Growing optimism in manufacturing

Published:

Norwegian industrial managers report a moderate increase in production in the first quarter. New orders and stock of orders also increase marginally. The general expectations for the second quarter of 2021 are also positive among most of the industry leaders.

- Full set of figures

- Business tendency survey for manufacturing, mining and quarrying

The business tendency survey for the first quarter of 2021 shows moderate growth in total output compared to the fourth quarter of 2020. The producers of intermediate goods are experiencing a clear increase in production. For producers of consumer goods the production volume is approximately unchanged from the previous quarter, while producers of capital good continue to report a decline in production volume. Many industry leaders for companies within capital goods have reported that production in the first quarter has been limited by a lack of competent labor from abroad as a result of strict restrictions related to the corona pandemic on entry into Norway in the first quarter. Companies within intermediate goods are generally far less labor intensive and the production within this type of product has therefore suffered far less from the entry restrictions.

Industrial managers report that total industrial employment in the first quarter is approximately unchanged compared with the fourth quarter of 2020. Producers of intermediate goods and consumer goods report moderate growth in employment, while producers of capital goods report unchanged employment.

Figure 1. Production and employment for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | Total volume of production | Average employment | |

| Q1-2012 | 50 | 53.22 | 53.64 |

| Q2-2012 | 50 | 52.47 | 54.09 |

| Q3-2012 | 50 | 52.04 | 54.27 |

| Q4-2012 | 50 | 51.02 | 53.14 |

| Q1-2013 | 50 | 49.74 | 52.29 |

| Q2-2013 | 50 | 50.83 | 52.39 |

| Q3-2013 | 50 | 52.69 | 51.59 |

| Q4-2013 | 50 | 54.00 | 50.58 |

| Q1-2014 | 50 | 54.43 | 49.87 |

| Q2-2014 | 50 | 52.97 | 49.55 |

| Q3-2014 | 50 | 51.34 | 49.84 |

| Q4-2014 | 50 | 50.44 | 49.04 |

| Q1-2015 | 50 | 48.11 | 45.13 |

| Q2-2015 | 50 | 46.21 | 41.01 |

| Q3-2015 | 50 | 46.82 | 39.11 |

| Q4-2015 | 50 | 47.49 | 39.39 |

| Q1-2016 | 50 | 48.62 | 41.07 |

| Q2-2016 | 50 | 49.08 | 42.19 |

| Q3-2016 | 50 | 47.36 | 41.98 |

| Q4-2016 | 50 | 47.57 | 42.60 |

| Q1-2017 | 50 | 49.68 | 44.90 |

| Q2-2017 | 50 | 50.01 | 47.46 |

| Q3-2017 | 50 | 50.37 | 49.80 |

| Q4-2017 | 50 | 51.32 | 50.56 |

| Q1-2018 | 50 | 52.38 | 50.31 |

| Q2-2018 | 50 | 54.17 | 51.12 |

| Q3-2018 | 50 | 55.50 | 52.68 |

| Q4-2018 | 50 | 56.02 | 54.29 |

| Q1-2019 | 50 | 55.87 | 55.22 |

| Q2-2019 | 50 | 55.26 | 54.99 |

| Q3-2019 | 50 | 52.86 | 52.16 |

| Q4-2019 | 50 | 49.58 | 48.63 |

| Q1-2020 | 50 | 45.68 | 44.68 |

| Q2-2020 | 50 | 45.23 | 42.98 |

| Q3-2020 | 50 | 48.54 | 45.59 |

| Q4-2020 | 50 | 51.48 | 48.98 |

| Q1-2021 | 50 | 51.39 | 50.39 |

Moderate growth in total stock of orders

The total stock of orders in manufacturing shows a moderate growth in the first quarter, but there are large differences in the development for the different types of goods. Producers of intermediate goods have a sharply increase in stock of orders in the first quarter, while the producers of capital goods report a clear decrease. For producers of consumer goods the stock of orders is unchanged. It was reported a marginal growth in total stock of orders for both the domestic market as well as for the export market in the first quarter. Producers of intermediate goods report a clear increase in new orders in both markets, and the growth is particularly strong in the export market. Producers of capital goods report a decline in new orders in the first quarter, this applies to both the domestic and export markets. For consumer goods, there are different developments for the two markets; here there is growth in the domestic market while there is a decline in new orders from the export market.

