Content

Published:

This is an archived release.

The release on 23 November will include revisions to previous figures for accrued investments and investment estimates within oil and gas extraction and pipeline transportation for the investment years 2013-2017.

Downward adjustment of investment estimates

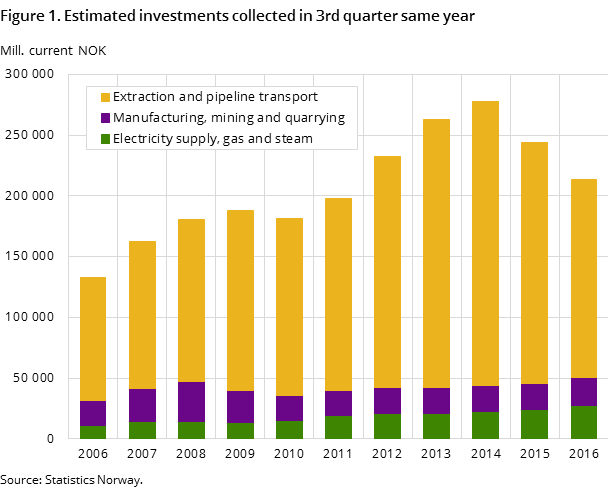

Estimates for total investments covering oil and gas, manufacturing, mining & quarrying and electricity supply are now down – adjusted for both 2016 and 2017 – compared with the estimates given in the previous survey.

| Estimates collected in Q3 the same year | |||

|---|---|---|---|

| 2016 / 2015 | 2015 | 2016 | |

| 1Values at current prices | |||

| Extraction, pipeline, mining, manuf. and elec | -12.3 | 243 580 | 213 698 |

| Extraction and pipeline transport | -17.5 | 198 190 | 163 496 |

| Manufacturing | 9.5 | 20 371 | 22 300 |

| Mining and quarrying | -22.1 | 883 | 688 |

| Electricity, gas and steam | 12.7 | 24 137 | 27 213 |

| Estimates collected in Q3 the previous year | |||

| 2017 / 2016 | 2016 | 2017 | |

| Extraction, pipeline, mining, manuf. and elec | -14.5 | 231 167 | 197 632 |

| Extraction and pipeline transport | -18.6 | 184 837 | 150 507 |

| Manufacturing | -18.8 | 19 355 | 15 720 |

| Mining and quarrying | -27.8 | 647 | 467 |

| Electricity, gas and steam | 17.5 | 26 328 | 30 938 |

New figures for 2016 show that total investments covering oil and gas, manufacturing, mining & quarrying and electricity supply are expected to amount to NOK 213.7 billion measured in current value. The estimate is 12.3 per cent lower than the corresponding figure for 2015. The decline is mainly due to a significant fall of 17.5 per cent within oil and gas. The decrease is, however, partly offset by higher investments in electricity supply and manufacturing.

The latest estimates for 2017 show that total investments are expected to amount to NOK 197.6 billion - 14.5 per cent lower than the corresponding figure for 2016. The decline is mainly due to a fall within oil and gas and manufacturing. The fall in total investments is moderated by higher expected investments within electricity supply.

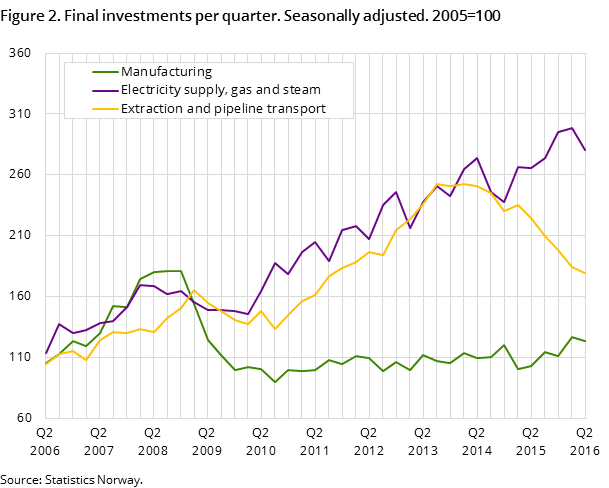

There was a 2.6 per cent decrease in quarterly final investments for extraction and pipeline transport in the second quarter of 2016 compared with the first quarter of 2015, according to seasonally-adjusted figures. Manufacturing and electricity supply also had a drop in quarterly final investments of 2.8 and 6.1 per cent respectively.

