Content

Published:

This is an archived release.

Solid growth in stock market

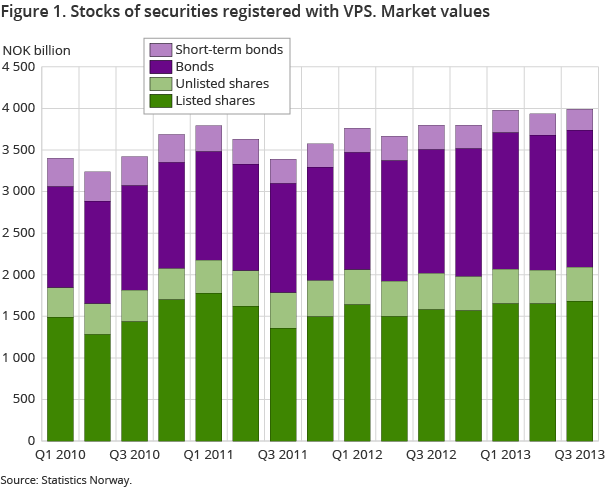

During the third quarter of 2013, the value of the VPS-registered stocks increased in value by 7.7 per cent. Some sectors net purchased significant amounts of bonds during the quarter.

| 4th quarter 2012 | 1st quarter 2013 | 2nd quarter 2013 | 3rd quarter 2013 | |

|---|---|---|---|---|

| Stocks (market value) | ||||

| Shares (listed) | 1 564.5 | 1 648.5 | 1 561.2 | 1 682.0 |

| Shares (unlisted) | 412.0 | 419.5 | 408.9 | 410.2 |

| Bonds | 1 541.6 | 1 625.1 | 1 612.8 | 1 647.0 |

| Short-term securities | 280.1 | 276.2 | 255.0 | 254.0 |

| Equity certificates | 17.2 | 20.7 | 20.2 | 20.5 |

| Dividends/coupon payments | ||||

| Shares (listed) | 3.8 | 0.7 | 60.6 | 3.5 |

| Shares (unlisted) | 0.5 | 0.5 | 2.8 | 0.9 |

| Bonds | 11.3 | 10.0 | 28.4 | 10.6 |

| Short-term securities | 0.5 | 0.5 | 0.5 | 0.4 |

| Equity certificates | .. | 0.1 | 0.8 | .. |

The positive trend in the stock market in the first quarter continued in the third quarter of 2013. The value of listed shares registered with the VPS increased by NOK 121 billion to NOK 1 681 billion. This was mainly due to higher prices on the Oslo Stock Exchange. Share prices increased in value during the quarter in line with stock markets in several other countries. Signals from leading central banks that stimulative measures will be continued may have contributed to the positive development.

Stock market at highest level since 2008

The All-Share Index, OSEAX, which shows price movements in shares listed on the Oslo Stock Exchange, stood at 552 points at the end of the third quarter. This is the highest level since the first half of 2008, just before the global financial crisis hit the markets, when the index stood at 604 points.

Non-life insurance companies place large sums in bonds

Corporations in the non-life insurance sector net purchased bonds for NOK 15.2 billion in the third quarter, of which NOK 11.5 billion were placed in bonds issued by mortgage companies. Because of these high net purchases, the non-life insurance sector’s holdings of bonds increased by 35 per cent in the third quarter, to NOK 57 billion.

Share repurchases affect net purchases

As an alternative to paying out dividends, some companies choose to instead repurchase their own shares in the market. Telenor and Yara repurchased and redeemed shares for NOK 5.8 and NOK 1.4 billion respectively. This type of activity is the main cause for the negative total net purchase of NOK -5.3 billion in the third quarter.

Foreigners purchase shares, households sell

Foreign investors net purchased listed shares for just over NOK 5 billion in the third quarter. In excess of NOK 4 billion of these were shares issued by non-financial corporations. Households net sold listed shares for a total of NOK 0.7 billion in the quarter.

Increased stocks of bonds

In the first quarter of 2013, the stocks of bonds increased by NOK 34 billion to NOK 1 647 billion at the end of the quarter. Holdings of short-term bonds fell slightly in the third quarter by NOK 1 billion to NOK 254 billion. See the statistics Bonds and commercial papers for more information on which sectors issued the bonds.

The statistics is now published as Securities.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42