Content

Published:

This is an archived release.

Increase in NI contributions

Figures show that the basis for employers’ National Insurance contributions within the private sector amounted to NOK 799 billion in 2012; an increase of 7.1 per cent from 2011. By comparison, the growth from 2010 to 2011 was 6.2 per cent.

| 2011 | 2012 | |||

|---|---|---|---|---|

| Basis for employer's National Insurance contributions | Calculated employer's National Insurance contributions | Basis for employer's National Insurance contributions | Calculated employer's National Insurance contributions | |

| Total zones | 745 489 | 98 403 | 798 702 | 105 527 |

| Zone 1 | 641 086 | 90 393 | 688 715 | 97 109 |

| Zone 1a | 23 660 | 2 742 | 24 846 | 2 877 |

| Zone 2 | 19 837 | 2 105 | 20 604 | 2 187 |

| Zone 3 | 7 870 | 504 | 8 191 | 524 |

| Zone 4 | 29 267 | 1 510 | 30 990 | 1 600 |

| Zone 4a | 14 076 | 1 104 | 14 979 | 1 175 |

| Zone 5 | 9 062 | 0 | 9 580 | 0 |

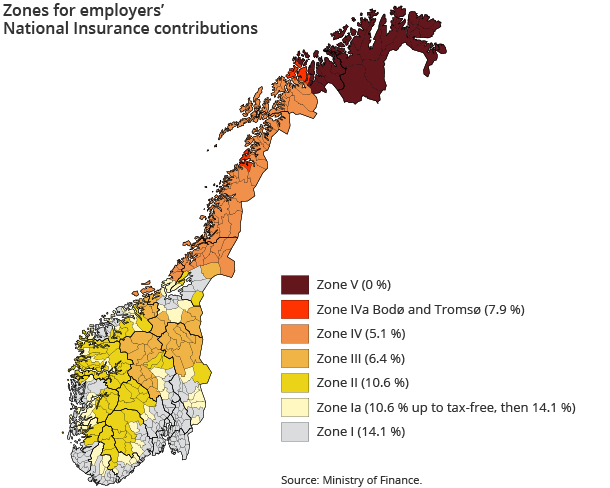

Employers’ contributions to National Insurance are divided into different rates by region. For eastern regions and central coastal regions south of Trondheimsfjord, the rate of contributions to National Insurance is 14.1 per cent. A total of 86 per cent of the total basis for employers’ National Insurance contributions within the private sector is from regions with this rate.

The lowest rate is found in Nord-Troms, Finnmark and Svalbard, where the rate for employers’ National Insurance contributions is zero. A total of 1.2 per cent of the basis is generated from workplaces within these regions.

Increase in pension contributions and premiums

Within the private sector, the normal basis for calculation of employer's National insurance contributions constitutes NOK 769 billion in 2012, whilst pension contributions and premiums subject to National Insurance contributions amount to NOK 44 billion, less reimbursement. This denotes an increase of 6.8 per cent and 12.3 per cent respectively from 2011 to 2012.

Increase within the public sector

The total National Insurance contribution within the public sector amounts to NOK 286 billion; an increase of 9.4 per cent from 2011. As within the private sector, pension contributions and premiums subject to National Insurance contributions in the public sector are the driving force behind the growth of the total National Insurance contribution, with a growth of 31.4 per cent from 2011.

The statistics cover all employers that report the basis for employers’ National Insurance contributions to the Directorate of Taxes. Hence, calculated employer contributions for civil servants are not included.

Additional information

Employers’ contributions to National Insurance are divided into different rates by region.

Contact

-

Thomas Hagen

E-mail: thomas.hagen@ssb.no

tel.: (+47) 40 81 13 20

-

Heidi Bekkevold Backe

E-mail: heidi.backe@ssb.no

tel.: (+47) 40 81 13 22

-

Marianne Mellem

E-mail: mnm@ssb.no

tel.: (+47) 40 81 14 42