Downward adjustment of estimates for 2016 in oil and gas

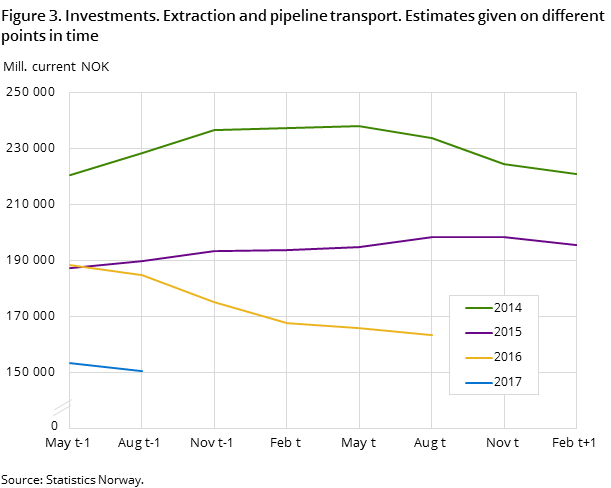

The investments in oil and gas extraction and pipeline transport for 2016 are estimated at NOK 163.5 billion. This is 1.5 per cent lower than the previous estimate for 2016. The decrease is mainly due to lower estimates for field development and shutdown and removal. The decrease in field development is partly due to the fact that fields have come on stream and are therefore transferred from the category field development to the category fields on stream.

The estimate for 2016 is 17.5 per cent lower than the corresponding estimate for 2015, given in the 3rd quarter of 2015. The decrease indicated in the present survey is higher than in the previous survey. In addition to the lower estimate for 2016 the extended relative decrease is due to a higher estimate for 2015 from the 2nd quarter to the 3rd quarter last year, see figure 3.

The decrease from 2015 to 2016 is due to lower investments within all categories, but the main contributions come from field development, fields on stream and exploration.

While the accrued investment costs came to NOK 38.3 billion in the 1st quarter, the accrued costs increased to NOK 41.8 billion in the 2nd quarter. The accrued investments in the first two quarters in 2016 totalled NOK 80 billion. Realisation of the current estimate for 2016 assumes investments of NOK 83.5 billion in the second half of 2016.

Slightly lower oil and gas estimates for 2017

The investments in oil and gas extraction and pipeline transport for 2017 are estimated at NOK 150.5 billion. This is 1.8 per cent lower than the previous estimate for 2017. A decrease from the 2nd quarter to the 3rd quarter in the year before the investment year is very unusual. This also happened last year for 2016, but until then the last time was in 1999 for the investment year 2000.

Almost the entire decrease from the last survey is due to lower estimates in shutdown and removal. The estimate for this category decreased by 25 per cent compared to the previous measurement in the 2nd quarter of 2016. Several shutdown and removal projects have been postponed. The estimate for exploration has also decreased, while the estimate for field development on the other hand has increased. The increase is partly due to the delivery of two plans for development and operation (PDO) earlier this quarter. These two projects are therefore now included in the investment survey.

The estimate for 2017 is 18.6 per cent lower than the corresponding estimate for 2016, given in the 3rd quarter of 2015. There is reason to believe that the sharp decrease indicated in this quarter’s survey might be moderated in future surveys. The estimates for 2016 have fallen sharply since the estimate given in the 3rd quarter of 2015. The present estimate for 2016 is 11.5 per cent lower than the estimate for 2016, given in the 3rd quarter of 2015. If the decrease from 2016 to 2017, indicated in the present survey, persists, the estimates for 2017 must be reduced by the equivalent decrease as the estimates for 2016.

