Content

Published:

This is an archived release.

Considerably weaker results in mutual funds

The mutual funds’ end results for 2015 were considerably weaker than 2014. The decrease of 37 per cent is primarily due to a net reduction in gains.

| 2015 | |

|---|---|

| TOTAL ASSETS | 961 571 |

| Mutual fund shares at par value | 608 701 |

| NET INCOME | 56 959 |

| Number of mutual funds | 374 |

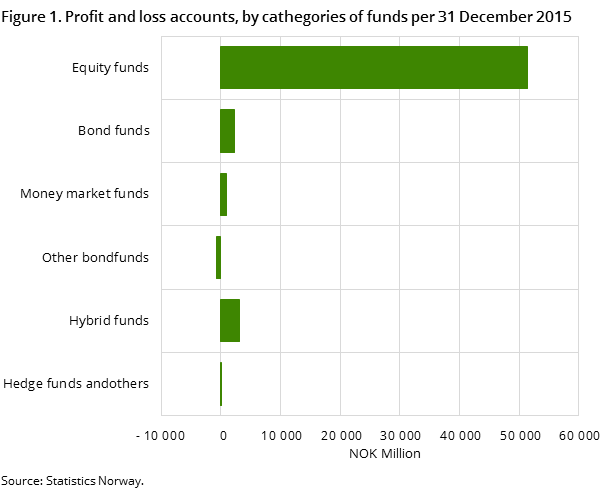

The mutual funds’ end results for 2015 totalled NOK 57 billion, down from NOK 90.5 billion in 2014. The reduced results are mainly due to a drop in unrealised gains of NOK 36.7 billion from 2014. Realised gains were on the other hand higher in 2015 than the previous year. These gains went up from NOK 39.4 billion to NOK 41 billion. As in previous years, equity funds contributed the most to the total end result in 2015, with a contribution of NOK 51.4 billion.

Income from management fees totalled NOK 5.4 billion in 2015. This is 7.8 per cent higher than in 2014, when management commissions totalled NOK 5 billion. Apart from management fees, no significant changes related to management commissions or other costs were observed.

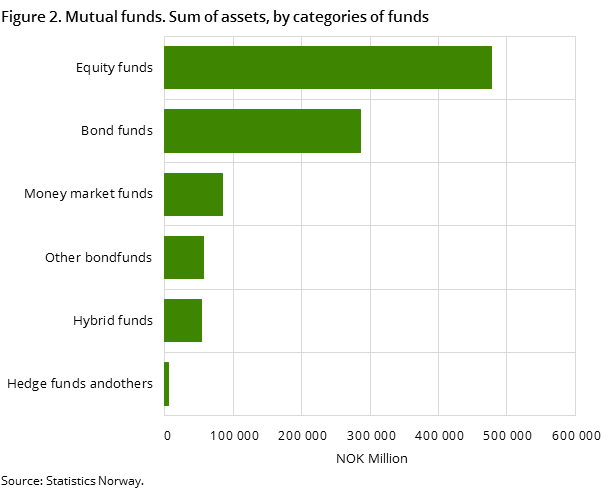

Growth in asset values

The value of all assets held by mutual funds totalled NOK 961.6 billion at the end of the year. This is an increase of NOK 54 billion – or 6 per cent compared to 2014. This increase is partially due to a decrease in the value of the Norwegian Kroner compared to other currencies during 2015. However, net purchases and increased values in securities have also contributed. NOK 541.9 billion was placed in equity, shares and equity certificates, NOK 336.7 billion in long-term bonds, and NOK 45.8 billion in short-term money market bonds. Out of all placements in equity, shares and equity certificates, 62 per cent were securities registered abroad, while 38 per cent were registered in Norway.

Continued increase in total share capital

The total share capital in Norwegian mutual funds increased by NOK 54 billion, or 5.7 per cent, in 2015. By the end of the year the total share capital was NOK 956.7 billion. The increase in share capital in Norwegian mutual funds is mainly due to a value increase in the funds’ portfolios, but net purchases also contributed. The value increase in the funds’ asset portfolios contributed substantially, totalling NOK 50.6 billion in 2015. Net purchases of fund shares, on the other hand, only contributed NOK 3.5 billion to the total increase. Net purchases of bond fund shares, hybrid funds and other bond funds totalled NOK 30.8 billion, NOK 4.8 billion and NOK 1.1 billion respectively. Equity funds and money market funds, on the other hand, saw net sales totalling NOK 29.9 billion and NOK 3.3 billion respectively.

Contact

-

Steven Chun Wei Got

E-mail: steven.got@ssb.no

tel.: (+47) 90 82 68 27

-

Harald Stormoen

E-mail: harald.stormoen@ssb.no

tel.: (+47) 95 91 95 91

-

Ole Petter Rygvold

E-mail: ole-petter.rygvold@ssb.no

tel.: (+47) 47 27 23 62