Content

Published:

This is an archived release.

Solid growth in stock market

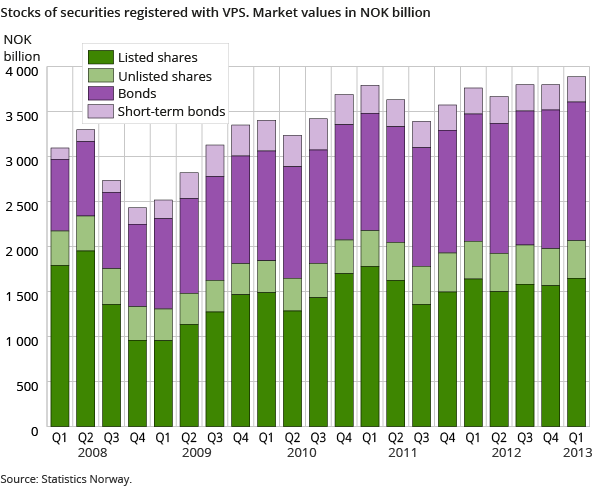

During the first quarter of 2013 the value of the VPS-registered stocks increased in value by 5.4 per cent. The quarter was characterised by low net purchases of shares between sectors.

| 2nd quarter 2012 | 3rd quarter 2012 | 4th quarter 2012 | 1st quarter 2013 | |

|---|---|---|---|---|

| Stocks (market value) | ||||

| Shares (listed) | 1 500.1 | 1 581.3 | 1 564.5 | 1 648.5 |

| Shares (unlisted) | 424.4 | 434.9 | 412.0 | 415.8 |

| Bonds | 1 443.5 | 1 489.1 | 1 541.6 | 1 624.3 |

| Short-term securities | 299.5 | 294.0 | 280.1 | 276.2 |

| Equity certificates | 14.9 | 15.9 | 17.2 | 20.7 |

| Dividends/coupon payments | ||||

| Shares (listed) | 54.4 | 4.2 | 3.8 | 0.7 |

| Shares (unlisted) | 2.8 | 0.3 | 0.5 | 0.5 |

| Bonds | 25.4 | 9.9 | 11.3 | 10.0 |

| Short-term securities | 0.6 | 0.6 | 0.5 | 0.5 |

| Equity certificates | 0.4 | .. | .. | 0.1 |

The positive trend in the stock market in 2012 continued in the first quarter of 2013, and the value of listed shares registered with the VPS increased by NOK 84 billion to NOK 1 649 billion. This was mainly due to higher prices on the Oslo Stock Exchange. Share prices increased in value during the quarter in line with stock markets in several other countries. Improved economic prospects in some countries may have contributed to the positive development. Virtually the entire increase in value took place in January.

Much of the loss in value from 2008 and 2011 offset

The global financial crisis of 2008 and the growing debt crisis that followed in the euro zone in 2011 contributed to substantially decreasing the value of listed shares registered with the VPS. A positive development in the stock market in 2012 and in the first quarter of this year, however, helped offset a large part of the fall. The All-Share Index, which shows price movements in shares listed on the Oslo Stock Exchange, fell considerably in 2008 from 604 to 232 points, and from 513 to 373 points in 2011. At the end of the first quarter of 2011, the index climbed to 519 points. The last time the index levels were this high was in 2008, just before the financial crisis fully hit the markets. The holdings of listed shares registered with the VPS have a similar development, but may deviate somewhat since the index is adjusted for dividend payments and capital events. The listed shares registered with the VPS reached their lowest level in the fourth quarter of 2008 at about NOK 950 billion. By the end of the first quarter of 2013, the stocks had increased to NOK 1 649 billion.

Private enterprises buy shares

One of the sectors with the highest net purchases of shares in the first quarter was private non-financial incorporated enterprises. Firms in this sector net purchased shares worth about NOK 3 billion. These net purchases are related to the German pharmaceutical group BASF's acquisition of Pronova BioPharma ASA, where the acquisition was carried out by the Norwegian-registered limited company BASF AS. The acquisition thus appears as private enterprises’ net purchases of shares issued by private enterprises, and not as an acquisition from abroad.

Increased stocks of bonds

In the first quarter of 2013, the stocks of bonds increased by NOK 83 billion to NOK 1 624 billion at the end of the quarter. Holdings of short-term bonds fell slightly in the third quarter by NOK 4 billion to NOK 276 billion. See the statistics Bonds and commercial papers for more information on which sectors issued the bonds.

Introduction of new sector classificationOpen and readClose

A new institutional sector classification was introduced in January 2012. One of the most significant changes was that the line between financial and non-financial sectors has been shifted such that the financial sectors increased in value. In addition to this, new financial sectors have been added. The introduction of a new sector standard means that the old tables will no longer be updated. New tables have been added that include time series from the first quarter of 2012 and onwards.

See document (in Norwegian) for more information on the new standard and a description of all sectors in the new standard.

New distinction between listed and unlisted sharesOpen and readClose

From the first quarter of 2012, listed and unlisted shares will be differentiated from another. Listed shares are shares listed for trading at the Oslo Stock Exchange and Oslo Axxess.

The statistics is now published as Securities.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42