Investments within field development, fields on stream and exploration are showing a particular decrease compared to corresponding estimates for 2016.

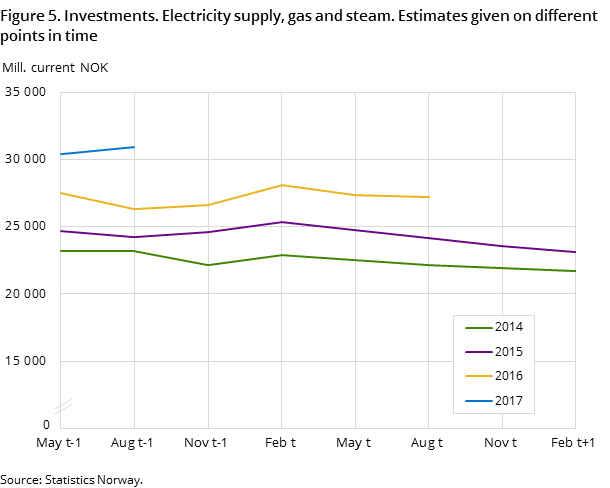

Growth in electricity supply in 2016 and 2017

New estimates for 2016 show that total investments within electricity supply are expected to amount to NOK 27.2 billion; 12.7 per cent higher than the corresponding figure for 2015. High estimates within transmission and distribution of electricity explain this rise. The growth is particularly related to power grid upgrades and installation of new automatic electricity meters (AMR).

Preliminary estimates for 2017 indicate a further investment growth within electricity supply; 17.5 per cent higher than the corresponding figure for 2016. Higher investments within production of electricity, and a further increase in transmission and distribution of electricity explain this development. The increment in electricity supply can partly be attributed to wind power development. Estimates for 2017 in electricity supply now appear to be about twice as high as the industry overall.

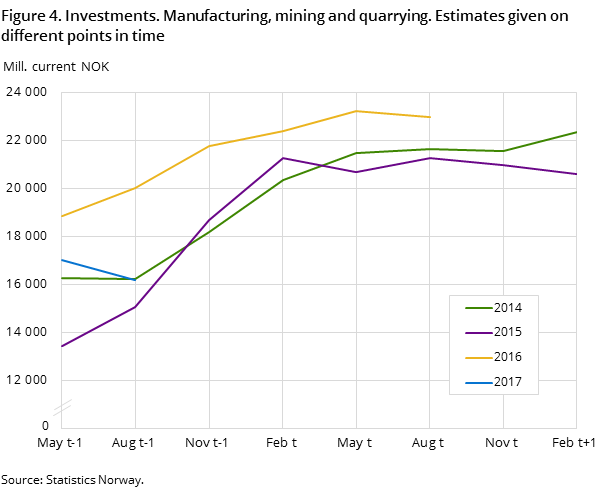

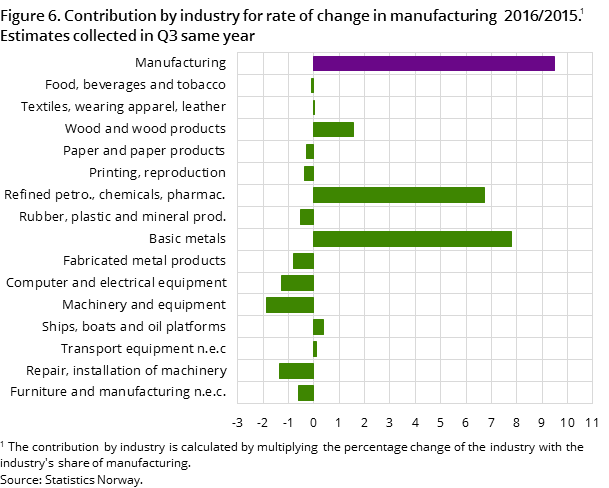

Strong growth in export-related manufacturing, decline in oil-related manufacturing in 2016

