Signs of optimism in manufacturing

Published:

In the first quarter of 2017, Norwegian industrial managers reported a levelling off of the decline in production. Suppliers to the oil and gas sector in particular reported a decline. The general expectations for the second quarter of 2017 are positive among most of the industry leaders, according to the statistics Business tendency survey for manufacturing, mining and quarrying.

The business tendency survey for the first quarter of 2017 shows that the downturn in total production has levelled off compared with the fourth quarter of 2016. For manufacturers of capital goods, there was a further decline in production due to the low activity among suppliers to the oil and gas sector. This is particularly affecting industries such as machinery and equipment, and building of ships and oil platforms.

Producers of intermediate goods reported a growth in production in the last quarter. There was an increase in industries such as wood and wood products and basic chemicals. At the same time there was increased production within consumer goods, especially for manufacturers of food products. The decline in production of capital goods was offset by the increase in the other industrial groupings, leading to a levelling off of the total industrial production. This is the first time since the first quarter of 2015 that the overall production trend has not been negative.

The overall employment declined in the first quarter of 2017. The decline stems from capital goods and consumer goods, while intermediate goods show an increase. The fall in employment was most significant among producers of capital goods, which are particularly affected by the reduced investment activity in the oil and gas sector.

Figure 1. Production and employment for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | Total volume of production | Average employment | |

| Q12008 | 50 | 56.44 | 54.20 |

| Q22008 | 50 | 53.67 | 51.35 |

| Q32008 | 50 | 47.83 | 46.42 |

| Q42008 | 50 | 40.96 | 40.33 |

| Q12009 | 50 | 37.62 | 36.18 |

| Q22009 | 50 | 39.78 | 36.65 |

| Q32009 | 50 | 44.58 | 39.40 |

| Q42009 | 50 | 47.89 | 42.41 |

| Q12010 | 50 | 50.02 | 44.54 |

| Q22010 | 50 | 51.33 | 45.43 |

| Q32010 | 50 | 52.02 | 46.99 |

| Q42010 | 50 | 53.24 | 50.46 |

| Q12011 | 50 | 55.35 | 53.88 |

| Q22011 | 50 | 55.91 | 54.71 |

| Q32011 | 50 | 55.06 | 54.23 |

| Q42011 | 50 | 54.18 | 53.64 |

| Q12012 | 50 | 53.19 | 53.63 |

| Q22012 | 50 | 52.48 | 54.06 |

| Q32012 | 50 | 52.06 | 54.28 |

| Q42012 | 50 | 51.00 | 53.17 |

| Q12013 | 50 | 49.74 | 52.26 |

| Q22013 | 50 | 50.87 | 52.35 |

| Q32013 | 50 | 52.67 | 51.61 |

| Q42013 | 50 | 53.95 | 50.62 |

| Q12014 | 50 | 54.43 | 49.97 |

| Q22014 | 50 | 53.05 | 49.77 |

| Q32014 | 50 | 51.33 | 49.99 |

| Q42014 | 50 | 50.36 | 49.02 |

| Q12015 | 50 | 48.07 | 45.01 |

| Q22015 | 50 | 46.36 | 40.96 |

| Q32015 | 50 | 46.83 | 39.17 |

| Q42015 | 50 | 47.50 | 39.48 |

| Q12016 | 50 | 48.13 | 40.96 |

| Q22016 | 50 | 48.45 | 42.09 |

| Q32016 | 50 | 47.44 | 42.23 |

| Q42016 | 50 | 47.75 | 43.10 |

| Q12017 | 50 | 50.04 | 45.48 |

Improvement for the domestic market

There was a decline in the total stock of orders in the first quarter. New orders from the domestic market increased for the first time since the first quarter of 2014. In the export market, the number of new orders fell. Producers of capital goods saw a decline in new orders from both markets, and in the stock of orders. For manufacturers of intermediate goods there was an increase in new orders from both markets and an increase in the stock of orders. Manufacturers of consumer goods also saw an increase in new orders from both markets and in the stock of orders.

