Content

Published:

Next release:

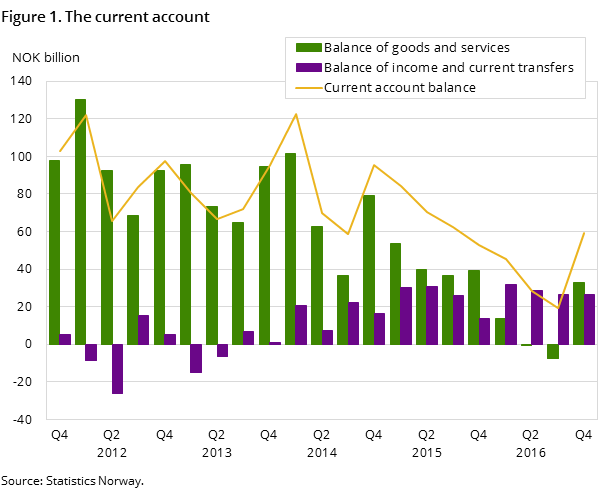

Raised current account surplus

The current account balance ended at NOK 59 billion in the 4th quarter of 2016, up NOK 40 billion from the previous quarter. The goods and services balance ended at NOK 33 billion, while net income and current transfers ended at NOK 27 billion.

| 4th quarter 2015 | 1st quarter 2016 | 2nd quarter 2016 | 3rd quarter 2016 | 4th quarter 2016 | |

|---|---|---|---|---|---|

| Current account balance | 52 851 | 45 482 | 28 427 | 19 019 | 59 304 |

| Balance of goods and services | 39 297 | 13 757 | -353 | -7 541 | 32 721 |

| Balance of income and current transfers | 13 554 | 31 725 | 28 780 | 26 560 | 26 583 |

| Capital transfers to abroad, net | 5 | 739 | 65 | 0 | 18 |

| Net lending, current account | 52 834 | 44 731 | 28 350 | 19 007 | 59 274 |

| Direct investment | 5 663 | -6 602 | 77 529 | -1 746 | 102 251 |

| Portofolio investment | 42 710 | -80 248 | 168 922 | -57 808 | 3 473 |

| Other investments | -29 095 | 69 633 | -51 777 | 72 250 | -57 021 |

| Reserve assets (IMF breakdown) | -34 793 | 45 234 | -5 376 | 2 805 | -13 033 |

| Net lending, financial account | -15 515 | 28 017 | 189 298 | 15 501 | 35 670 |

| Net errors and omissions | 68 349 | 16 714 | -160 948 | 3 506 | 23 604 |

Goods and services in surplus

Preliminary figures show that total export of goods and services in the 4th quarter of 2016 ended at NOK 285 billion. This was more than NOK 32 billion higher than the previous quarter, and was mostly due to growth in income from exports of crude oil and natural gas. Here both prices and volume were higher compared to the previous quarter. Preliminary calculations show that export of services rose slightly from the 3rd to the 4th quarter.

The import value of goods and services in the 4th quarter of 2016 ended at NOK 252 billion, representing a decline in nominal terms of NOK 8 billion compared to the 3rd quarter. Import of goods was up almost NOK 3 billion, while the import value of services was reduced NOK 11 billion, due mostly to the normal seasonal reduction in residents’ travel expenditures abroad.

For more information about export and import, including price and volume considerations and seasonal adjustments, please see the quarterly national accounts.

Stable surplus of income and current transfers

The balance of income and current transfers ended at NOK 27 billion in the 4th quarter, the same as in the previous quarter. For 2016 as a whole, the preliminary estimate of the balance of income and current transfers is NOK 114 billion, which is triple that of the goods and services balance and the highest ever recorded. This must be viewed in light of Norway’s total net international assets of almost NOK 6 000 billion (at the end of the 3rd quarter of 2016).

Restructuring influenced the financial investments

The financial investments abroad were reduced by NOK 151 billion at the end of the 4th quarter of 2016. Investments in Norway were accordingly reduced by NOK 186 billion.

The decline in both assets and liabilities was strongly driven by reduced foreign direct investment. In 2016, several large Norwegian corporations went through a corporate inversion and brought parts of their activity abroad home to Norway. This restructuring across borders entailed financial transactions that particularly became visible in the 4th quarter. Foreign direct investment in equity abroad was substantially reduced by NOK 58 billion. Debt instruments under foreign direct investment in Norway had a reduction of a staggering NOK 185 billion, highly driven by the disappearance of intercompany lending from abroad.

The rise in portfolio investments was mainly due to net purchases of equity, both abroad and in Norway. General government purchased equity abroad amounting to NOK 15 billion.

On both the asset and liability side, other investments declined.

Changes in the financial account through 2016 are mentioned in the statistics Foreign assets and liabilities.

RevisionsOpen and readClose

For the current account: figures have been revised for the first three quarters in 2016.

For the financial account: figures include revisions dating back to the 1st quarter of 2015.

Additional information

For more information about price and volume growth of exports and imports, see the quarterly national accounts.

More details about exports and imports of goods and services are available in the statistics on external trade in goods and services.

Contact

-

Håvard Sjølie

E-mail: havard.sjolie@ssb.no

tel.: (+47) 40 90 26 05

-

Linda Wietfeldt

E-mail: linda.wietfeldt@ssb.no

tel.: (+47) 40 90 25 48