of public services is only broken down into gender and age. This means that persons of the same age and gender on average use all public services to the same extent regardless of reason for residence or country of origin. This assumption on its own probably entails an underestimation of public spending on refugees.

- The current tax rates and public welfare schemes are continued in all years. This makes the effects transparent and controllable. It is, however, easy to justify alternative assumptions, and we discuss this briefly towards the end of the article.

The projections extend into 2100. Of course we know very little about everything that can happen in the next 87 years. The uncertainty must, however, be assessed in light of what is central to the calculations. There are two types of changes that are crucial and both need a long time to play out. First, the payments between individuals and the government vary considerably and systematically over a lifetime. It is only uncertain in a rather uninteresting academic sense that the vast majority of those who currently have subsidised child care will become future tax payers and old-age pensioners. A horizon of 2100 covers almost all of the effects generated by the additional immigrants arriving in 2015 are covered, and most of those generated by their children.

Second, the long projection period shows that births, deaths and emigration can cause significant changes in the size and composition of the population surplus created by increased immigration. These changes are obviously uncertain. But they are hardly any more uncertain than the changes in oil prices and exchange rates over the course of a few years. All in all, we believe that a shorter calculation period results in a great loss of relevance compared to a small reduction in the relevant uncertainty.

The impact of more generations – results

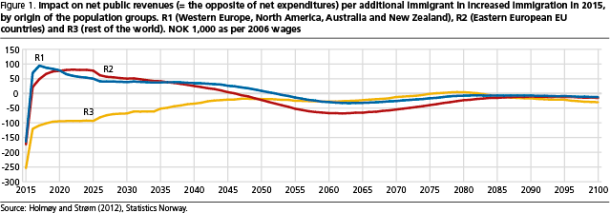

Figure 1 shows the annual impact on net public spending, measured per additional immigrant, of an increase in 2015 of 5,000 immigrants from R1, R2 and R3 (see text box) respectively . The figures are adjusted for 4 per cent wage growth in all years in order to obtain recognizable figures. Most public spending and revenues, excluding the oil revenues, are more or less proportional with wages.

The effects go through three phases: in the first few years after 2015, the net spending increases markedly because the capacity in kindergartens, schools, infrastructure and other public sectors has to be expanded in order to meet the demand from our new fellow citizens. The capacity expansion will, in practice, take longer than in our calculations. The need to develop public welfare is greatest for additional R3 immigration since the increase in the number of children and young people is greatest in this case.

The calculations also show that increased public services lead to lower tax revenues. The reason is that employment is shifted from the private to the public sector, and this reduces the basis for indirect taxes and business taxes. For R3 immigration, the increase in public spending in the first years is strengthened by the introduction benefit for new immigrants. Statistics Norway (2013) gives a brief overview of this scheme.

Phase two covers the roughly 30 years following the capacity expansion in the public sector, i.e. the years 2018-2050. Additional immigration from R3 raises net public spending by a relatively high amount. However, this increase falls over time. Measured per additional immigrant in 2006-prices, it falls from NOK 94,000 in 2020 to about NOK 20,000 in 2050. The opposite applies to immigration from R1 and R2. Non-recurring immigration in 2015 has generated net public revenues in 2020 equal to NOK 79,000 (77,000) in 2006 values per additional immigrant when they are from R1 (R2). The reasons for these disparities between the immigrant groups are discussed below.

In phase three – the period 2050-2100 - most of the immigrants who arrived in 2015 are old age pensioners, or have emigrated or are deceased. Each of the three population surpluses are thus dominated by the immigrants’ children and grandchildren. As these are assumed to have “Norwegian” behaviour, the impact after about 2050 has very little, if any, bearing on the disparities between different immigrant groups. They are therefore primarily determined by how many additional children have been born, and the age distribution for these.

The impact in phase three is therefore less, and is more similar across country backgrounds. This is the case despite the fact that R3 immigration leads to a far greater increase in the population, and thus also in the gross amounts for public revenue and expenditure. The small long-term effects illustrate that an increased population has little impact on net public revenues. One modification here is that the State’s annual use of oil revenues covers a smaller part of public spending when the population increases, since the petroleum wealth is independent of demographic changes.

Differences in the groups’ contributions

Differences in employment income and welfare benefits are key reasons for the disparities between the immigrant groups’ contributions to net public revenues in phase 2 - the period 2018-2050. Paid employment does not only produce the main basis for direct personal taxes, but also the basis for almost all indirect taxes and business taxes outside of the State’s petroleum revenues.

The R3 immigrants take up employment at a later stage and to a lesser extent. They earn less, and have a faster transition to disability benefits than other groups. This must be viewed in light of the fact that many R3 immigrants are refugees, and the share that lack relevant education and work experience, and have language problems, is greater than in the other immigrant groups where there are almost no refugees. The disparities between the immigrant groups’ transition to disability benefits is confirmed in more refined studies, see Bratsberg, Raaum and Røed (2011).

