Content

Published:

This is an archived release.

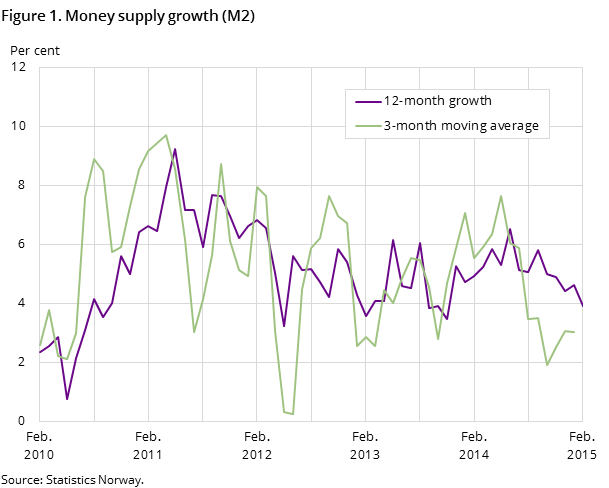

Decreased money supply growth

The twelve-month growth in total money supply (M2) was 3.9 per cent to end-February 2015, down from 4.6 per cent the previous month.

| September 2014 | October 2014 | November 2014 | December 2014 | January 2015 | February 2015 | |

|---|---|---|---|---|---|---|

| 12-month growth, M2 | 5.8 | 5.0 | 4.9 | 4.4 | 4.6 | 3.9 |

| 3-month moving average, M2 | 3.5 | 1.9 | 2.5 | 3.1 | 3.0 | .. |

| 12-month growth, households, M2 | 6.4 | 6.3 | 6.8 | 7.2 | 7.1 | 7.1 |

| 12-month growth, non-financial corporations, M2 | 5.5 | 5.3 | 4.2 | 4.1 | 3.5 | 1.7 |

The total money supply amounted to NOK 1 966 billion at end-February, down from NOK 1 999 billion at end-January.

Unchanged growth in money supply for households

Households’ money supply constitutes more than half of the total money supply. At end-February it accounted for NOK 1 122 billion, up from NOK 1 113 billion at end-January. The twelve-month growth in households’ money supply was 7.1 per cent to end-February, unchanged from the previous month.

The growth in households’ money supply was higher than the growth in households’ gross domestic debt, which amounted to 6.2 per cent to end-February according to the credit indicator C2.

Decreased growth of money supply for non-financial corporations

Non-financial corporations’ money supply amounted to NOK 600 billion at end-February, down from NOK 636 billion at end-January. The twelve-month growth was 1.7 per cent to end-February, down from 3.5per cent the previous month. Non-financial corporations’ money supply constituted 31 per cent of the total money supply at end-February.

Decreasing money supply growth for municipal government

Municipal government’s money supply amounted to NOK 70 billion at end-February, up from NOK 67 billion the previous month. The twelve-month growth rate was 1.3 per cent to end-February, down from 4.7 per cent to end-January.

Decreased money supply growth for other financial corporations

Other financial corporations’ money supply amounted to NOK 174 billion at end-February, down from NOK 183 billion at the end of the previous month. The twelve-month growth was -6.3 per cent to end-February, down from -5.3 per cent the previous month.

Steady composition of money supply

The composition of the money supply remains steady. The broad monetary aggregate M2 amounted to NOK 1 966 billion at end-February, of which the major part, 94 per cent, consisted of bank deposits. In comparison, notes and coins accounted for 2.3 per cent. The rest of the broad monetary aggregate consisted of shares in money market funds and certificates of deposits, which accounted for 3.3 and 0.1 per cent respectively.

Decreased growth in base money

Base money (M0) amounted to NOK 107 billion at the end of February, down from NOK 137 billion at the end of January. The twelve-month growth in M0 was at -6.5 per cent to end-February, down from 2.6 per cent the previous month.

The statistics is published with Monetary aggregates.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42