Small growth in entrepreneurial income

Published:

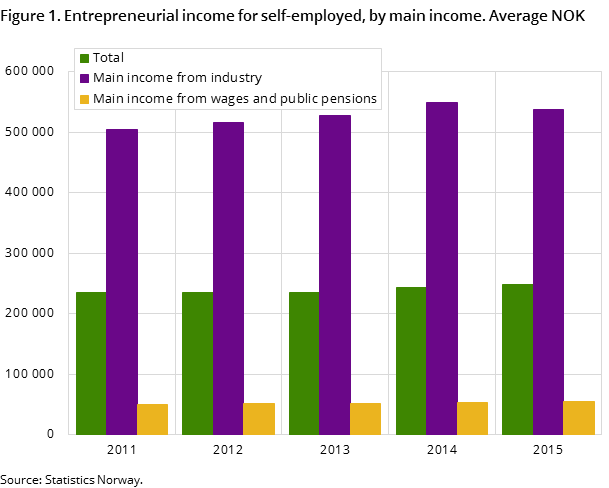

Entrepreneurial income for the self-employed amounted to NOK 249 000 on average in 2015. This is an increase of NOK 5 000, or 2 per cent.

- Full set of figures

- Income, self-employed

- Series archive

- Income, self-employed (archive)

A total of 332 000 persons reported entrepreneurial income in 2015. This is an increase of 1 000 from 2014.

Income from self-employment forms main income for about 4 in 10

A total of 133 000 of the self-employed have their main income from self-employment. This is an increase of 5 per cent from 2014. In this period, the average entrepreneurial income has shrunk by 2 per cent to NOK 538 000 for this group of self-employed. Just under 200 000 of the self-employed had their main income from wages and public pensions. This is 5 000 less than in 2014. This last group had an average entrepreneurial income of NOK 56 000.

Among those that were assessed as self-employed or those assessed with entrepreneurial income, many did not have an obligation to submit an income statement due to low annual turnover or because they are assessed as a general partnership. The latter will not be included in the statistics showing the income and costs of self-employed in sole proprietorships.

Unaltered result for sole proprietorships with main income from self-employment

A total of 235 000 sole proprietorships submitted an electronic income statement in 2015 with an average operating result of NOK 245 700.

Sole proprietorships with main income from self-employment comprise of almost 104 000 firms. Average operating profit amounted to NOK 495 000, which is about the same as the year before. Operating income amounted to NOK 1 290 000 on average, while operating cost amounted to NOK 795 000. Among the operating incomes there is a decrease in sales revenues of just below 3 per cent. When it comes to operating costs, there is a decrease in both commodity and wage costs of over 5 per cent. These comparisons with 2014 need to be interpreted in relation to changes in the data material described in the box below. The income statement for sole proprietorships having their main income from self-employment is divided by industry, and the results for some of them show:

•Primary industries. Sole proprietorships within the industry had an operating profit of NOK 421 000 on average. This is an increase of 1 per cent from 2014. Average operating income and cost amounted to NOK 1 707 000 and NOK 1 286 000 respectively.

•Transportation and storage. Sole proprietorships within the industry had an operating profit of NOK 539 000 on average. This is an increase of 0.2 per cent from 2014. Average operating income and cost amounted to NOK 1 602 000 and NOK 1 063 000 respectively.

•Construction industry. Sole proprietorships within the industry had an operating profit of NOK 469 000 on average. This is an increase of 4 per cent from 2014. Average operating income and cost amounted to NOK 1 197 000 and NOK 728 000 respectively.

•Commodity trade and auto repair shops. Sole proprietorships within the industry had an operating profit of NOK 401 000 on average. This is a decrease of 7 per cent from 2014. Average operating income and cost amounted to NOK 2 272 000 and NOK 1 871 000 respectively.

•Other industries. See StatBank: http://www.ssb.no/en/table/10265

Contact

-

Ingrid Melby

-

Christian Brovold

-

Statistics Norway's Information Centre