Figure 2. New orders received for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | New orders received from home markets | New orders received from export markets | |

| Q12008 | 50 | 52.80 | 50.10 |

| Q22008 | 50 | 49.38 | 46.48 |

| Q32008 | 50 | 42.58 | 42.72 |

| Q42008 | 50 | 34.48 | 28.81 |

| Q12009 | 50 | 32.46 | 28.00 |

| Q22009 | 50 | 37.37 | 38.02 |

| Q32009 | 50 | 42.34 | 41.09 |

| Q42009 | 50 | 44.47 | 43.87 |

| Q12010 | 50 | 46.94 | 47.57 |

| Q22010 | 50 | 50.77 | 51.80 |

| Q32010 | 50 | 53.47 | 53.43 |

| Q42010 | 50 | 55.41 | 54.17 |

| Q12011 | 50 | 57.37 | 53.08 |

| Q22011 | 50 | 56.90 | 50.06 |

| Q32011 | 50 | 54.83 | 47.87 |

| Q42011 | 50 | 54.92 | 47.22 |

| Q12012 | 50 | 54.86 | 48.01 |

| Q22012 | 50 | 52.32 | 48.86 |

| Q32012 | 50 | 49.76 | 46.56 |

| Q42012 | 50 | 49.28 | 44.63 |

| Q12013 | 50 | 48.33 | 45.05 |

| Q22013 | 50 | 48.78 | 47.97 |

| Q32013 | 50 | 50.50 | 52.37 |

| Q42013 | 50 | 50.94 | 54.89 |

| Q12014 | 50 | 50.20 | 54.80 |

| Q22014 | 50 | 49.74 | 53.10 |

| Q32014 | 50 | 48.19 | 49.63 |

| Q42014 | 50 | 45.96 | 46.07 |

| Q12015 | 50 | 43.69 | 43.46 |

| Q22015 | 50 | 42.66 | 42.30 |

| Q32015 | 50 | 43.23 | 43.39 |

| Q42015 | 50 | 44.55 | 43.94 |

| Q12016 | 50 | 46.02 | 43.50 |

| Q22016 | 50 | 46.65 | 43.31 |

| Q32016 | 50 | 47.16 | 43.91 |

| Q42016 | 50 | 49.17 | 45.59 |

| Q12017 | 50 | 51.38 | 47.57 |

Overall, prices were slightly down for the export market, while remaining almost unchanged for the domestic market. For producers of capital goods, there was a decline in prices in both markets, while producers of intermediate goods and consumers goods had an increase in both markets.

Figure 3. Prices on products for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | Prices on products at home markets | Prices on products at export markets | |