Investments for 2016 in manufacturing are estimated at NOK 22.3 billion – measured in current value. The 2016 estimate is 9.5 percent higher than the estimate for 2015 given in Q3 last year. There are, however, large disparities between the various industrial sectors. Some large projects within the manufacturing groups oil refining, chemical and pharmaceutical industries as well as the metal industry contribute greatly to the overall growth. On the other hand, declines are registered in some of the industries that supply goods and services to the oil and gas industry, which partly offset the rise in manufacturing. The low investment in these industries can be attributed to lower investment activity in the oil and gas industry.

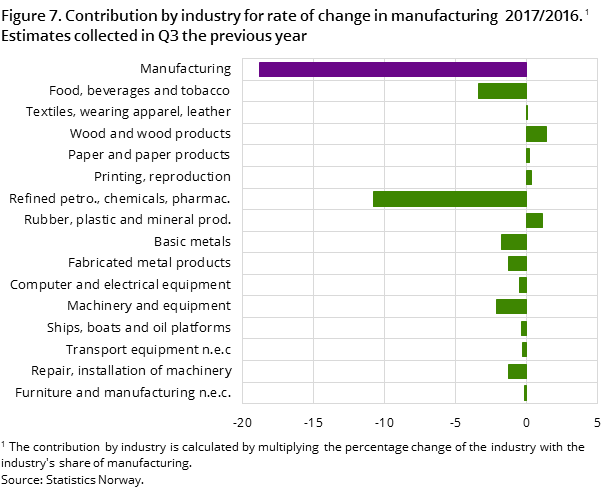

Decline in manufacturing investment in 2017

New estimates for 2017 show a negative trend in industrial investments next year. Compared with the corresponding estimate for 2016, a decline of 18.8 per cent is implied. The sharp decline in 2017 has primarily to do with the industry group of oil refining, chemical and pharmaceutical industries having a considerably lower estimate than for 2016, published at the same time last year. Completion of some major projects is the main reason for the decline in this industrial sector. The food industry also had a negative impact, with an estimate for 2017 that was considerably lower than the last survey.

Strong decline in mining and quarrying in 2016

Estimates for mining and quarrying in 2016 are expected to amount to NOK 688 million; a strong decline of 22 per cent compared with the corresponding figures for the last year.

The survey is merged with oil and gas activities, investments, starting with the next quarterly publicationOpen and readClose

From the Q3 publication in 2015, the statistics on investments in manufacturing, mining and quarrying and electricity supply (KIS) have been merged with the statistics on oil and gas activities, investments (OLJEINV). The combined statistics will provide a more comprehensive presentation of final and planned investments for oil and gas, manufacturing, mining and quarrying and electricity supply.

Changes to historical figuresOpen and readClose

- As from the survey in the 2nd quarter of 2016, the delimitation within the exploration activity has changed. The exploration activity now also comprises the licensees` exploration costs on top of licence costs. As from the 3rd quarter of 2016, historical figures are affected by the new delimitation dating back to the investment year 2007.

- As from the survey in the 2nd quarter of 2017, the delimitation was extended to also comprise shutdown and removal. In addition, the accrued costs for this category were included in the investment statistics dating back to the investment year 2002. As from the 3rd quarter of 2016, estimates are included for this category dating back to the investment year 2002. Since real estimates for the years 2002-2013 do not exist, estimates for this category are set to be equal to the annual accrued costs.

- A quality review has resulted in a few small changes in historical figures dating back to 2001.

Find more figures

Fin detailed figures from Investments in oil and gas, manufacturing, mining and electricity supply

Contact

-

Ståle Mæland

E-mail: stale.maeland@ssb.no

tel.: (+47) 95 05 98 88

-

Edvard Andreassen

E-mail: edvard.andreassen@ssb.no

tel.: (+47) 40 90 23 32