Content

Published:

This is an archived release.

Mutual funds with large surplus

While mutual funds as a whole made a loss in 2011, there was a significant improvement in results in 2012. The increase in profit from 2011 to 2012 totalled NOK 79 billion, and was primarily due to increases in the net changes of unrealised capital gains.

| 2012 | |

|---|---|

| TOTAL ASSETS | 608 557 |

| Share capital at nominal value | 427 176 |

| PROFIT/LOSSES | 44 332 |

| Number of unit trusts | 419 |

2012 was a very good year for mutual funds, with profit after tax of NOK 44 billion. In comparison, the result in 2011 was a loss of NOK 35 billion. The improvements can be attributed to a sharp rise in the net changes of unrealised gains from an unrealised loss of NOK 55 billion in 2011 to an unrealised profit of NOK 26 billion in 2012.

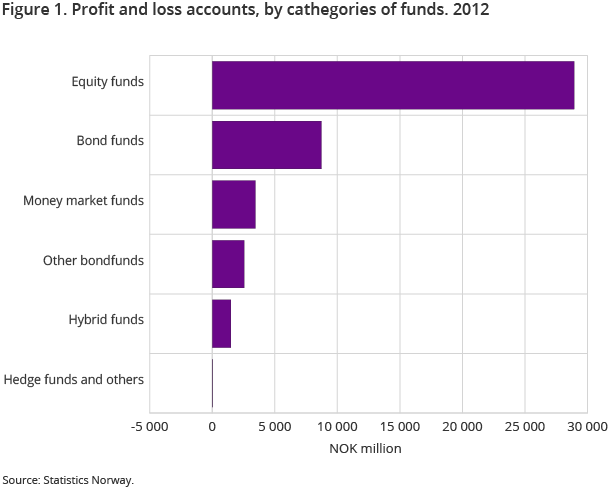

All types of funds had a positive result in 2012. Equity funds had a profit after tax of NOK 28 billion, while the corresponding figure for all other types of funds was NOK 16 billion.

Management fees amounted to NOK 4 billion in 2012. This is somewhat lower than in 2011. Beyond that there were no significant changes in costs associated with commission income and other costs.

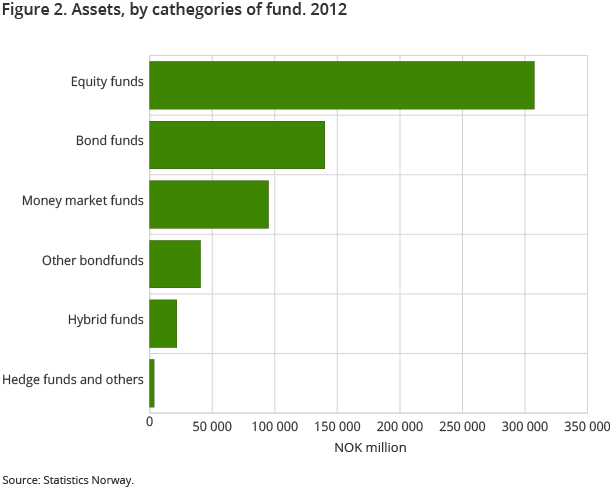

Holdings of current assets increased

In 2012, the mutual funds’ holdings of shares, equity certificates and other equity had increased by NOK 38 billion, or by 11.2 per cent, to NOK 338 billion at the end of the year. Of this amount, NOK 77 billion was placed in holdings of Norwegian and foreign mutual fund shares. In the same period, the holdings of bonds increased by NOK 34 billion, or by 16.9 per cent, to NOK 202 billion. Correspondingly, the holdings of short-term securities increased by NOK 1.8 billion, or by 4.8 per cent, to NOK 38 billion.

The total value of all assets held by mutual funds increased from NOK 529 billion at the end of 2011 to NOK 609 billion at the end of 2012. This amounted to an increase of 13.1 per cent.

Strong growth in the mutual funds’ share capital

The value of all mutual fund shares issued by Norwegian registered mutual funds grew by 13.2 per cent, from NOK 526 billion at the end of 2011 to NOK 606 billion at the end of 2012. In terms of percentages, the bond funds and equity funds had the largest growth, i.e. with an increase of 17.8 per cent and 11.8 respectively. On the other hand, the value of the mutual funds’ shares issued by money market funds decreased by 22.2 per cent in 2012.

Changes in classification of funds Open and readClose

Statistics Norway has decided to introduce changes in the classification of the funds as of 1 January 2012. This decision is in line with the Norwegian Fund and Asset Management Association’s (VFF) standards that were introduced in 2010. According to this, a new group called ‘other bond funds’ was introduced and the money market funds were defined more precisely.

Contact

-

Steven Chun Wei Got

E-mail: steven.got@ssb.no

tel.: (+47) 90 82 68 27

-

Harald Stormoen

E-mail: harald.stormoen@ssb.no

tel.: (+47) 95 91 95 91

-

Ole Petter Rygvold

E-mail: ole-petter.rygvold@ssb.no

tel.: (+47) 47 27 23 62