Figure 2. New orders received for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | New orders received from home markets | New orders received from export markets | |

| Q1-2012 | 50 | 55.13 | 48.07 |

| Q2-2012 | 50 | 52.57 | 48.85 |

| Q3-2012 | 50 | 49.80 | 46.57 |

| Q4-2012 | 50 | 49.07 | 44.63 |

| Q1-2013 | 50 | 48.19 | 45.00 |

| Q2-2013 | 50 | 48.87 | 47.97 |

| Q3-2013 | 50 | 50.65 | 52.41 |

| Q4-2013 | 50 | 50.75 | 54.97 |

| Q1-2014 | 50 | 50.08 | 54.85 |

| Q2-2014 | 50 | 49.86 | 53.02 |

| Q3-2014 | 50 | 48.23 | 49.56 |

| Q4-2014 | 50 | 46.30 | 46.16 |

| Q1-2015 | 50 | 44.44 | 43.54 |

| Q2-2015 | 50 | 43.08 | 42.17 |

| Q3-2015 | 50 | 43.16 | 43.33 |

| Q4-2015 | 50 | 44.36 | 44.09 |

| Q1-2016 | 50 | 45.88 | 43.27 |

| Q2-2016 | 50 | 46.84 | 42.68 |

| Q3-2016 | 50 | 47.47 | 43.72 |

| Q4-2016 | 50 | 49.23 | 45.88 |

| Q1-2017 | 50 | 50.29 | 47.93 |

| Q2-2017 | 50 | 49.92 | 49.39 |

| Q3-2017 | 50 | 51.50 | 50.27 |

| Q4-2017 | 50 | 53.74 | 51.93 |

| Q1-2018 | 50 | 53.91 | 54.24 |

| Q2-2018 | 50 | 53.37 | 55.56 |

| Q3-2018 | 50 | 53.61 | 55.21 |

| Q4-2018 | 50 | 54.22 | 53.89 |

| Q1-2019 | 50 | 54.68 | 52.77 |

| Q2-2019 | 50 | 54.22 | 51.60 |

| Q3-2019 | 50 | 51.60 | 49.78 |

| Q4-2019 | 50 | 46.76 | 46.79 |

| Q1-2020 | 50 | 42.02 | 44.91 |

| Q2-2020 | 50 | 41.47 | 45.00 |

| Q3-2020 | 50 | 45.02 | 46.70 |

| Q4-2020 | 50 | 49.06 | 49.16 |

| Q1-2021 | 50 | 51.47 | 51.11 |

Industrial managers report growth in the price level both in the home and export market for overall manufacturing in the first quarter. Producers of intermediate goods report clear growth in prices for sales in both markets. For producers of capital goods and consumer goods report increased prices for sales to the domestic market and unchanged prices for the export market compared with the fourth quarter.

Figure 3. Prices on products for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | Prices on products at home markets | Prices on products at export markets | |

