Content

Published:

This is an archived release.

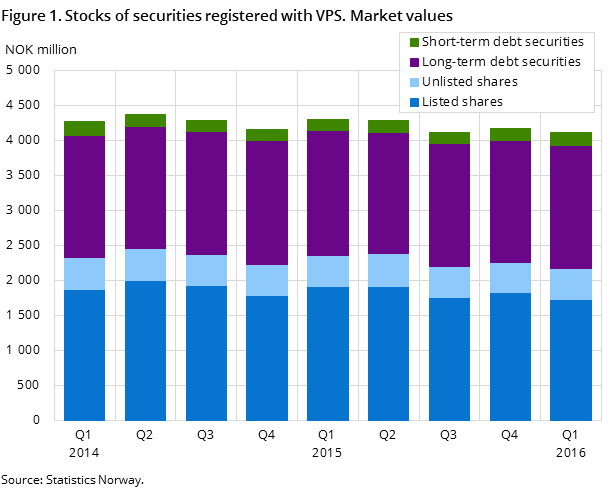

Fall in share values, decline in debt growth

In the 1st quarter of 2016, the value of issued shares registered with the Norwegian Central Securities Depository (VPS) fell due to the global market turmoil at the start of the year. At the same time, domestic issuers’ growth of debts declined due to a reversal in the fall of the Norwegian currency.

| 2nd quarter 2015 | 3rd quarter 2015 | 4th quarter 2015 | 1st quarter 2016 | |

|---|---|---|---|---|

| Stocks (market value) | ||||

| Shares (listed) | 1 912.6 | 1 751.7 | 1 827.2 | 1 733.7 |

| Shares (unlisted) | 444.2 | 443.3 | 433.4 | 433.2 |

| Long-term debt securities issued in Norway | 1 728.8 | 1 756.0 | 1 735.2 | 1 759.5 |

| Short-term debt securities issued in Norway | 173.9 | 166.9 | 170.4 | 182.3 |

| Equity certificates | 30.1 | 28.0 | 31.3 | 31.4 |

| Dividends/coupon payments | ||||

| Shares (listed) | 44.0 | 7.3 | 13.4 | 6.8 |

| Shares (unlisted) | 5.7 | 1.3 | 0.4 | 2.9 |

| Long-term debt securities issued in Norway | 24.8 | 9.0 | 10.1 | 10.9 |

| Short-term debt securities issued in Norway | 0.3 | 0.3 | 0.3 | 0.3 |

| Equity certificates | 1.2 | .. | .. | 0.2 |

The market value of the listed shares, including all shares listed on the Oslo Børs and Oslo Axess exchanges, fell by NOK 76 billion and amounted to NOK 1 734 billion at the end of the first quarter of 2016. The decrease in value is due to a relatively sharp fall in stock markets worldwide in January. The Oslo Stock Exchange All-Share Index (OSEAX), which shows the price development of quoted shares, fell by 3.2 per cent from the previous quarter. The 5.2 per cent fall in the value of stock of shares reported in the statistics was higher than the fall reported in the index due to the index being continually weighted and adjusted for capital events and dividend payouts. Most of the value disparities in the 1st quarter of 2016 are caused by a foreign-registered company moving to another exchange in another country.

Norwegian mutual funds and households buy shares

Norwegian-registered mutual funds, with a net purchase of listed shares of NOK 3.4 billion, was the sector with the highest net purchase of shares in the 1st quarter of 2016. Of this, a dominating part was placed in shares issued by private enterprises and state-owned enterprises.

For the second quarter in a row, households were net purchasers of listed shares. The net purchases amounted to NOK 1.3 billion. The highest net sales of shares, NOK 2.3 and 2.4 billion, referred to banks and foreign investors respectively.