| Q12008 | 50 | 61.95 | 54.05 |

| Q22008 | 50 | 60.85 | 54.97 |

| Q32008 | 50 | 56.22 | 54.45 |

| Q42008 | 50 | 50.09 | 50.29 |

| Q12009 | 50 | 44.77 | 45.16 |

| Q22009 | 50 | 44.35 | 43.94 |

| Q32009 | 50 | 46.02 | 44.06 |

| Q42009 | 50 | 46.22 | 43.85 |

| Q12010 | 50 | 46.72 | 45.53 |

| Q22010 | 50 | 49.05 | 49.27 |

| Q32010 | 50 | 51.35 | 51.54 |

| Q42010 | 50 | 53.53 | 52.67 |

| Q12011 | 50 | 55.82 | 52.85 |

| Q22011 | 50 | 54.85 | 50.00 |

| Q32011 | 50 | 52.63 | 46.55 |

| Q42011 | 50 | 52.03 | 44.95 |

| Q12012 | 50 | 51.90 | 45.57 |

| Q22012 | 50 | 51.41 | 46.26 |

| Q32012 | 50 | 51.87 | 45.43 |

| Q42012 | 50 | 51.80 | 44.34 |

| Q12013 | 50 | 51.15 | 45.09 |

| Q22013 | 50 | 52.13 | 47.27 |

| Q32013 | 50 | 53.10 | 49.98 |

| Q42013 | 50 | 53.65 | 52.84 |

| Q12014 | 50 | 54.42 | 53.32 |

| Q22014 | 50 | 54.27 | 51.93 |

| Q32014 | 50 | 53.51 | 51.22 |

| Q42014 | 50 | 53.03 | 51.73 |

| Q12015 | 50 | 50.97 | 50.14 |

| Q22015 | 50 | 48.79 | 48.70 |

| Q32015 | 50 | 48.21 | 49.25 |

| Q42015 | 50 | 48.41 | 48.67 |

| Q12016 | 50 | 49.44 | 47.98 |

| Q22016 | 50 | 50.26 | 48.14 |

| Q32016 | 50 | 49.97 | 47.87 |

| Q42016 | 50 | 49.80 | 47.66 |

| Q12017 | 50 | 50.02 | 48.54 |

Positive expectations for the second quarter of 2017

The general outlook for the second quarter of 2017 is positive. Business leaders report that investment plans have been adjusted upwards slightly and that employment will see a further drop. New orders from both the domestic market and export market are expected to increase. The total stock of orders is expected to see a slight increase. Producers of intermediate goods and consumer goods are optimistic about the second quarter, while manufacturers of capital goods have an almost unchanged view on the matter.

Figure 4. General judgement of the outlook in next quarter for manufacturing.

| Turning point value | General judgement of the outlook | |

| Q12008 | 50 | 56.98 |

| Q22008 | 50 | 52.38 |

| Q32008 | 50 | 45.47 |

| Q42008 | 50 | 40.34 |

| Q12009 | 50 | 40.17 |

| Q22009 | 50 | 43.98 |

| Q32009 | 50 | 47.54 |

| Q42009 | 50 | 50.26 |

| Q12010 | 50 | 53.24 |

| Q22010 | 50 | 56.05 |

| Q32010 | 50 | 59.01 |

| Q42010 | 50 | 61.00 |

| Q12011 | 50 | 60.13 |

| Q22011 | 50 | 57.55 |

| Q32011 | 50 | 56.03 |

| Q42011 | 50 | 56.04 |

| Q12012 | 50 | 56.38 |

| Q22012 | 50 | 56.19 |

| Q32012 | 50 | 55.53 |

| Q42012 | 50 | 55.13 |

| Q12013 | 50 | 55.16 |

| Q22013 | 50 | 55.00 |

| Q32013 | 50 | 54.79 |

| Q42013 | 50 | 54.70 |

| Q12014 | 50 | 54.18 |

| Q22014 | 50 | 53.33 |

| Q32014 | 50 | 51.59 |

| Q42014 | 50 | 48.55 |

| Q12015 | 50 | 45.46 |

| Q22015 | 50 | 43.37 |

| Q32015 | 50 | 42.89 |

| Q42015 | 50 | 44.28 |

| Q12016 | 50 | 47.06 |

| Q22016 | 50 | 50.30 |

| Q32016 | 50 | 52.75 |

| Q42016 | 50 | 53.31 |

| Q12017 | 50 | 52.58 |

The industrial confidence indicator in the first quarter was 1.1 (seasonally-adjusted net figures), up from -0.2 in the previous quarter. This is the first time since the third quarter of 2014 that this indicator has been positive, but it is still below the historical average of 3.0. Values above zero indicate that total output will grow, while values below zero indicate that total output will fall. International comparisons of the industrial confidence indicator are available from Eurostat (EU), The Swedish National Institute of Economic Research and Statistics Denmark.

