Content

Published:

This is an archived release.

Less growth in NI contributions

The basis for employers’ National Insurance contributions amounted to NOK 1.140 billion in 2013; an increase of 5.1 per cent from 2012. By comparison, the growth from 2011 to 2012 was 7.7 per cent.

| 2012 | 2013 | |||

|---|---|---|---|---|

| Total basis for employer's National insurance contributions | Calculated employer's National insurance contributions | Total basis for employer's National insurance contributions | Calculated employer's National insurance contributions | |

| Both private and public sector | 1 084 456 | 141 362 | 1 140 260 | 148 854 |

| Public sector | 285 754 | 35 834 | 298 473 | 37 551 |

| Private sector | 798 702 | 105 527 | 841 787 | 111 304 |

| Zone 1 | 688 715 | 97 109 | 727 018 | 102 510 |

| Zone 1a | 24 846 | 2 877 | 26 151 | 3 037 |

| Zone 2 | 20 604 | 2 187 | 21 259 | 2 257 |

| Zone 3 | 8 191 | 524 | 8 399 | 538 |

| Zone 4 | 30 990 | 1 600 | 31 990 | 1 651 |

| Zone 4a | 14 979 | 1 175 | 16 034 | 1 258 |

| Zone 5 | 9 580 | 0 | 10 107 | 0 |

The basis for employers' National Insurance contributions within the private sector increased by 5.4 per cent between 2012 and 2013. For the corresponding period last year, the private sector experienced a growth of 7.1 per cent.

Decrease in pension contributions and premiums within the public sector

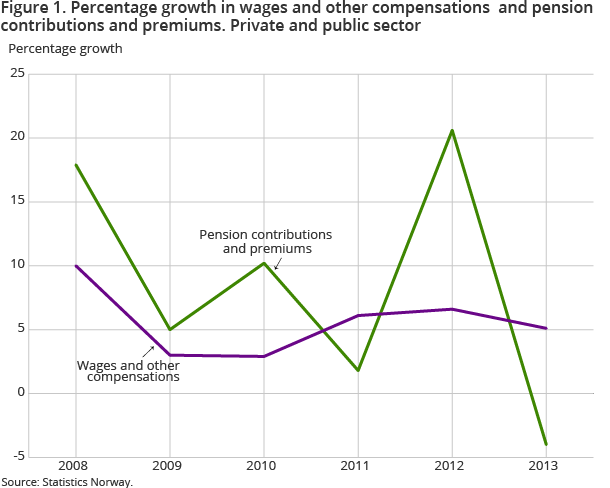

Within the public sector, the basis for employers' National insurance contributions constitutes NOK 299 billion in 2013. Pension contributions and premiums subject to National Insurance contributions within the public sector decreased by 4.0 per cent from 2012 to 2013. By comparison, the growth in pension contributions and premiums increased by 31.4 per cent between 2011 and 2012. The variation of pension contributions and premiums is related to the nature of the liability to pay duty.

Least growth within zone 3

The basis for employers' National insurance contributions constitutes NOK 727 billion in 2013 within zone 1; an increase of 5.6 per cent from 2012. Zone 3 experienced the weakest growth in wages and other compensations , growing by 2.9 per cent since 2012.

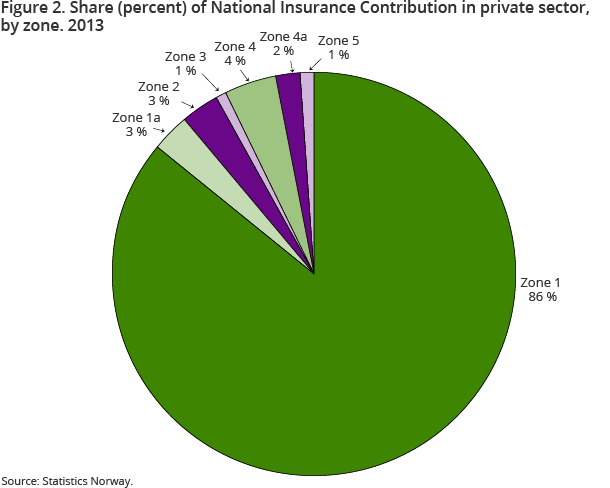

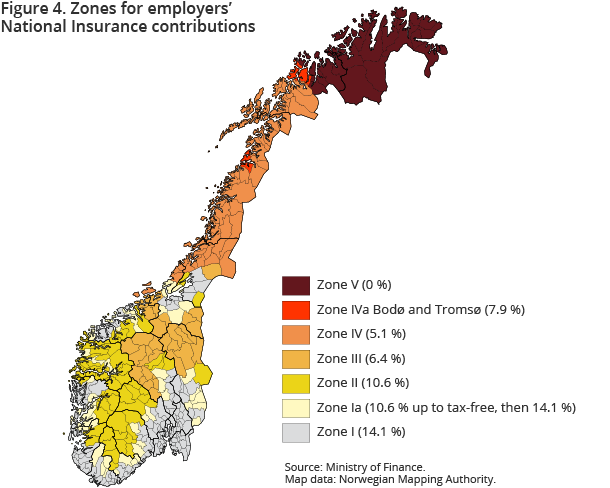

Employers’ contributions to National Insurance are divided into different rates by region. For eastern regions and central coastal regions south of Trondheimsfjord, the rate of contributions to National Insurance is 14.1 per cent. As shown in figure 2, a total of 86 per cent of the total basis for employers’ National Insurance contributions within the private sector is from regions with this rate. The lowest rate is found in Nord-Troms, Finnmark and Svalbard, where the rate for employers’ National Insurance contributions is zero. A total of 1.2 per cent of the basis is generated from workplaces within these regions.

Urban municipalities give the highest contribution to wage totals within the private sector

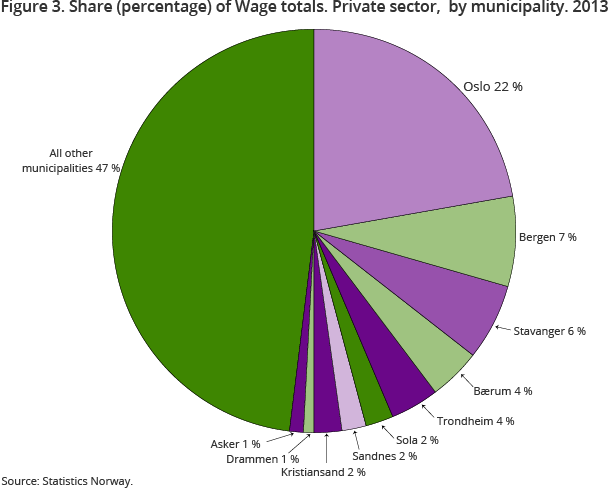

Three of the largest cities account for 35 per cent of wage totals ; Oslo, Bergen and Stavanger. Furthermore, 21.9 per cent of reported wage totals are reported on enterprises in Oslo. Figure 3 shows the ten municipalities with the highest wage totals. These municipalities make up 53 per cent of the combined wage totals of all municipalities in Norway.

Additional information

Employers’ contributions to National Insurance are divided into different rates by region.

Contact

-

Thomas Hagen

E-mail: thomas.hagen@ssb.no

tel.: (+47) 40 81 13 20

-

Heidi Bekkevold Backe

E-mail: heidi.backe@ssb.no

tel.: (+47) 40 81 13 22

-

Marianne Mellem

E-mail: mnm@ssb.no

tel.: (+47) 40 81 14 42