Content

Published:

This is an archived release.

Slow income growth in households

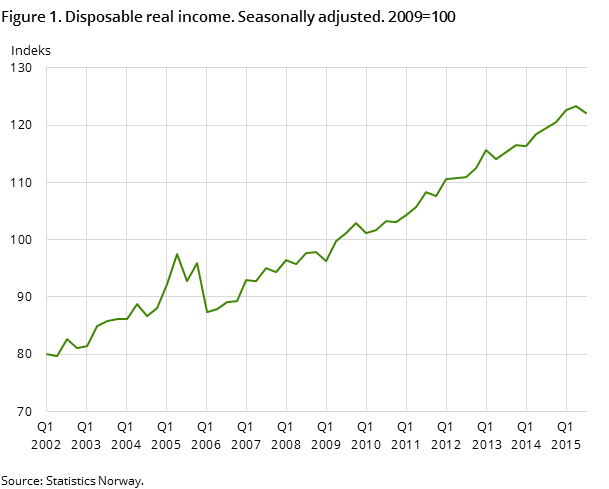

According to seasonally-adjusted figures, disposable income in households and non-profit institutions serving households increased slowly by 0.2 per cent in nominal terms in the 3rd quarter of 2015 compared to the previous quarter. Real disposable income was reduced following a longer period of growth.

| 4th quarter 2014 | 1st quarter 2015 | 2nd quarter 2015 | 3rd quarter 2015 | |

|---|---|---|---|---|

| Compensation of employees | 359 347 | 362 876 | 366 535 | 369 100 |

| Disposable income | 336 197 | 343 574 | 347 091 | 347 743 |

| Total consumption | 325 120 | 331 854 | 330 574 | 331 322 |

| Saving, net | 32 169 | 33 675 | 39 959 | 40 372 |

| Savings ratio (per cent) | 9.0 | 9.2 | 10.8 | 10.9 |

| Real disposable income, growth | 0.9 | 1.6 | 0.7 | -1.1 |

Compensation of employees was up 0.7 per cent in the 3rd quarter. Property income received was reduced more than property income paid and thus made a positive contribution to growth in disposable income. On the other hand, pensions and benefits received from general government, mostly sickness and maternity benefits, decreased, while current taxes on income and wealth increased, resulting in a small increase in disposable Income of 0.2 per cent from the 2nd quarter. Real disposable Income is estimated to have decreased by 1.1 per cent or 1.4 per cent per capita.

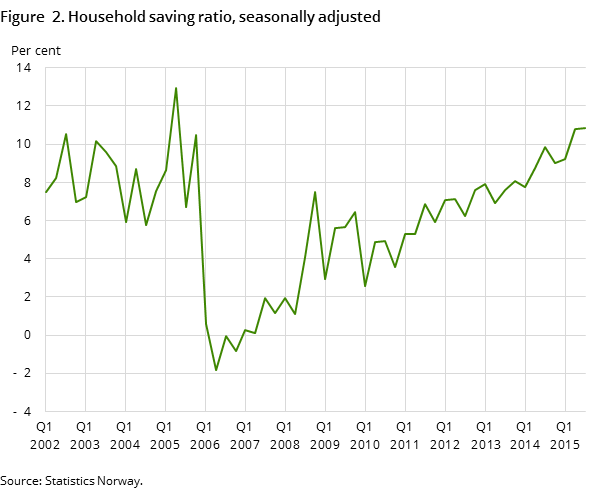

Consumption expenditure increased less than disposable income adjusted by households’ savings in pension funds, resulting in a small increase in savings. The savings ratio is calculated to 10.9 per cent; just above the ratio of the 2nd quarter.

Accumulated over the first three quarters of 2015, the non-adjusted figures show a reduction in disposable income in both the enterprise sectors and in general government. In the non-financial enterprise sector the fixed capital formation was reduced more than the reduction in income, resulting in a reduction in net borrowing. In general government on the other hand, both final consumption expenditures and fixed capital formation increased, and together with the reduced income led to a marked fall in net lending.

In this publication, Statistics Norway has released for the first time non-financial sector accounts for all institutional sectors, i.e. non-financial enterprises, financial enterprises, general government, households, non-profit organisations serving households (NPISHs), and the rest of the world. For variables also included in Quarterly national accounts and in Balance of payments, the figures are the same as those presented there. Time series cover all quarters dating back to the year 2002.

For the time being, only non-seasonally adjusted figures have been estimated and published for the sectors other than households and NPISHs. Such figures will be published during 2016.

RevisionsOpen and readClose

With the publication of the 3rd quarter 2015, the statistics comprise all institutional sectors, not only households and non-profit organisations serving households (NPISHs). New sources and methods and the integration and balancing of households and NPISHs with the other institutional sectors have resulted in revisions of the previously published quarterly figures for households and NPISHs. Before 2013, only figures for consumption of fixed capital had been revised on an annual (and quarterly) basis.

Quarterly sector accounts are based on preliminary calculations. The uncertainty in the last quarter is the greatest. New information is continuously being integrated into the figures, which could cause revisions in the previously released data. Quarterly sector accounts are also consolidated against the data from the quarterly national accounts data. When the last quarters of the unadjusted series are updated, seasonally-adjusted series may also be revised backwards.

Additional information

Contact

-

Pål Sletten

E-mail: pal.sletten@ssb.no

tel.: (+47) 99 29 06 84

-

Nils Amdal

E-mail: nils.amdal@ssb.no

tel.: (+47) 91 14 91 46