Content

Published:

This is an archived release.

Large decrease in dividends

Dividend payouts from enterprises registered with the Norwegian Central Securities Depository (VPS) decreased by 30.7 per cent in the second quarter of 2015 compared to the same quarter last year. The total dividend payouts amounted to NOK 49.7 billion, which is the lowest since the second quarter of 2011.

| 3rd quarter 2014 | 4th quarter 2014 | 1st quarter 2015 | 2nd quarter 2015 | |

|---|---|---|---|---|

| Stocks (market value) | ||||

| Shares (listed) | 1 934.8 | 1 788.8 | 1 912.3 | 1 912.6 |

| Shares (unlisted) | 435.8 | 471.1 | 514.9 | 508.1 |

| Long-term debt securities | 1 750.9 | 1 772.0 | 1 776.2 | 1 728.6 |

| Short-term debt securities | 158.6 | 149.5 | 165.6 | 173.7 |

| Equity certificates | 27.4 | 27.7 | 28.9 | 30.1 |

| Dividends/coupon payments | ||||

| Shares (listed) | 9.9 | 11.1 | 6.5 | 44.0 |

| Shares (unlisted) | 1.0 | 2.2 | 1.3 | 5.7 |

| Long-term debt securities | 10.6 | 11.9 | 11.5 | 24.8 |

| Short-term debt securities | 0.3 | 0.4 | 0.3 | 0.3 |

| Equity certificates | .. | .. | 0.2 | 1.2 |

The large decrease in dividends was due to low dividend payouts from quoted enterprises. The dividend payouts from these enterprises amounted to NOK 68.8 billion in the second quarter in 2014, compared to NOK 44 billion in the second quarter of 2015, which corresponds to a decrease of 36 per cent.

Dividend payouts from unquoted enterprises registered with the VPS amounted to NOK 5.7 billion in the second quarter of 2015; an increase of NOK 2.7 billion compared to the same period last year.

Low dividend payouts from public incorporated enterprises owned by central government

In the second quarter of 2015, quoted public incorporated enterprises owned by central government disbursed dividends for NOK 14 billion. Compared to the same quarter last year, the dividend disbursements from these enterprises fell by NOK 19.7 billion or 58.5 per cent, and contributed strongly to the overall decrease of dividend payouts.

Dividend payouts from quoted private non-financial incorporated enterprises and quoted non-life insurance companies also showed a decrease in the second quarter compared to the same period last year. On the other hand, the disbursement of dividends in financial holding companies increased compared to the second quarter of last year.

As a receiver, the central government with its large stake in quoted public incorporated enterprises owned by central government was strongly affected by the large decrease of dividend payouts. In the second quarter of 2015 they received dividends amounting to NOK 13.9 billion, compared to NOK 27.4 billion in the second quarter of 2014. This corresponds to a decrease of dividend disbursements of 49.2 per cent.

Foreign investors also received considerably lower dividends in the second quarter. More precisely, they received dividends for NOK 14 billion; a decrease of 34.1 per cent compared to the same period last year.

Negligible changes in the share market

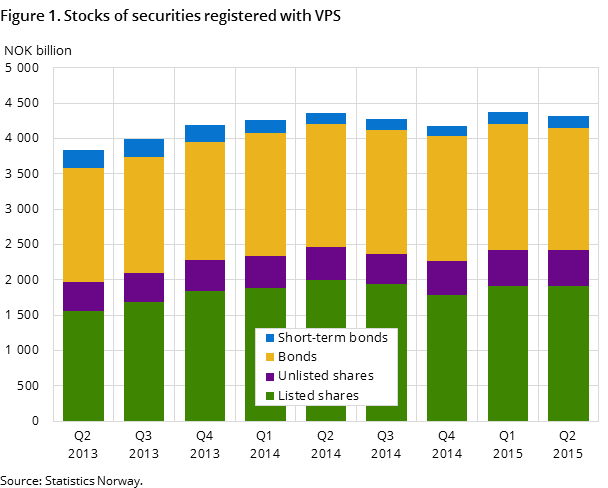

After a substantial increase in the market value of shares during the first quarter of 2015, the market value of enterprises registered with the VPS was NOK 2 421 billion at the end of the second quarter, i.e. about the same amount as at the end of the first quarter. Of this, the market value of the quoted enterprises amounted to NOK 1 913 billion and the unquoted enterprises to NOK 508 billion.

Foreign investors and banks made the largest net purchases of shares in the second quarter, each buying shares worth NOK 4.5 billion. While the foreign investors in all material aspects purchased quoted shares, more than half of the banks’ net purchases related to unquoted shares. The central government net purchased quoted shares for NOK 1.9 billion in the period.

On the other hand, employees etc. and private non-financial incorporated enterprises net sold shares for NOK 3.5 billion and NOK 2.4 billion respectively. On the whole, both cases relate to the net sale of unquoted shares.

Outstanding amounts of debt securities roughly unchanged

The market value of the total outstanding amounts of long-term debt securities registered with VPS was NOK 1 729 billion at the end of the second quarter; corresponding to a decrease of 2.7 per cent compared to the previous quarter. The market value of the total outstanding amounts of short-term debt securities with an original term to maturity of one year or less increased by 4.9 per cent during the quarter, to NOK 174 billion at the end of the quarter.

For more information on institutional sectors issuing debt securities registered with VPS, see Statistics Norway’s Debt securities statistics.

The statistics is now published as Securities.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42