| Q1-2012 | 50 | 51.87 | 45.54 |

| Q2-2012 | 50 | 51.44 | 46.21 |

| Q3-2012 | 50 | 51.90 | 45.44 |

| Q4-2012 | 50 | 51.77 | 44.44 |

| Q1-2013 | 50 | 51.08 | 45.04 |

| Q2-2013 | 50 | 52.20 | 47.17 |

| Q3-2013 | 50 | 53.14 | 50.00 |

| Q4-2013 | 50 | 53.61 | 53.05 |

| Q1-2014 | 50 | 54.37 | 53.30 |

| Q2-2014 | 50 | 54.18 | 51.54 |

| Q3-2014 | 50 | 53.37 | 50.82 |

| Q4-2014 | 50 | 53.05 | 51.71 |

| Q1-2015 | 50 | 51.06 | 50.62 |

| Q2-2015 | 50 | 48.67 | 49.44 |

| Q3-2015 | 50 | 48.27 | 49.77 |

| Q4-2015 | 50 | 48.75 | 49.02 |

| Q1-2016 | 50 | 49.61 | 47.87 |

| Q2-2016 | 50 | 50.33 | 47.80 |

| Q3-2016 | 50 | 50.04 | 47.87 |

| Q4-2016 | 50 | 49.58 | 47.91 |

| Q1-2017 | 50 | 50.28 | 49.59 |

| Q2-2017 | 50 | 51.73 | 51.08 |

| Q3-2017 | 50 | 53.23 | 52.29 |

| Q4-2017 | 50 | 54.34 | 53.30 |

| Q1-2018 | 50 | 55.49 | 55.17 |

| Q2-2018 | 50 | 56.29 | 56.12 |

| Q3-2018 | 50 | 56.41 | 55.22 |

| Q4-2018 | 50 | 56.19 | 53.53 |

| Q1-2019 | 50 | 55.51 | 51.98 |

| Q2-2019 | 50 | 54.36 | 51.39 |

| Q3-2019 | 50 | 54.23 | 52.01 |

| Q4-2019 | 50 | 54.73 | 53.34 |

| Q1-2020 | 50 | 53.97 | 53.14 |

| Q2-2020 | 50 | 53.47 | 52.22 |

| Q3-2020 | 50 | 54.02 | 51.76 |

| Q4-2020 | 50 | 55.10 | 52.44 |

| Q1-2021 | 50 | 56.51 | 53.33 |

Positive expectations for the second quarter of 2021

The general outlook for the second quarter of 2021 is overall somewhat positive, and the proportion with an optimistic view for the coming quarter is higher than in the previous survey. Although producers of all goods types have positive expectations, it is producers of intermediate goods and consumer goods who have the most optimistic view related to the second quarter. The industrial managers further report that the total production volume is expected to grow compared with the first quarter. Moderate employment growth is also expected in the coming quarter. It is only producers in consumer goods that expect growth in employment. The development in employment is expected to be unchanged within the producer of intermediate goods and capital goods. It is reported that adopted investment plans are marginally adjusted upwards, and that new orders from both the domestic and export markets will increase further. It is expected growth in the total stock orders. Here, however, there are different expectations within the different good types. While producer of intermediate goods and consumer goods expect the total stock orders to increase in the coming quarter, producers of capital goods expect a fall.

