Content

Published:

This is an archived release.

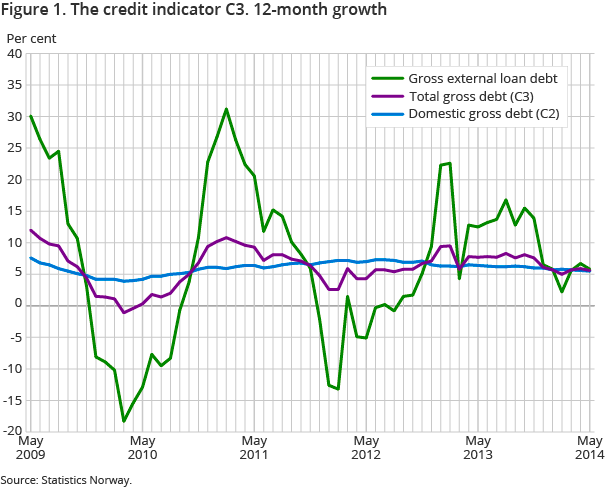

Reduced total debt growth

The twelve-month growth in total gross debt (C3) was 5.6 per cent to end-May, down from 5.9 per cent the previous month. The decrease stemmed from both domestic and foreign debt sources.

| May 2014 | April 2014 | March 2014 | February 2014 | January 2014 | December 2013 | |

|---|---|---|---|---|---|---|

| Total gross debt (C3) | 5.6 | 5.9 | 5.7 | 5.0 | 5.7 | 6.1 |

| Total gross loan debt, offshore ind. | 12.3 | 10.6 | 8.5 | 4.0 | 7.8 | 6.4 |

| Total gross loan debt, mainland-Norway | 4.6 | 5.2 | 5.3 | 5.2 | 5.4 | 6.1 |

| Domestic gross debt (C2) | 5.5 | 5.6 | 5.7 | 5.8 | 5.7 | 6.0 |

| Gross external loan debt | 5.8 | 6.7 | 5.6 | 2.2 | 5.8 | 6.5 |

| Gross external loan debt, offshore ind. | 15.9 | 13.8 | 12.5 | 6.0 | 11.7 | 10.0 |

| Gross external loan debt, mainland-Norway | -2.2 | 0.8 | 0.0 | -1.1 | 0.9 | 3.7 |

Total gross debt amounted to NOK 5 686 billion at end-May, up from NOK 5 665 billion at end-April.

Mainland Norway’s gross debt accounted for 86 per cent of the total gross debt at end-May. This amounted to NOK 4 913 billion, up from NOK 4 894 billion at end-April.

Weaker foreign debt growth

The general public gross foreign debt, which mainly relates to non-financial corporations, amounted to NOK 1 217 billion at end-May, down from NOK 1 222 billion the previous month. The twelve-month growth decreased from 6.7 per cent to end-April to 5.8 per cent to end-May.

Mainland Norway accounted for 51 per cent of the public gross foreign debt, which amounted to NOK 625 billion at end-May. The twelve-month growth in mainland Norway’s foreign debt was -2.2 per cent to end-May, down from 0.8 per cent to end-April. The decrease in mainland Norway’s foreign debt stemmed from both short and long-term debt.

Offshore industries accounted for the remainder of the foreign debt, which amounted to NOK 592 billion at end-May. The twelve-month growth was 15.9 per cent to end-May, up from 13.8 per cent to end-April. The increase in the twelve-month growth rate for the offshore industries stemmed from short-term debt.

Reduced domestic debt growth

The credit indicator (C2) amounted to NOK 4 469 billion at end-May. The twelve-month growth was 5.5 per cent to end-May, moderately down from 5.6 per cent the month before. The debt growth in non-financial corporations was 2.8 per cent to end-May, while the growth in household debt was 6.7 per cent in the same period. The C2 statistics show that the twelve-month growth in the general public domestic debt fell to 5.4 per cent to end-June.

The statistics is now published as Credit indicator.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42