Content

Published:

This is an archived release.

Decrease in domestic debt growth

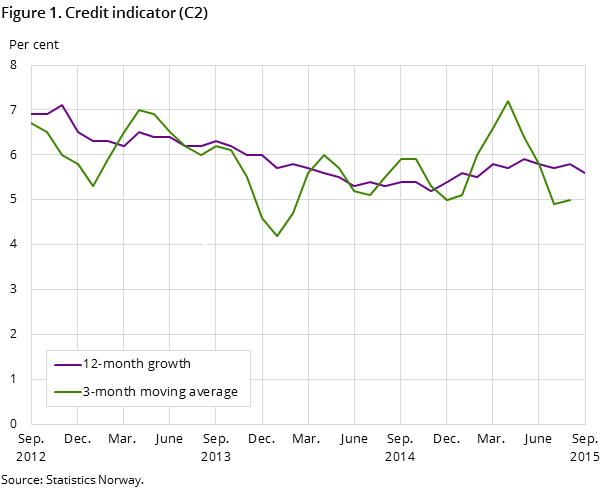

The twelve-month growth in the credit indicator C2 was 5.6 per cent to end-September, down from 5.8 per cent the previous month.

| April 2015 | May 2015 | June 2015 | July 2015 | August 2015 | September 2015 | |

|---|---|---|---|---|---|---|

| 1Annualised figure | ||||||

| 12-month growth, total | 5.7 | 5.9 | 5.8 | 5.7 | 5.8 | 5.6 |

| 3-month moving average, total1 | 7.2 | 6.4 | 5.8 | 4.9 | 5.0 | .. |

| 12-month growth, households | 6.2 | 6.4 | 6.5 | 6.5 | 6.4 | 6.4 |

| 12-month growth, non-financial corporations | 3.9 | 4.4 | 3.9 | 3.5 | 4.2 | 3.8 |

The general public’s gross domestic debt C2 amounted to NOK 4 854 billion at end-September, up from NOK 4 830 billion at end-August.

Unchanged debt growth for households

Households’ gross domestic debt totalled NOK 2 850 billion at end-September, up from NOK 2 832 billion the previous month. The twelve-month growth was 6.4 per cent to end-September, unchanged from the previous month.

Lower debt growth for non-financial corporations

Non-financial corporations’ gross domestic debt amounted to NOK 1 582 billion at end-September, up from NOK 1 572 billion at end-August. The twelve-month growth was 3.8 per cent to end-September, down from 4.2 per cent the previous month.

Decreased debt growth for municipal government

Municipal government’s gross domestic debt totalled NOK 422 billion at end-September, down from NOK 425 billion at end-August. The twelve-month growth was 6.7 per cent to end-September, down from 7.6 per cent the month before.

Decreased growth in banks and mortgage companies’ loans

Of the general public’s gross domestic debt, 80 per cent consisted of banks and mortgage companies’ loans at end-September. This amounted to NOK 3 886 billion. The twelve-month growth in banks and mortgage companies’ loans was 5.8 per cent to end-September, a decrease from 6.1 per cent to end-August.

Weaker growth in bond debt

The twelve-month growth rate in bond debt was 6.8 per cent to end-September, down from 7.1 per cent to end-August. The twelve-month growth rate in certificate debt was 1.2 per cent to end-September, up from -1.0 per cent the previous month.

The statistics is now published as Credit indicator.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42