Content

Published:

More and more choose electronic tax return

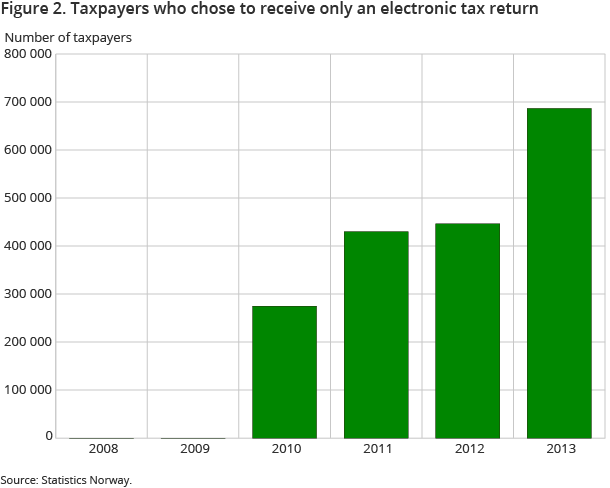

In 2013, approximately 700 000 taxpayers chose to receive only an electronic tax return, which was an increase of 240 000 taxpayers or 54 per cent from 2012.

| 2011 | 2012 | 2013 | 2012 - 2013 | |

|---|---|---|---|---|

| Relative change | ||||

| Input | ||||

| Own production (NOK million) | 5 096 | 5 195 | 5 316 | 2.3 |

| Contracted man-year adjusted for long term-leaves | 5 621 | 5 597 | 5 527 | -1.3 |

| Activities and services | ||||

| Persons with tax settlement | 4 357 301 | 4 479 686 | 4 582 182 | 2.3 |

| Companies with tax settlement | 239 995 | 241 053 | 256 811 | 6.5 |

| Processed inheritance and gift cases | 45 826 | 46 335 | 45 901 | -0.9 |

| Processed people registrations in total | 1 650 526 | 1 744 555 | 2 093 514 | 20.0 |

| Calls to the Tax Hotline | 2 666 115 | 2 193 548 | 2 150 962 | -1.9 |

| Calls to the Tax Hotline (per cent) | 74.6 | 73.3 | 84.0 | 14.6 |

| Share of non-response approval of the tax return for persons | 65.3 | 67.1 | 69.0 | 2.8 |

| Outcomes | ||||

| Share of complaints on the tax assessment processed within 3 months | 93.2 | 86.9 | 91.1 | 4.8 |

| Share of inheritance and gift cases processed within 6 months | 91.3 | 67.6 | 80.7 | 19.4 |

| Filed police reports | 834 | 856 | 975 | 13.9 |

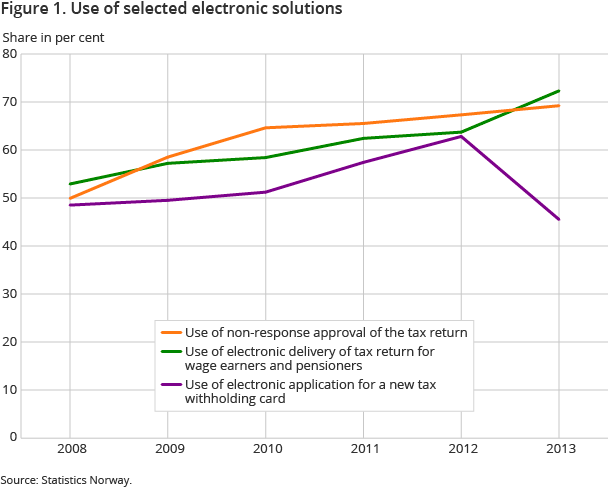

Seven in ten wage earners and pensioners made no changes to their tax return and chose not to submit it in 2013. There was an increase in electronic submission among those who submitted tax returns, with seven out of ten wage earners and pensioners submitting electronically.

Fewer seek guidance and information

Telephone calls to the Tax Hotline are declining with the growing use of electronic solutions. The number of telephone enquiries has been falling since 2008, and 2013, with a fall of 2 per cent from the previous year, was no exception. However, the proportion of answered telephone calls rose and 83 per cent of the telephone calls concerning tax returns and tax withholding cards for wage earners and pensioners were answered.

Fewer complaints

The number of complaints about tax settlements has been decreasing every year since 2010. The Tax Administration received scarcely 80 000 complaints about tax assessments in 2013, 90 per cent of which were processed within three months.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42