Increase in pension liabilities

Published:

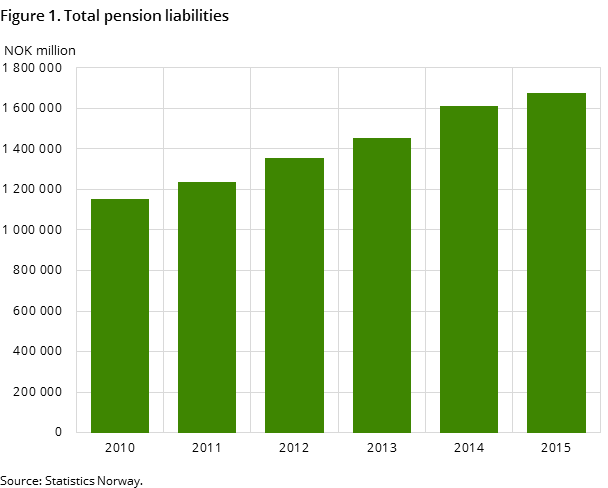

The total pension liabilities in occupational pensions increased by NOK 65.8 billion to NOK 1 678 billion from 2014 to 2015.

- Full set of figures

- Occupational pensions

- Series archive

- Occupational pensions (archive)

Total pension liabilities in occupational pensions

In private pension schemes, the pension liabilities increased by 7.5 per cent, where the highest growth was in defined contribution schemes. The pension liabilities in defined contribution schemes were NOK 143 billion in 2015, which is an increase of 19 per cent.

In public pension schemes, the liabilities increased by 2 per cent from 2014 to 2015, to NOK 1 035 billion.

Earned premiums

Earned premiums for occupational pensions decreased from NOK 104.4 billion in 2014 to NOK 100.3 billion in 2015; a decrease of 4 per cent.

In 2015, the earned premiums for occupational pensions in private pension schemes were NOK 43.8 billion. NOK 20.4 billion of this is from the defined contribution pension schemes.

Earned premiums for public occupational pension schemes decreased by 10 per cent in the same period, to NOK 56.5 billion.

Pension payments

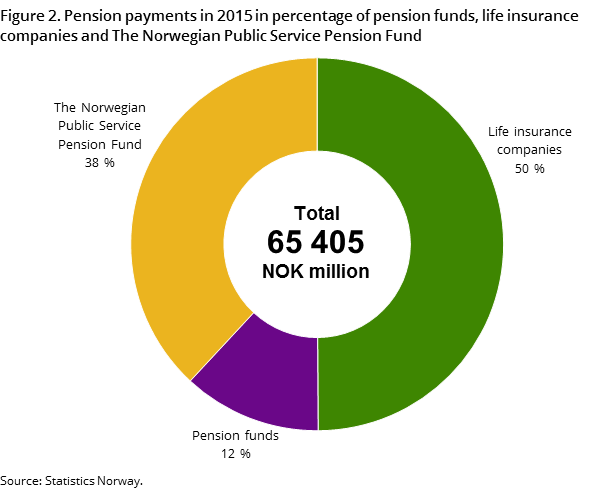

The pension payments have increased by NOK 3.5 billon in 2015, to NOK 65.4 billion. The life insurance companies have 50 per cent of the total pension payment, or NOK 32.6 billion, while The Norwegian Public Service Pension Fund accounts for 38 per cent of the payments.

Contact

-

Dag Waage Gausdal

-

Ola Tveita

-

Statistics Norway's Information Centre