Figure 5. Industrial confidence indicator¹

| Seasonally adjusted | Average 1990-2017 | |

| Q12008 | 6.9 | 3.0 |

| Q22008 | -0.7 | 3.0 |

| Q32008 | -6.9 | 3.0 |

| Q42008 | -22.9 | 3.0 |

| Q12009 | -19.3 | 3.0 |

| Q22009 | -7.9 | 3.0 |

| Q32009 | -2.9 | 3.0 |

| Q42009 | 0.1 | 3.0 |

| Q12010 | 3.2 | 3.0 |

| Q22010 | 4.5 | 3.0 |

| Q32010 | 8.9 | 3.0 |

| Q42010 | 11.1 | 3.0 |

| Q12011 | 9.1 | 3.0 |

| Q22011 | 8.6 | 3.0 |

| Q32011 | 5.7 | 3.0 |

| Q42011 | 5.9 | 3.0 |

| Q12012 | 9.0 | 3.0 |

| Q22012 | 6.6 | 3.0 |

| Q32012 | 0.7 | 3.0 |

| Q42012 | 4.7 | 3.0 |

| Q12013 | 1.3 | 3.0 |

| Q22013 | 1.5 | 3.0 |

| Q32013 | 6.0 | 3.0 |

| Q42013 | 7.8 | 3.0 |

| Q12014 | 6.4 | 3.0 |

| Q22014 | 6.9 | 3.0 |

| Q32014 | 1.2 | 3.0 |

| Q42014 | -1.8 | 3.0 |

| Q12015 | -3.9 | 3.0 |

| Q22015 | -8.0 | 3.0 |

| Q32015 | -7.5 | 3.0 |

| Q42015 | -8.1 | 3.0 |

| Q12016 | -7.0 | 3.0 |

| Q22016 | -1.4 | 3.0 |

| Q32016 | -5.1 | 3.0 |

| Q42016 | -0.2 | 3.0 |

| Q12017 | 1.1 | 3.0 |

Decrease in capacity utilisation

The average capacity utilisation for Norwegian manufacturing had a marginal decrease and was calculated to 76.6 per cent at the end of the first quarter of 2017, compared with 76.9 in the fourth quarter of 2016. This is below the historical average of 80.3 per cent. International comparisons of average capacity utilisation are available from Eurostat (EU).

Figure 6. Capacity utilisation in per cent for manufacturing

| Smoothed seasonally adjusted | Average 1990-2017 | |

| Q12008 | 83.66 | 80.27 |

| Q22008 | 82.98 | 80.27 |

| Q32008 | 81.37 | 80.27 |

| Q42008 | 78.90 | 80.27 |

| Q12009 | 76.83 | 80.27 |

| Q22009 | 76.04 | 80.27 |

| Q32009 | 76.35 | 80.27 |

| Q42009 | 76.83 | 80.27 |

| Q12010 | 77.09 | 80.27 |

| Q22010 | 77.75 | 80.27 |

| Q32010 | 78.48 | 80.27 |

| Q42010 | 78.93 | 80.27 |

| Q12011 | 79.45 | 80.27 |

| Q22011 | 79.76 | 80.27 |

| Q32011 | 79.56 | 80.27 |

| Q42011 | 79.57 | 80.27 |

| Q12012 | 79.69 | 80.27 |

| Q22012 | 79.67 | 80.27 |

| Q32012 | 79.78 | 80.27 |

| Q42012 | 79.79 | 80.27 |

| Q12013 | 79.43 | 80.27 |

| Q22013 | 79.27 | 80.27 |

| Q32013 | 79.54 | 80.27 |

| Q42013 | 79.96 | 80.27 |

| Q12014 | 80.41 | 80.27 |

| Q22014 | 80.49 | 80.27 |

| Q32014 | 80.07 | 80.27 |

| Q42014 | 79.30 | 80.27 |

| Q12015 | 78.41 | 80.27 |

| Q22015 | 77.40 | 80.27 |

| Q32015 | 76.75 | 80.27 |

| Q42015 | 76.78 | 80.27 |

| Q12016 | 77.08 | 80.27 |

| Q22016 | 77.23 | 80.27 |

| Q32016 | 77.09 | 80.27 |

| Q42016 | 76.86 | 80.27 |

| Q12017 | 76.73 | 80.27 |

The average number of working months covered by the current stock of orders was 4.1 in the first quarter of 2017. This is around the same level as the previous quarter, and above the historical average for the indicator of 3.9.