Demographic effects also have a significant impact on the disparities between the immigrant groups’ contribution to net public revenues in phase 2. Re-emigration and relatively few births quickly reduce the population surplus generated by more R1 and R2 immigrants.

The opposite is the case for R3 immigration. After about 35 years, the population surplus has increased by about 20 per cent because the re-emigration is relatively modest, and the R3 women have more children than women in the other groups (see Marianne Tønnessen’s article in this issue of Samfunnsspeilet). The population surplus generated by R3 immigration thus has a much higher proportion of children and young people than the R1 and R2 surpluses. This is an important factor in why the R3 surplus pays significantly less in taxes and receives more public services related to childcare, education and health, and more in child-related benefits.

Interpretation of the sum of costs over time

The sum of the effects over the 86 years from 2015 to 2100, as shown in Figure 1, can be interpreted as the present value when the so-called discount rate is assumed to equal wage growth that is nominally 4 per cent in our calculations. The discount rate expresses that a krone received/paid next year is worth less than a krone today. This present value of increased net public spending is NOK 4.1 million when expressed in 2012 values. Correspondingly, present values of net spending increases for R1 and R2 immigration are NOK -0.8 and 0.8 million respectively in 2012 values.

These present values were not calculated in Holmøy and Strøm (2012) – they were calculated and presented for the first time in the Finansavisen newspaper on 13 April this year. Since then it is particularly the figure NOK 4.1 million that has become a regular in the immigration debate.

Finansavisen has described these present values as «a net cost obligation for the State”. With this perspective, Finansavisen uses the present values precisely and meaningfully when, for example, it writes (13 April): “When a non-Western immigrant arrives, the Norwegian government takes on a future net cost obligation that Statistics Norway estimates at NOK 4.1 million in 2012 values.”

Although the sum of effects over a period of time, as shown in Figure 1, has a meaningful interpretation, there are a variety of problems with using this estimate. First, when the effects do not die out, their sum can be almost anything by extending the calculation period, as long as the discount rate is not higher than wage growth. Second, the sum is increasingly determined by the descendants’ behaviour when the period is extended. Perhaps the most important reason, however, is that the concept of present value is too difficult to work well in a public debate. It has been shown that there is a great danger of comparing sums of the effects over 86 years with annual amounts.

The impact of one additional individual

The aforementioned sum of NOK 4.1 million is derived from calculations based on interpretation 2, i.e. where a group of immigrants of different ages and both genders arrives in Norway, who have children and can re-emigrate. Because of births among the additional immigrants, it would be wrong to use this amount to explain interpretation 1 above; the NOK 4.1 million is not the sum of payments between the government and an average immigrant over one lifetime. An example of such a misrepresentation is given in the Aftenposten newspaper of 19 May (Hege Storhaug 2013): “The truth is, says Finansavisen of 13 April, with the approval of Statistics Norway researcher Erling Holmøy, that every non-western immigrant costs Norway around NOK 4.1 million on average during their lifetime.”

What if the taxes are raised or the welfare offer is cut?

The calculations are based on the continuation of current tax rates and welfare systems throughout the calculation period. It could be argued that the taxes should have been increased and/or public spending cut because all long-term projections show that aging makes the present welfare schemes and tax rates unsustainable. A tighter fiscal policy will make both immigrants and non-immigrants more “profitable” for the State. We referred to this in an article in Aftenposten on 7 June (Holmøy and Strøm 2013a).

The main reason for basing the projections on the current tax rates and welfare schemes is transparency. An analysis that combines changes in immigration with changes in tax or welfare changes must clarify how much of the impact is caused solely by changes in immigration – i.e. our effects - and how much can be attributed to guesses about the timing and composition of the future tightening of the State budget. Cuts in the introduction programme will obviously have a different effect than cuts in the agricultural support. Raising the surtax rate and taxes on housing and property will be a lesser burden on R3 immigrants than on others. The impact of immigration on public finances also depends on when the State budget will be tightened.

The choice of constant or tighter fiscal policy as a starting point is not a choice between right or wrong. There are good arguments for both sets of assumptions because they answer two different questions – which are both interesting.

Employment is crucial

The major impact of immigration following the EU expansion in 2004 particularly relates to macroeconomic magnitudes such as total employment, production and consumption. Over the life course, however, each person is a producer, consumer, taxpayer and user of public welfare. Thus, the population size has little impact on the average income and prosperity level of a country over a longer period of time. The same applies to balances, such as the disparity between public revenues and public expenditure (see the interpretation of the long-term effects in Figure 1).

