Content

Published:

This is an archived release.

Positive start to 2014

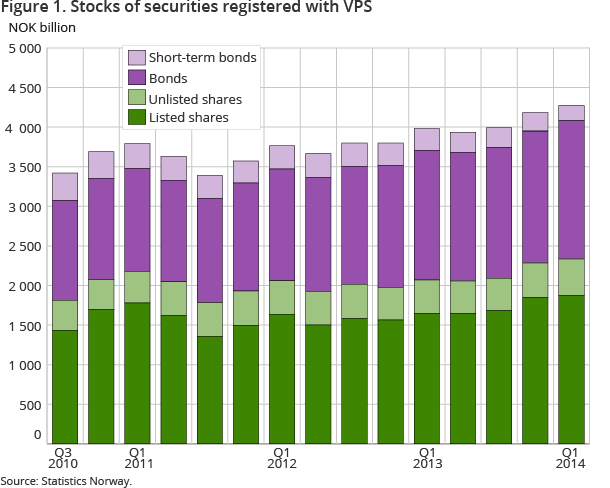

During the first quarter of this year, the value of the listed VPS-registered shares increased by nearly 2 per cent. The positive development in 2013 has therefore continued into this year.

| 2nd quarter 2013 | 3rd quarter 2013 | 4th quarter 2013 | 1st quarter 2014 | |

|---|---|---|---|---|

| Stocks (market value) | ||||

| Shares (listed) | 1 561.2 | 1 682.0 | 1 843.7 | 1 876.9 |

| Shares (unlisted) | 408.9 | 410.5 | 436.4 | 458.7 |

| Bonds | 1 612.8 | 1 641.8 | 1 665.2 | 1 748.0 |

| Short-term securities | 255.0 | 254.9 | 234.1 | 189.7 |

| Equity certificates | 20.2 | 20.5 | 24.5 | 24.3 |

| Dividends/coupon payments | ||||

| Shares (listed) | 60.6 | 3.5 | 3.5 | 7.6 |

| Shares (unlisted) | 2.8 | 0.9 | 1.1 | 0.6 |

| Bonds | 28.4 | 10.6 | 11.5 | 10.4 |

| Short-term securities | 0.5 | 0.4 | 0.5 | 0.4 |

| Equity certificates | 0.8 | .. | 0.0 | 0.2 |

The value of the VPS-registered listed shares increased by NOK 33 billion in the first quarter of 2014 to NOK 1877 billion, mainly due to rising prices in the stock market. As was the case in many markets around the world, the Norwegian stock market had a moderately positive development in the first quarter. The All-Share Index, OSEAX, which shows price movements in shares listed on the Oslo Stock Exchange, increased by 3.2 per cent to 622 points in the first quarter - the highest registered level at the end of a quarter. The index, which is adjusted for dividend pay-outs and capital events, provides a clear picture of returns in the stock market over time, while the stocks of shares in the statistics give an accurate picture of the listed companies’ market value.

Private non-financial incorporated enterprises with high net purchases of shares

Private non-financial incorporated enterprises net purchased shares for a total of NOK 13 billion in the first quarter. The purchases can be attributed to the foreign enterprise acquiring all shares issued by the Norwegian enterprise. The acquisition of shares was registered on a domestic registered company, established by the foreign company. Therefore, the acquisition is shown in the statistics as private enterprises’ purchase of shares issued by private enterprises, and not as a purchase from abroad.

Higher dividend pay-outs than usual

During the first quarter, as much as NOK 8.2 billion was paid out in dividends by enterprises registered with the VPS. Most of this was paid out by listed corporations. In the corresponding quarter in 2013, only NOK 0.6 billion was paid out in dividends. The high dividend pay-outs this year can mainly be attributed to an extraordinary dividend pay-out from a listed corporation.

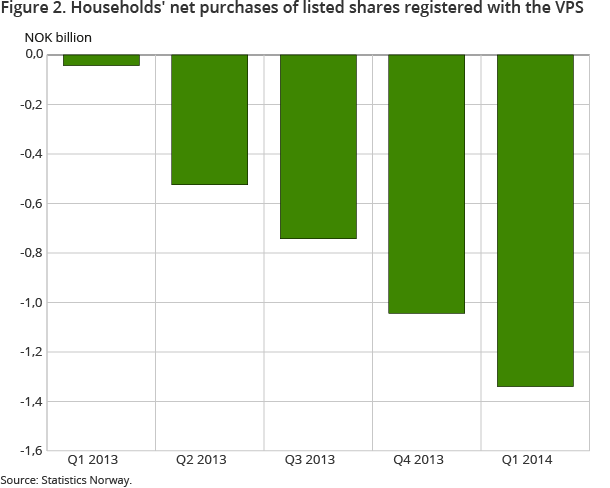

Households net sell shares

After net selling listed shares in all four quarters of 2013, households continued to sell shares in 2014. Net sales of shares in the first quarter amounted to NOK 1.4 billion, and the largest net sales were made in shares issued by private non-financial incorporated enterprises.

Increased stocks of bonds

During the first quarter of 2014, the stocks of bonds increased by NOK 83 billion to NOK 1 748. Holdings of short-term bonds fell in the third quarter by NOK 44 billion to NOK 190 billion.

The statistics is now published as Securities.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42