Figure 7. Number of working months covered by current stock of orders for manufacturing

| Smoothed seasonally adjusted | Average 1990-2017 | |

| Q12008 | 4.83 | 3.9 |

| Q22008 | 4.78 | 3.9 |

| Q32008 | 4.65 | 3.9 |

| Q42008 | 4.46 | 3.9 |

| Q12009 | 4.23 | 3.9 |

| Q22009 | 3.97 | 3.9 |

| Q32009 | 3.77 | 3.9 |

| Q42009 | 3.74 | 3.9 |

| Q12010 | 3.83 | 3.9 |

| Q22010 | 3.95 | 3.9 |

| Q32010 | 4.12 | 3.9 |

| Q42010 | 4.25 | 3.9 |

| Q12011 | 4.31 | 3.9 |

| Q22011 | 4.37 | 3.9 |

| Q32011 | 4.34 | 3.9 |

| Q42011 | 4.13 | 3.9 |

| Q12012 | 4.00 | 3.9 |

| Q22012 | 4.09 | 3.9 |

| Q32012 | 4.26 | 3.9 |

| Q42012 | 4.32 | 3.9 |

| Q12013 | 4.29 | 3.9 |

| Q22013 | 4.20 | 3.9 |

| Q32013 | 4.15 | 3.9 |

| Q42013 | 4.26 | 3.9 |

| Q12014 | 4.45 | 3.9 |

| Q22014 | 4.51 | 3.9 |

| Q32014 | 4.42 | 3.9 |

| Q42014 | 4.35 | 3.9 |

| Q12015 | 4.28 | 3.9 |

| Q22015 | 4.25 | 3.9 |

| Q32015 | 4.23 | 3.9 |

| Q42015 | 4.17 | 3.9 |

| Q12016 | 4.05 | 3.9 |

| Q22016 | 3.95 | 3.9 |

| Q32016 | 3.94 | 3.9 |

| Q42016 | 3.98 | 3.9 |

| Q12017 | 4.03 | 3.9 |

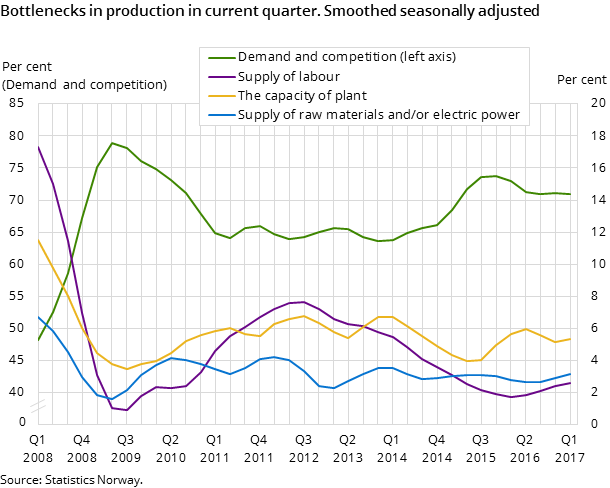

The resource shortage indicator remains at the same level as the previous quarter. There is still little shortage of labour, good access to raw materials and electrical power, and few industry leaders are reporting full capacity utilisation.

Timeliness

The survey data was collected in the period from 9 March 2017 to 19 April 2017.

Assessment of Q1 2017 and the short-term outlook¹

|

1 An overall evaluation of the present situation and expected short-term developments. 2 Very good: ++, Good: +, Stable: ~, Poor: -, Very poor: --, Good, but with certain negative indications: +(-), A situation where the + and - factors even out: +/-, Poor, but with certain positive indications: -(+) |

|

| Industry | Evaluation 2 |

| Food, beverages and tobacco | + |

| Wood and wood products | ++ |

| Paper and paper products | + |

| Basic chemicals | + |

| Non-ferrous metals | + |

| Fabricated metal products | +(-) |

| Computer and electrical equipment | -(+) |

| Machinery and equipment | -- |

| Ships, boats and oil platforms | -- |

| Repair, installation of machinery | - |

Contact

-

Nils-Arne Rye Krøtø

-

Statistics Norway's Information Centre