Content

Published:

This is an archived release.

Strong results for insurance

Both non-life and life insurance companies’ profits for 2012 improved considerably compared to 2011. The main reason is the realised gains and increase in net value from financial assets.

| Total | Per cent | ||

|---|---|---|---|

| 2011 | 2012 | 2011 - 2012 | |

| Life insurance companies | |||

| Assets | 907 232 | 993 919 | 9.6 |

| Earned premium | 85 932 | 92 008 | 7.1 |

| Gross claims payment | 40 796 | 44 944 | 10.2 |

| Profitt/loss before tax and allocation to customers | 3 606 | 5 183 | 43.7 |

| Value-adjusted profitt/loss | -877 | 17 312 | -2 074.0 |

| Net income from financial assets | 18 054 | 56 746 | 214.3 |

| Non-life insurance companies | |||

| Assets | 192 992 | 202 988 | 5.2 |

| Earned premium | 54 580 | 57 514 | 5.4 |

| Gross claims payments | 41 553 | 46 318 | 11.5 |

| Profitt/loss on ordinary activities | 6 707 | 15 021 | 124.0 |

| Profitt/loss on the technical account | 5 817 | 8 529 | 46.6 |

Life insurance

The total profit for the life insurance industry amounted to NOK 4.8 billion in 2012. The value adjusted result was NOK 17.3 billion; an increase of NOK 18.2 billion compared with 2011.The profit before tax and allocation to customers was NOK 5.2 billion. The increase in the result was mainly due to realised gains and increase in net value from financial assets. The increase from 2011 to 2012 in the net value of shares, participations and primary capital certificates amounted to NOK 19.8 billion. The realised gains on shares, participations and primary capital certificates were NOK 4.4 billion. Interest income from bonds and certificates increased by 11.0 per cent and amounted to NOK 24.1 billion.

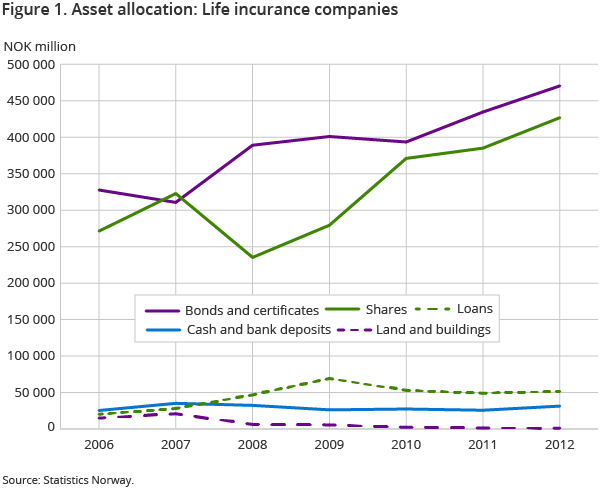

Total assets increased by NOK 86.7 billion in 2012. Total assets amounted to NOK 994 billion at the end of 2012. Investments in subsidiaries and other shares, participation and primary capital certificates increased by NOK 41.7 billion, and amounted to 42.9 per cent of total assets. Compared to 2011, the holdings of bonds and certificates increased by 8.2 per cent. As a share of the total assets, bonds and certificates decreased by 0.6 percentage points, and amounted to 47.3 per cent.

Non-life insurance

The total profit for the non-life insurance industry amounted to NOK 12.0 billion in 2012. The balance on the technical account ended at NOK 8.5 billion; an improvement of 46.6 per cent. The strong result for non-life insurance was mainly due to a positive net change in value from financial assets. The net realised gains on financial assets contributed to the good results. The profit for ordinary activities showed an increase of NOK 8.3 billion at the end of 2012.

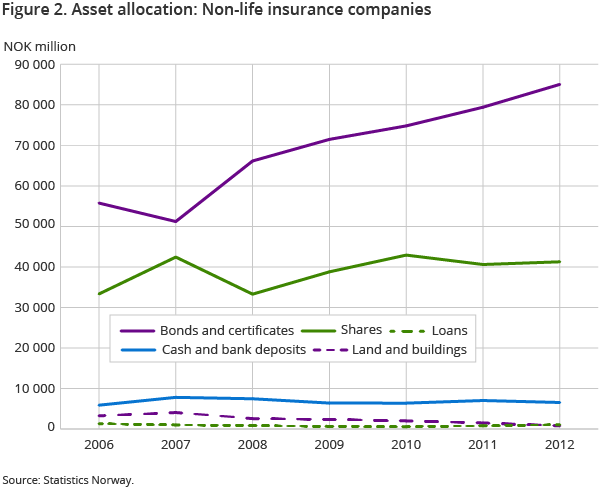

Total assets increased by 5.2 per cent from 2011 to 2012. Investments in subsidiaries and other shares, participation and primary capital certificates amounted to 20.3 per cent of the total assets; a decline of 0.7 percentage points. The holdings of bonds and certificates amounted to 41 per cent of the total assets; an increase of 1 percentage point compared to 2011.

Contact

-

Kjell Hammer

E-mail: kjell.hammer@ssb.no

tel.: (+47) 40 90 26 76

-

Ola Tveita

E-mail: ola.tveita@ssb.no

tel.: (+47) 99 73 45 83