Content

Published:

This is an archived release.

Net purchases of mutual fund shares, but foreigners sell

Net purchases of mutual fund shares registered in Norway continued during the 2nd quarter of 2016. Net purchases during the period reached NOK 9.1 billion, with the financial companies being the biggest buying sector. Foreigners net sold NOK 2.9 billion worth of fund shares.

| 3rd quarter 2015 | 4th quarter 2015 | 1st quarter 2016 | 2nd quarter 2016 | |

|---|---|---|---|---|

| All sectors | ||||

| Outstanding amounts | 942 528 | 958 123 | 959 517 | 977 485 |

| Net purchases/sales | 5 871 | -26 930 | 24 936 | 9 110 |

| General government | ||||

| Outstanding amounts | 11 994 | 12 576 | 12 750 | 13 322 |

| Net purchases/sales | -87 | 321 | 395 | 549 |

| Financial corporations | ||||

| Outstanding amounts | 610 114 | 607 132 | 619 936 | 639 082 |

| Net purchases/sales | 11 394 | -17 524 | 26 344 | 10 966 |

| Non-financial corporations | ||||

| Outstanding amounts | 62 705 | 59 898 | 61 716 | 62 843 |

| Net purchases/sales | 275 | -4 831 | 2 244 | 1 131 |

| Households | ||||

| Outstanding amounts | 132 317 | 139 758 | 134 235 | 134 226 |

| Net purchases/sales | -1 134 | 2 721 | -344 | -334 |

| Non-profit institutions serving households | ||||

| Outstanding amounts | 31 793 | 31 609 | 31 550 | 31 485 |

| Net purchases/sales | 631 | -1 043 | -1 139 | -238 |

| Rest of the world | ||||

| Outstanding amounts | 93 444 | 106 855 | 99 202 | 96 411 |

| Net purchases/sales | -5 208 | -6 587 | -2 538 | -2 961 |

| Unspecified sector | ||||

| Outstanding amounts | 161 | 295 | 128 | 116 |

| Net purchases/sales | 0 | 13 | -26 | -3 |

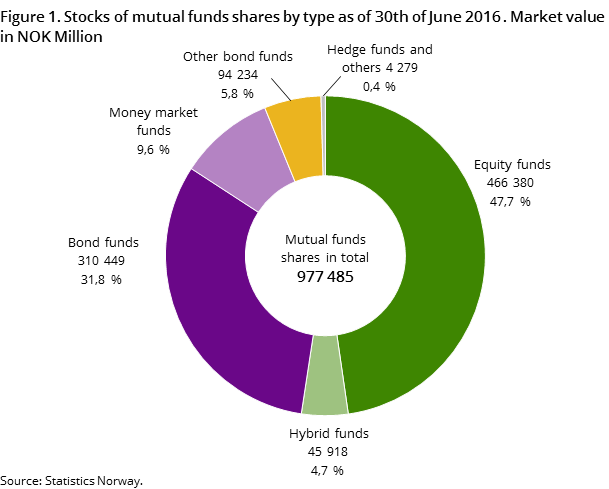

The net purchases are mainly due to net purchases of bond and money market fund shares. These types of funds were net purchased for a sum of NOK 6.7 billion and NOK 7 billion respectively. This corresponds to a 2.2 and 8.1 per cent increase in total share capital for these fund types. Equity fund shares were on the other hand net sold for a total of NOK 4.1 billion. This corresponds to a 0.9 per cent decrease in total equity fund share capital. Other fund types only saw minor movements in share capital and net sales during the period.

The total market value of the assets held by mutual funds increased by NOK 17.9 billion during the second quarter of 2016, reaching a total of NOK 982.4 billion. This corresponds to a 2 per cent increase compared to the previous quarter. A particular increase was observed in the funds’ stocks of short and long-term debt securities during the period.

