Content

Published:

This is an archived release.

Decreased margins on housing loans

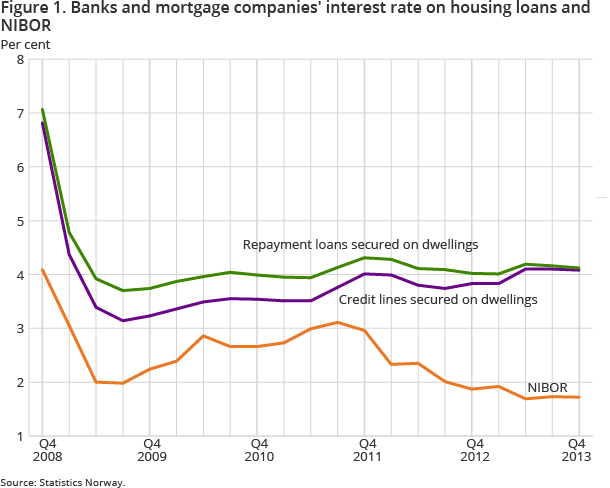

Banks and mortgage companies’ margin on repayment loans secured on dwellings fell by 0.03 percentage points in the 4th quarter of 2013. The margin on credit lines secured on dwellings was approximately unchanged in the same period. Compared to the 4th quarter of 2012, the margins have increased by 0.25 and 0.40 percentage points respectively.

| 4th quarter 2013 | 3rd quarter 2013 | |

|---|---|---|

| 1Due to changes in specifications applied from 3rd quarter 2013, the time series are not directly comparable to previous periods. | ||

| Interest rates including commissions on loans | ||

| Banks | 4.74 | 4.78 |

| Mortgage comanies | 3.73 | 3.74 |

| State lending institutions | 2.48 | 2.49 |

| Life insurance companies | 3.57 | 3.71 |

| Financial corporations, total | 4.16 | 4.19 |

| The Norwegian Public Service Pension Fund | 2.25 | 2.25 |

| Interest rates on deposits | ||

| Banks | 2.23 | 2.22 |

| Margins | ||

| Banks and mortgage companies. Loans margin | 2.59 | 2.61 |

| Banks. Interest rate margin | 2.51 | 2.56 |

| Banks. Deposits margin | -0.51 | -0.49 |

The loan margin on repayment loans secured on dwellings from banks and mortgage companies was 2.40 percentage points at the end of the 4th quarter of 2013, down from 2.43 percentage points at the end of the 3rd quarter. The margin on credit lines secured on dwellings was 2.36 percentage points at the end of the 4th quarter, marginally down from 2.37 percentage points at the end of the 3rd quarter.

Banks and mortgage companies’ interest rate on repayment loans secured on dwellings fell by 0.04 percentage points in the 4th quarter of 2013, to 4.12 per cent. The interest rate on credit lines secured on dwellings fell marginally by 0.02 percentage points to 4.08 per cent in the same period. Compared to the end of the 4th quarter of 2012, the interest rates on repayment loans and credit lines secured on dwellings are 0.10 and 0.25 percentage points higher respectively at the end of the 4th quarter of 2013.

Stable interest rate on total loans

The interest rate on total loans from banks and mortgage companies was 4.31 per cent at the end of the 4th quarter of 2013, down from 4.34 per cent at the end of the 3rd quarter. This interest rate has been stable between 4.23 per cent and 4.35 per cent since the end of the 2nd quarter of 2012.

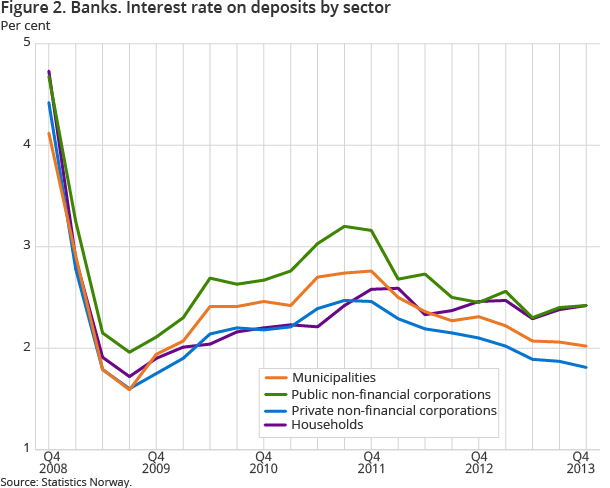

The banks’ interest rate on deposits in total was 2.23 per cent at the end of the 4th quarter in 2013, approximately unchanged compared to the previous quarter. The interest rate on deposits from households increased by 0.04 percentage points in the 4th quarter of 2013, reaching 2.42 per cent. The interest rate on deposits from public non-financial corporations rose marginally in the 4th quarter, while interest rates on deposits from private non-financial corporations and municipalities fell in the same period.

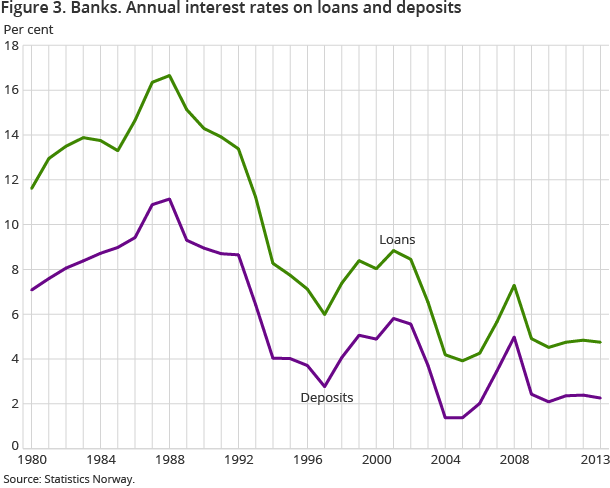

Fall in annual interest rates

The annual average interest rate on loans from banks fell by 0.09 percentage points from 2012 to 2013, and was 4.75 per cent last year. The interest rate on loans has been stable between 4.52 and 4.91 per cent during the last five years. Historically, this is a low interest rate level. The average interest rate on deposits was 2.26 per cent in 2013; a decrease of 0.13 percentage points compared to 2012.

About the dataOpen and readClose

At the end of the 4th quarter of 2013, the interest rate statistics included data from 137 banks, 27 mortgage companies, 6 life insurance companies, 3 state lending institutions and the Norwegian Public Service Pension Fund. The share of loans from banks, mortgage companies, state lending institutions and life insurance companies was 53, 39, 7 and 1 per cent of total loans respectively (excluding the Norwegian Public Service Pension Fund).

The interest rates on loans from the state lending institutions are determined on the basis of the interest rates on treasury bills and government bonds.

The statistics is now published as Interest rates in banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42