Content

Published:

This is an archived release.

Weaker growth in domestic debt

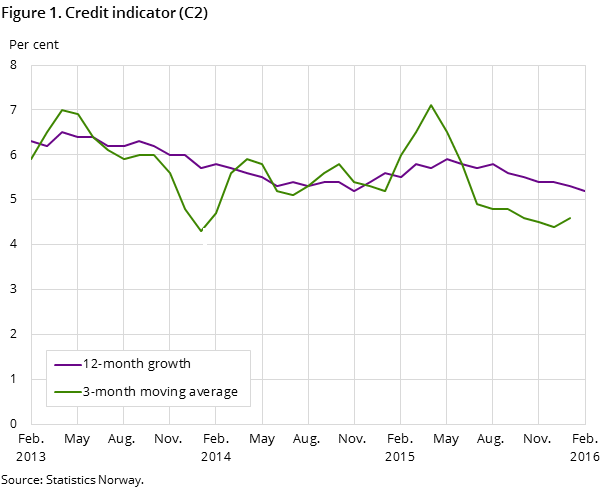

The twelve-month growth in the credit indicator C2 was 5.2 per cent to end-February, down from 5.3 per cent the previous month.

| September 2015 | October 2015 | November 2015 | December 2015 | January 2016 | February 2016 | |

|---|---|---|---|---|---|---|

| 1Annualised figure | ||||||

| 12-month growth, total | 5.6 | 5.5 | 5.4 | 5.4 | 5.3 | 5.2 |

| 3-month moving average, total1 | 4.8 | 4.6 | 4.5 | 4.4 | 4.6 | .. |

| 12-month growth, households | 6.4 | 6.2 | 6.2 | 6.1 | 6.1 | 6.0 |

| 12-month growth, non-financial corporations | 3.7 | 3.7 | 3.2 | 3.5 | 3.6 | 3.8 |

The general public’s gross domestic debt C2 amounted to NOK 4 944 billion at end-February.

Decreased debt growth for households

Households’ gross domestic debt totalled NOK 2 902 billion at end-February. The twelve-month growth was 6.0 per cent to end-February, marginally down from 6.1 per cent the month before.

Increased debt growth for non-financial corporations

Non-financial corporations’ gross domestic debt amounted to NOK 1 605 billion at end-February. The twelve-month growth was 3.8 per cent to end-February, up from 3.6 per cent the previous month.

Decreased debt growth for municipal government

Municipal government’s gross domestic debt totalled NOK 437 billion at end-February. The twelve-month growth was 5.3 per cent to end-February, down from 6.2 per cent the month before.

Decreased growth in banks and mortgage companies’ loans

Of the general public’s gross domestic debt, 80 per cent consisted of banks and mortgage companies’ loans at end-February. This amounted to NOK 3 946 billion. The twelve-month growth in banks and mortgage companies’ loans was 5.7 per cent to end-February, a decrease from 5.8 per cent to end-January.

Decreased growth in bond debt

The twelve-month growth rate in bond debt was 1.7 per cent to end-February, down from 3.9 per cent to end-January. The twelve-month growth rate in certificate debt was 22.0 per cent to end-February, up from 15.4 per cent the previous month.

Revision of seasonally-adjusted figuresOpen and readClose

The seasonally-adjusted figures were revised in January 2016 with new seasonal components. For more information see “About seasonal adjustment".

The statistics is now published as Credit indicator.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42