Content

Published:

This is an archived release.

Dampened growth in NI contributions

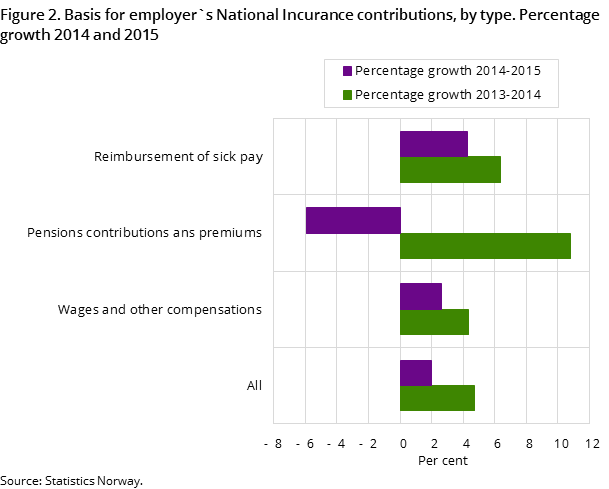

The basis for employers’ National Insurance contributions amounted to NOK 1.218 billion in 2015, an increase of 2.0 per cent from 2014. By comparison, the growth from 2013 to 2014 was 4.7 per cent.

| 2014 | 2015 | |||

|---|---|---|---|---|

| Total basis for employer's National insurance contributions | Calculated employer's National insurance contributions | Total basis for employer's National insurance contributions | Calculated employer's National insurance contributions | |

| Both private and public sector | 1 194 103 | 155 455 | 1 218 004 | 158 861 |

| Public sector | 318 308 | 39 975 | 322 486 | 40 238 |

| Private sector | 875 795 | 115 480 | 895 518 | 118 623 |

| Zone 1 | 754 257 | 0 | 767 390 | 0 |

| Zone 1a | 20 886 | 0 | 19 232 | 0 |

| Zone 2 | 29 780 | 0 | 34 718 | 0 |

| Zone 3 | 9 116 | 0 | 9 901 | 0 |

| Zone 4 | 33 214 | 0 | 34 669 | 0 |

| Zone 4a | 16 641 | 0 | 17 429 | 0 |

| Zone 5 | 10 992 | 0 | 11 253 | 0 |

Within the public sector, the basis for employers’ National Insurance contributions increased by 1.3 per cent between 2014 and 2015. Corresponding, the private sector experienced a growth of 2.3 per cent.

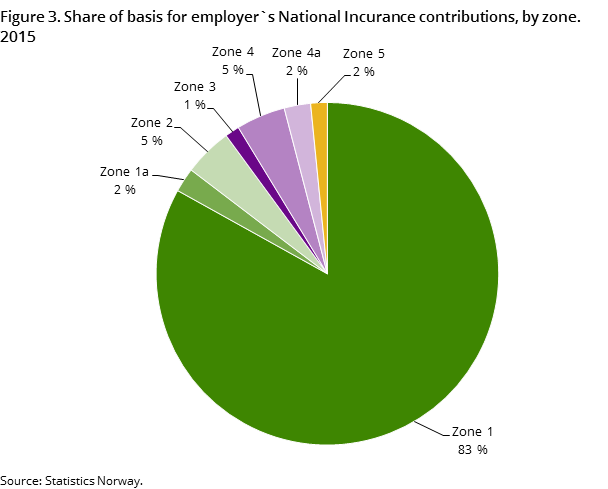

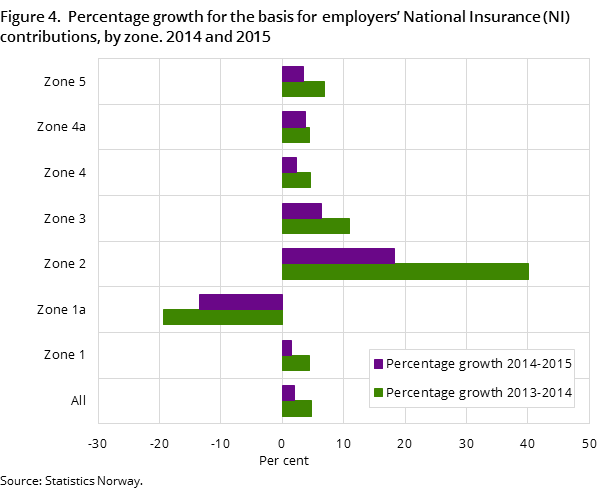

Municipalities relocated to new zones

Within the private sector, the basis for employers’ National insurance contributions constitutes NOK 896 billion in 2015. Employers’ contributions to National insurance are divided into different rates by region; each municipality is assigned to a zone. From July 1, 2014 31 municipalities were relocated to zones with lower contribution rates, respectively from zone 1a to zone 2 and 3. This caused a decrease on 7.9 per cent in wages and other compensations in zone 1a from 2014 to 2015. Corresponding, zone 2 and 3 experienced a growth of respectively 17.1 per cent and 8.9 per cent in wages and other compensations.

Decrease in pension contributions and premiums within the public sector

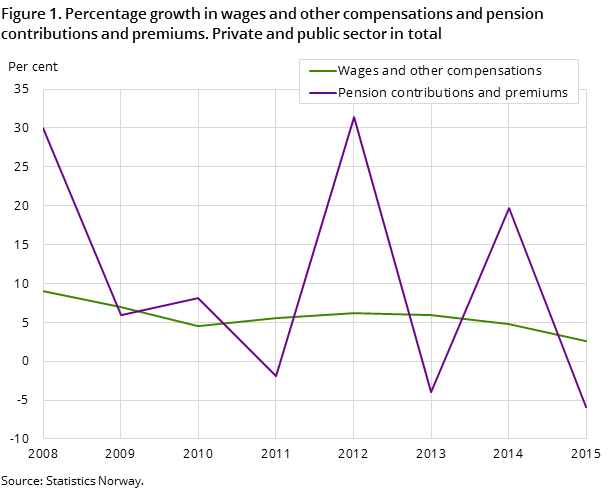

Within the public sector, the basis for employer’s National insurance contributions constitutes NOK 322 billion in 2014. Pension contributions and premiums subject to National Insurance contributions decreased by 14.0 per cent between 2014 and 2015. From 2013 to 2014 pension contributions and premiums increased by 19.7 percent. The variation of pension contributions and premium is related to the nature of the liability to pay the duty.

New data source

From 2015 the statistics are based on data from the “a-meldingen”. This data source do not have detailed information about municipalities, hence the figures on wage totals not be published for 2015.

Additional information

Employers’ contributions to National Insurance are divided into different rates by region.

Contact

-

Thomas Hagen

E-mail: thomas.hagen@ssb.no

tel.: (+47) 40 81 13 20

-

Heidi Bekkevold Backe

E-mail: heidi.backe@ssb.no

tel.: (+47) 40 81 13 22

-

Marianne Mellem

E-mail: mnm@ssb.no

tel.: (+47) 40 81 14 42