Content

Published:

NOK 1.9 billion in inheritance tax

Assessed inheritance tax amounted to NOK 1.9 billion in 2013; an average of 6 per cent of the inheritance tax basis. About NOK 34 billion was received in taxable inheritance and gifts in 2013.

| 2012 | 2013 | |||

|---|---|---|---|---|

| Recipients | Total tax basis (NOK mill.) | Recipients | Total tax basis (NOK mill.) | |

| Inheritance | ||||

| Total | 17 047 | 22 435 | 17 513 | 23 617 |

| Bank deposits/Cash | 15 105 | 5 479 | 15 269 | 6 066 |

| Dwelling | 11 266 | 14 646 | 11 382 | 15 053 |

| Recreational property | 2 665 | 1 282 | 2 650 | 1 271 |

| Gifts | ||||

| Total | 7 484 | 9 877 | 7 217 | 10 435 |

| Bank deposits/Cash | 4 001 | 4 223 | 3 051 | 3 259 |

| Dwelling | 1 446 | 2 784 | 1 461 | 2 858 |

| Recreational property | 878 | 1 210 | 433 | 531 |

The value of taxable inheritance amounted to NOK 24 billion in 2013, while NOK 10 billion was gifts. Residential property accounted for 64 per cent of the taxable inheritance, while cash amounted to 26 per cent. Fifty-one per cent of those who received taxable inheritance also inherited debt.

Average inheritance of NOK 1 349 000

Average taxable inheritance amounted to NOK 1.3 million in 2013. This is an increase of about 3 per cent from the previous year. Average taxable gifts amounted to NOK 1.4 million.

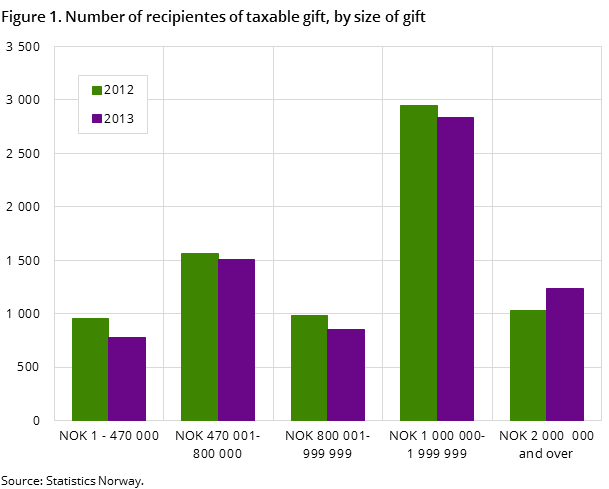

Increasing number of large gifts

The number of recipients of taxable gifts was 7 200 in 2013; a decline of 4 per cent since last year. The number of recipients of gifts of a value under NOK 2 million has decreased by 7 per cent, while the number of recipients of gifts of a value over NOK 2 million has increased by 20 per cent. The total value of gifts increased by 6 per cent, and amounted to NOK 10 billion.

About the statisticsOpen and readClose

The statistics present figures for both possession date and decision date. Possession date is the date on which the recipient takes possession of the inheritance/gift. Decision date is the date the tax collector decides on taxes in the specific cases. The statistics do not cover estates in which the tax basis is under the tax-free amount or public administrated estates. A recipient is liable for taxation for inheritance or gifts to a value up to NOK 470 000 if he or she has received an inheritance or gift from the same donor in the past and the overall value exceeds the tax-free amount. A recipient may have received parts of one object, more than one unit of one type of object or a multiple number of different types of objects. Advances on the inheritance are considered as a gift. Inheritance tax was abolished on 1 January 2014.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42