Figure 4. General judgement of the outlook in next quarter for manufacturing

| Turning point value | Smoothed seasonally adjusted | |

| Q1-2012 | 50 | 56.38 |

| Q2-2012 | 50 | 56.20 |

| Q3-2012 | 50 | 55.53 |

| Q4-2012 | 50 | 55.12 |

| Q1-2013 | 50 | 55.16 |

| Q2-2013 | 50 | 55.01 |

| Q3-2013 | 50 | 54.79 |

| Q4-2013 | 50 | 54.68 |

| Q1-2014 | 50 | 54.16 |

| Q2-2014 | 50 | 53.39 |

| Q3-2014 | 50 | 51.60 |

| Q4-2014 | 50 | 48.49 |

| Q1-2015 | 50 | 45.38 |

| Q2-2015 | 50 | 43.51 |

| Q3-2015 | 50 | 42.89 |

| Q4-2015 | 50 | 44.16 |

| Q1-2016 | 50 | 46.91 |

| Q2-2016 | 50 | 50.51 |

| Q3-2016 | 50 | 52.97 |

| Q4-2016 | 50 | 53.61 |

| Q1-2017 | 50 | 53.94 |

| Q2-2017 | 50 | 54.92 |

| Q3-2017 | 50 | 56.98 |

| Q4-2017 | 50 | 58.93 |

| Q1-2018 | 50 | 59.49 |

| Q2-2018 | 50 | 58.86 |

| Q3-2018 | 50 | 59.32 |

| Q4-2018 | 50 | 59.33 |

| Q1-2019 | 50 | 59.70 |

| Q2-2019 | 50 | 57.24 |

| Q3-2019 | 50 | 51.60 |

| Q4-2019 | 50 | 44.24 |

| Q1-2020 | 50 | 39.88 |

| Q2-2020 | 50 | 42.45 |

| Q3-2020 | 50 | 48.28 |

| Q4-2020 | 50 | 52.97 |

| Q1-2021 | 50 | 55.68 |

The industrial confidence indicator is clearly positive

The industrial confidence indicator in the first quarter was 8.2, (seasonally-adjusted) up from 3.8 in the previous quarter. The indicator is now well above the historical average and this indicates growth in production volume for the second quarter of 2021.

The industrial confidence indicator is clear positive for both the majority of producers of intermediate goods and consumer goods, while it is still negative for producers of capital goods.

Values above zero indicate that total output will grow in the forthcoming quarter, while values below zero indicate that total output will fall. International comparisons of the industrial confidence indicator are available from Eurostat (EU), The Swedish National Institute of Economic Research and Statistics Denmark.

1 Industrial confidence indicator is the arithmetic average of the answers (balances) to the questions on production expectations, total stock of orders and inventories of own products (the latter with inverted sign).