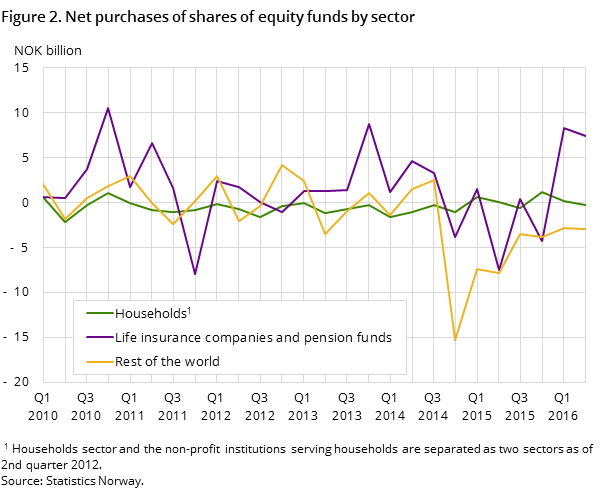

Foreigners sell equity fund shares

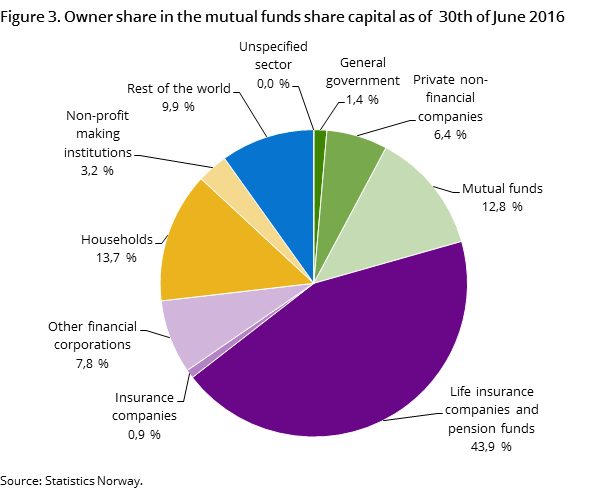

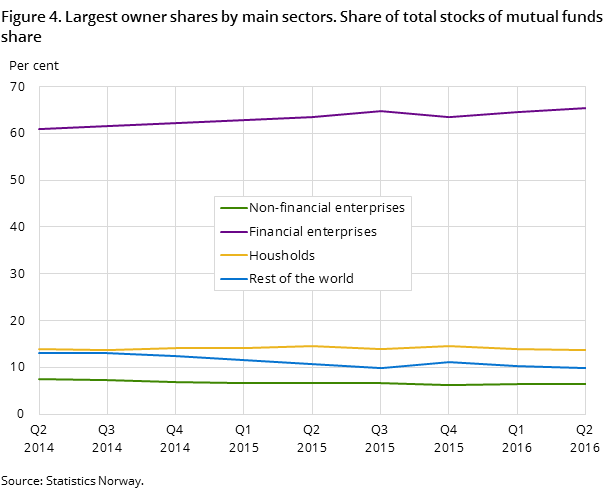

The second quarter of 2016 saw a total of NOK 4.1 billion net sales of equity fund shares, of which foreigners’ net sales contributed NOK 3.9 billion. This means they sold 5 per cent of their share capital. There is no corresponding net purchase in foreigners’ net purchases of other types of fund shares. Foreigners’ total net purchases in fund types other than equity fund shares totalled NOK 1 billion. This is the seventh quarter in a row that foreigners have net sold mutual fund shares registered in Norway. Their total share of the total market is now down to 9.9 per cent, down from 13.2 per cent during the second quarter of 2014.

Life insurance companies and pension funds biggest net purchaser of bond fund shares

Life insurance companies and pension funds net purchased fund shares for NOK 7.4 billion in the second quarter of 2016 making it the holding sector with the largest net purchases in this quarter. The investments were mainly made in bond shares and money market shares, worth a total of NOK 4.3 billion and NOK 1.8 billion respectively.

Life insurance companies and pension funds still make up the largest holding sector of mutual fund shares with an owner share of 43.9 per cent of the total share capital. More specifically, they own 69.1 per cent of the share capital in bond funds.

The statistics is now published as Mutual funds.

Contact

-

Harald Stormoen

E-mail: harald.stormoen@ssb.no

tel.: (+47) 95 91 95 91

-

Steven Chun Wei Got

E-mail: steven.got@ssb.no

tel.: (+47) 90 82 68 27