Decline in debt growth

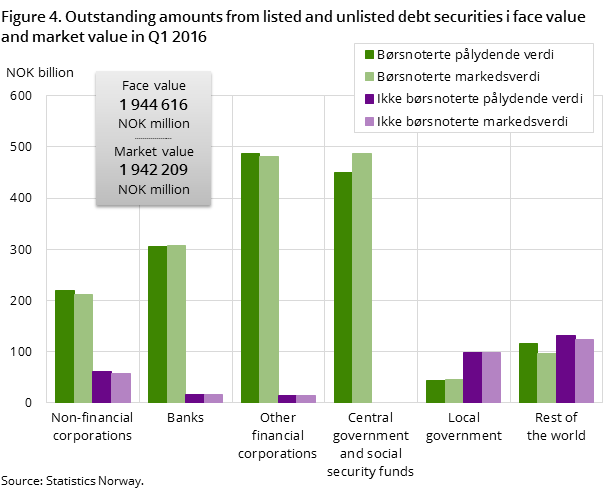

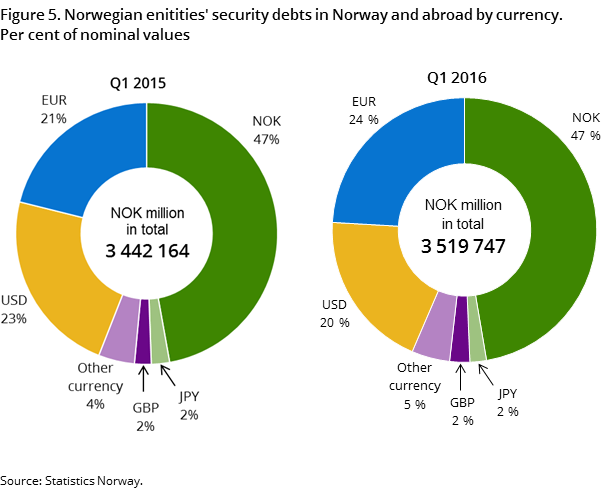

The face value of outstanding amounts from debt securities referring to issues in Norway amounted to NOK 1 945 billion at the end of March 2016. This is a growth of 2 per cent compared to the end of March 2015. Eighty-seven per cent of the outstanding amounts from debt securities issued in Norway referred to Norwegian issuers. At the same time, registered security debts from issues by Norwegian entities abroad amounted to NOK 1 823 billion; a marginal growth of above one per cent compared to the end of March last year. A depreciation of NOK has had a noticeable effect, and caused an increase in the value of debts in foreign currency compared with the value of such debt one year ago. However, this effect has declined, and has been reversed in the 1st quarter of 2016. By comparison, these effects led to an 8 per cent growth of Norwegian entities’ debt from issues abroad in 2015.

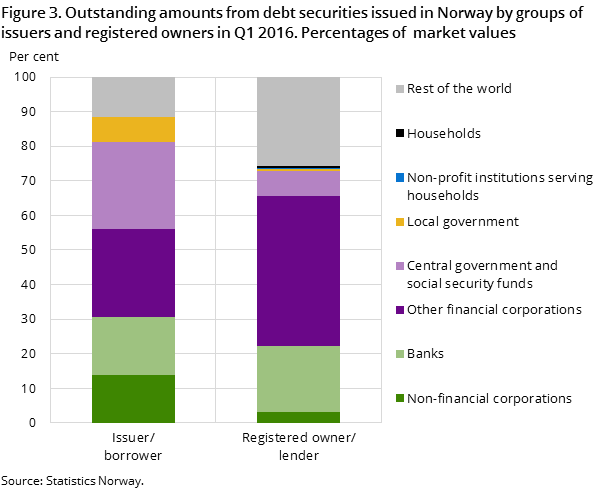

Financial corporations issue and own most debt securities

The largest shares of the outstanding amounts of issues from debt securities in Norway at the end of March 2016 referred to financial corporations and the central government, each with a share of 25 per cent. At the same time, financial corporations were registered as owners of 44 per cent of the holdings of debt securities in Norway. Fourteen per cent and 11 per cent of the outstanding amounts from issues of debt securities in Norway referred to the general government and rest of the world respectively. The rest of the world owned a total of 26 per cent of the holdings.

A large part of rest of the world’s holdings (90 per cent) refers to nominees; i.e. companies representing clients, where a large part of the actual security owners might be Norwegian entities.

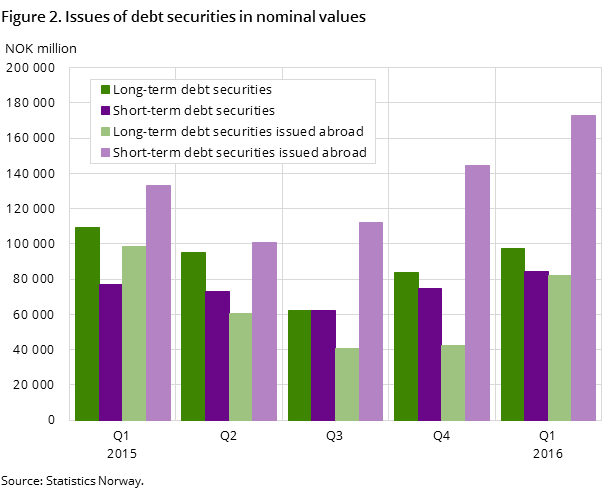

Moderate issues in Norway, but considerable issues abroad

In Norway, 238 issues of long-term debt securities and 316 issues of short-term debt securities valued at NOK 181 billion were registered in the 4th quarter of 2015; an increase in issues of 3 per cent compared to the 1st quarter last year. In the same period, Norwegian entities also issued 316 debt securities abroad, valued at NOK 254.7 billion. Compared to the 4th quarter of 2014, the number of issues was reduced by 2 per cent, while the amount of the issues rose by 10 per cent.

The largest shares of the volumes of issues, 55 per cent and 30 per cent, referred to the general government and financial corporations respectively. Ninety per cent of the issues of debt securities abroad referred to financial corporations.

Considerable net purchases of domestic debt securities

The total amount of net purchases of debt securities in Norway amounted to NOK 55 billion in the 1st quarter of 2016. Banks, the central government and rest of the world’s net purchases of debt securities amounted to NOK 30 billion, NOK 18 billion and NOK 11 billion respectively.

Contact

-

Steven Chun Wei Got

E-mail: steven.got@ssb.no

tel.: (+47) 90 82 68 27

-

Ole Petter Rygvold

E-mail: ole-petter.rygvold@ssb.no

tel.: (+47) 47 27 23 62

-

Harald Stormoen

E-mail: harald.stormoen@ssb.no

tel.: (+47) 95 91 95 91