The main conclusion of Holmøy and Strøm (2012) is that it is primarily the aging of the population that will cause future fiscal sustainability problems, given continuation of the current, or a more generous, welfare state. The solution to this would be a continuous adjustment of the tax burden to the choice of ambition level for tax-financed welfare. In this case the impact of more inhabitants (regardless of their origin) on public finances will also be more positive than in our calculations. The changes in immigration have very little bearing on public finances in the long term, as long as the average labour input per capita does not change significantly. This not only depends on the individual’s participation in the labour market, but also on demographic factors, particularly the age distribution of immigrants. Labour input provides the basis for most of the taxes in mainland Norway. Integration into the labour market is therefore crucial for the impact of immigration on public finances. There is probably considerable room for improvement in integrating immigrants from typical low-income countries in Africa and Asia.

Costs – for whom?

The effects on net public spending will also be an important factor in more comprehensive assessments of the advantages and disadvantages of immigration. If immigration increases net public spending, the standard of living of those who are already living in Norway is reduced since the taxes could otherwise have been lowered and/or public welfare could have been strengthened.

However, a full assessment of the economic effects of non-immigrants’ living standards must take into account a number of other effects, including lower prices, pressure on wages and possible displacement of local workforces. And who should be included as «those who are already living in Norway» in such an assessment? Even if they are accurate, the statistics’ definitions of non-immigrants will be irrelevant when answering questions such as: «To what extent should one take into account that new immigrants can affect the wages, job security and other economic conditions of immigrants who have lived in Norway for, say, four years?”

For many, a crucial factor in a broad assessment of the advantages and disadvantages of immigration will be the effects experienced by immigrants. There are reasons to believe that it is generally the immigrants who experience the greatest advantages of moving. For refugees and asylum seekers, humanitarian reasons can make the benefit extreme. Norwegian authorities grant residence to asylum seekers and refugees based on their need for protection – not their impact on public finances in Norway.

References

Bratsberg, B., O. Raaum and K. Røed (2011): Yrkesdeltaking på lang sikt blant ulike innvandrergrupper i Norge (Labour force participation in the long term among different immigrant groups in Norway), Report 2011/1, Frisch Centre.

Brunborg, H. and I. Texmon (2013): The growth and composition of the population under varying immigration assumptions, Report 23/2013, Statistics Norway. (http://www.ssb.no/en/befolkning/artikler-og-publikasjoner/vekst-og-sammensetning-av-befolkningen-ved-ulike-forutsetninger-om-innvandring)

Henriksen, K. and L. Østby (2009): Mot norsk fruktbarhetsmønster (Towards the Norwegian fertility pattern), Minerva, 29 September 2009. (http://www.minerva.as/2009/09/29/mot-norskfruktbarhetsm%c3%b8nster/)

Holmøy, E. and V.O. Nielsen (2008): Velferdsstatens langsiktige finansieringsbehov (The welfare state’s long-term funding needs), Økonomiske analyser 4, 2008, Statistics Norway. (http://www.ssb.no/offentlig-sektor/artikler-og-publikasjoner/velferdsstatens-langsiktige-finansieringsbehov)

Holmøy, E. and B. Strøm (2012): Makroøkonomi og offentlige finanser i ulike scenarioer for innvandring (Macroeconomy and public finances in different scenarios for immigration), Reports 15/2012, Statistics Norway. (http://www.ssb.no/nasjonalregnskap-og-konjunkturer/artikler-og-publikasjoner/makrookonomi-og-offentlige-finanser-i-ulike-scenarioer-for-innvandring)

Holmøy, E. and B. Strøm (2013a): «Hva betyr innvandringen for offentlige finanser» (What impact does immigration have on public finances), article in Aftenposten 7 June.

Holmøy, E. and B. Strøm (2013b): “Computable General Equilibrium Assessments of Fiscal Policy in Norway”, in P. Dixon and D. W. Jorgenson (eds.): Handbook of Computable General Equilibrium Modeling, Vol. 1A, Ch. 3, Amsterdam: Elsevier.

Ministry of Finance (2013): Perspektivmeldingen 2013 (Long-term Perspectives on the Norwegian Economy 2013), White Paper no. 12 to the Storting (2012-2013).

NOU (2011:7): Velferd og migrasjon (Welfare and migration), Official Norwegian reports, Ministry of Children, Equality and Social Inclusion.

Statistics Norway (2013): Introduction programme for immigrants 2012. Published: 21 June 2013. (http://www.ssb.no/en/utdanning/statistikker/introinnv)

Storhaug, H. (2013): ”Hvorfor forteller ikke mediene hva en ikke-vestlig innvandrer koster?” (Why does the media not report how much a non-western immigrant costs?), article in Aftenposten 19 May.

Contact

-

Statistics Norway's Information Centre