Figure 5. Industrial confidence indicator¹

| Seasonally adjusted | Average 1990-2021 | |

| Q1-2012 | 9.0 | 3.0 |

| Q2-2012 | 6.4 | 3.0 |

| Q3-2012 | 0.8 | 3.0 |

| Q4-2012 | 4.9 | 3.0 |

| Q1-2013 | 1.4 | 3.0 |

| Q2-2013 | 1.0 | 3.0 |

| Q3-2013 | 6.3 | 3.0 |

| Q4-2013 | 8.0 | 3.0 |

| Q1-2014 | 6.5 | 3.0 |

| Q2-2014 | 6.1 | 3.0 |

| Q3-2014 | 1.9 | 3.0 |

| Q4-2014 | -1.7 | 3.0 |

| Q1-2015 | -3.6 | 3.0 |

| Q2-2015 | -9.3 | 3.0 |

| Q3-2015 | -6.4 | 3.0 |

| Q4-2015 | -8.2 | 3.0 |

| Q1-2016 | -6.6 | 3.0 |

| Q2-2016 | -3.0 | 3.0 |

| Q3-2016 | -3.6 | 3.0 |

| Q4-2016 | -0.5 | 3.0 |

| Q1-2017 | 1.6 | 3.0 |

| Q2-2017 | 2.5 | 3.0 |

| Q3-2017 | 3.8 | 3.0 |

| Q4-2017 | 6.5 | 3.0 |

| Q1-2018 | 6.9 | 3.0 |

| Q2-2018 | 8.8 | 3.0 |

| Q3-2018 | 9.2 | 3.0 |

| Q4-2018 | 8.9 | 3.0 |

| Q1-2019 | 7.5 | 3.0 |

| Q2-2019 | 5.9 | 3.0 |

| Q3-2019 | 1.1 | 3.0 |

| Q4-2019 | -0.1 | 3.0 |

| Q1-2020 | -17.5 | 3.0 |

| Q2-2020 | -9.3 | 3.0 |

| Q3-2020 | 2.1 | 3.0 |

| Q4-2020 | 3.8 | 3.0 |

| Q1-2021 | 8.2 | 3.0 |

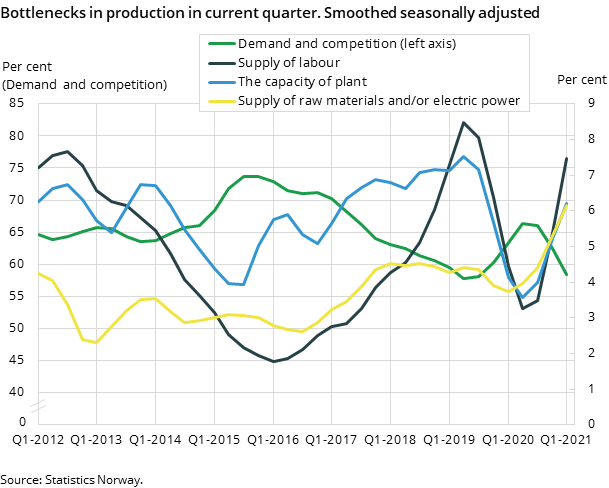

Access to labor limits production

Compared with the previous survey, there are a higher proportion of industry leaders who highlight that the lack of qualified labor and full capacity utilization are factors that contributed to limiting production in the first quarter of 2021. At the same time, a lower proportion of industry leaders point out that weak demand and strong competition have limited production.

The average capacity utilisation for Norwegian manufacturing is slightly higher than the previous quarter, and was calculated to 78.9 per cent at the end of the first quarter of 2021. The capacity utilisation is higher than in the fourth quarter of 2020, but is still below the historical average of 80.0 per cent. International comparisons of average capacity utilisation are available from Eurostat (EU).

Figure 7. Capacity utilisation in per cent for manufacturing

| Smoothed seasonally adjusted | Average 1990-2021 | |

| Q1-2012 | 79.7 | 80.02 |

| Q2-2012 | 79.7 | 80.02 |

| Q3-2012 | 79.8 | 80.02 |

| Q4-2012 | 79.8 | 80.02 |

| Q1-2013 | 79.4 | 80.02 |

| Q2-2013 | 79.3 | 80.02 |

| Q3-2013 | 79.5 | 80.02 |

| Q4-2013 | 80.0 | 80.02 |

| Q1-2014 | 80.4 | 80.02 |

| Q2-2014 | 80.5 | 80.02 |

| Q3-2014 | 80.1 | 80.02 |

| Q4-2014 | 79.3 | 80.02 |

| Q1-2015 | 78.4 | 80.02 |

| Q2-2015 | 77.4 | 80.02 |

| Q3-2015 | 76.7 | 80.02 |

| Q4-2015 | 76.9 | 80.02 |

| Q1-2016 | 77.1 | 80.02 |

| Q2-2016 | 77.2 | 80.02 |

| Q3-2016 | 77.0 | 80.02 |

| Q4-2016 | 76.9 | 80.02 |

| Q1-2017 | 77.1 | 80.02 |

| Q2-2017 | 77.6 | 80.02 |

| Q3-2017 | 77.8 | 80.02 |

| Q4-2017 | 77.8 | 80.02 |

| Q1-2018 | 78.3 | 80.02 |

| Q2-2018 | 78.8 | 80.02 |

| Q3-2018 | 79.3 | 80.02 |

| Q4-2018 | 79.5 | 80.02 |

| Q1-2019 | 79.5 | 80.02 |

| Q2-2019 | 79.6 | 80.02 |

| Q3-2019 | 79.3 | 80.02 |

| Q4-2019 | 78.1 | 80.02 |

| Q1-2020 | 76.6 | 80.02 |

| Q2-2020 | 76.1 | 80.02 |

| Q3-2020 | 76.8 | 80.02 |

| Q4-2020 | 78.1 | 80.02 |

| Q1-2021 | 78.9 | 80.02 |

Timelines

The survey data was collected in the period from 9 March 2021 to 20 April 2021.

Contact

-

Edvard Andreassen

-

Ståle Mæland

-

Statistics Norway's Information Centre