Content

Published:

This is an archived release.

Increase in technical account for non-life insurance

Non-life insurance companies had an increase in the technical account of NOK 1.4 billion compared to 2013. One of the main reasons was an increase of 5.5 per cent in earned premiums.

| Total | Per cent | ||

|---|---|---|---|

| 2013 | 2014 | 2013 - 2014 | |

| Life insurance companies | |||

| Assets | 1 090 624 | 1 206 318 | 10.6 |

| Earned premium | 95 365 | 131 726 | 38.1 |

| Gross claims payment | 45 625 | 47 314 | 3.7 |

| Profitt/loss before tax and allocation to customers | 6 993 | 6 086 | -13.0 |

| Value-adjusted profitt/loss | 22 454 | 31 080 | 38.4 |

| Net income from financial assets | 66 140 | 71 106 | 7.5 |

| Non-life insurance companies | |||

| Assets | 216 580 | 227 769 | 5.2 |

| Earned premium | 60 142 | 63 465 | 5.5 |

| Gross claims payments | 43 902 | 47 449 | 8.1 |

| Profitt/loss on ordinary activities | 14 417 | 16 841 | 16.8 |

| Profitt/loss on the technical account | 7 180 | 8 616 | 20.0 |

The total profit for the life insurance industry amounted to NOK 4.9 billion in 2014. The value adjusted result was NOK 31 billion; an increase of NOK 8.6 billion compared with 2013.The profit before tax and allocation to customers was NOK 6.1 billion. The increase in the result was mainly due to an increase in realised gains from financial assets.

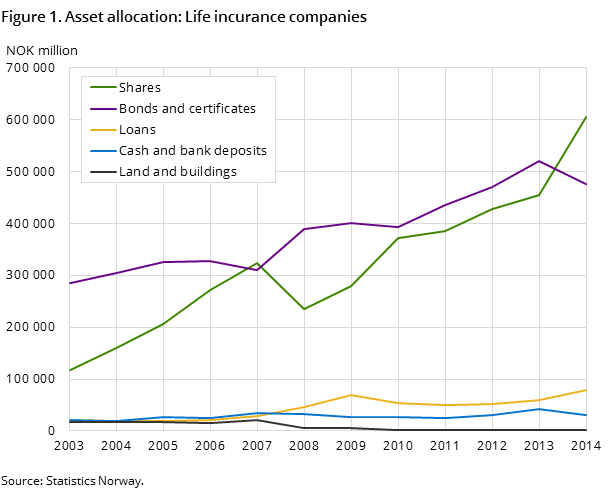

Share in securities funds increases for life insurance

Life insurance companies’ total assets increased by 10.6 per cent in 2014 to NOK 1 206 billion. Bonds and certificates made up 39.5 per cent of total assets; a decrease of 8.2 percentage points from last year. Shares in securities funds increased by a total of 45.8 per cent to NOK 416 billion. As a share of total assets, the increase amounted to 8.3 percentage points.

Increase in technical account for non-life insurance

The balance of the technical account increased by a total of 20 per cent, and amounted to NOK 8.6 billion in 2014.The profit on ordinary activities amounted to NOK 16.8 billion; an increase of 16.8 per cent. Non-life insurance companies’ earned premiums written increased by 5.5 per cent.

Decrease in shares, participation and primary capital certificates

The non-life insurance companies holdings of shares, participation and primary capital certificates decreased by 3.5 compared to 2013. At the same time, shares in security funds increased by 14.6 per cent. As a share of total assets, holdings of shares, participations and primary capital accounted for 8.2 per cent. This is a decline of 0.7 percentage points compared to the previous year. Bonds and certificates as a share of total assets amounted to 39.1 per cent; a decrease of 1.2 percentage points from the previous year.

Total assets increased by 6.7 per cent from 2012 to 2013. Investments in subsidiaries and other shares, participation and primary capital certificates amounted to 21.1 per cent of the total assets; a decline of 0.7 percentage points. The holdings of bonds and certificates amounted to 40.3 per cent of the total assets; a decrease of 1.6 percentage points compared to 2012.

Contact

-

Kjell Hammer

E-mail: kjell.hammer@ssb.no

tel.: (+47) 40 90 26 76

-

Ola Tveita

E-mail: ola.tveita@ssb.no

tel.: (+47) 99 73 45 83