Content

Published:

Assets and liabilities adjusted

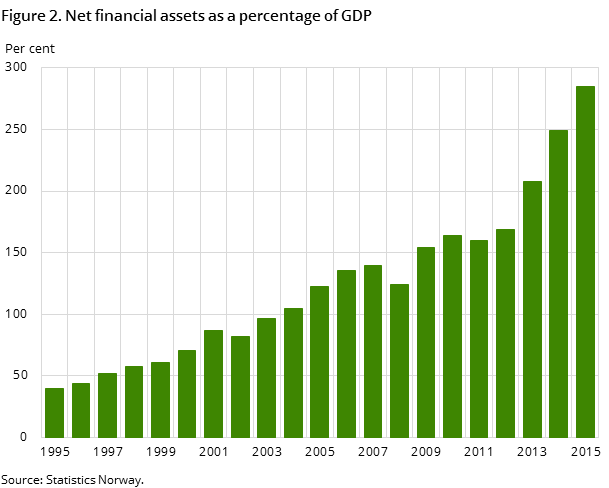

General government net financial assets amounted to NOK 8 876 billion at the end of 2015. The figure has been adjusted downwards by NOK 4 billion from the figure published in June.

| 2015 | Opening balance | Transactions | Capital gains | Closing balance |

|---|---|---|---|---|

| TOTAL ASSETS | 8 875 | 372 | 849 | 10 096 |

| Currency and deposits | 228 | -14 | 1 | 215 |

| Bonds | 2 415 | 144 | 226 | 2 785 |

| Loans | 638 | 91 | 9 | 738 |

| Shares and other equity | 5 233 | 135 | 609 | 5 977 |

| Other accounts receivable | 360 | 17 | 4 | 381 |

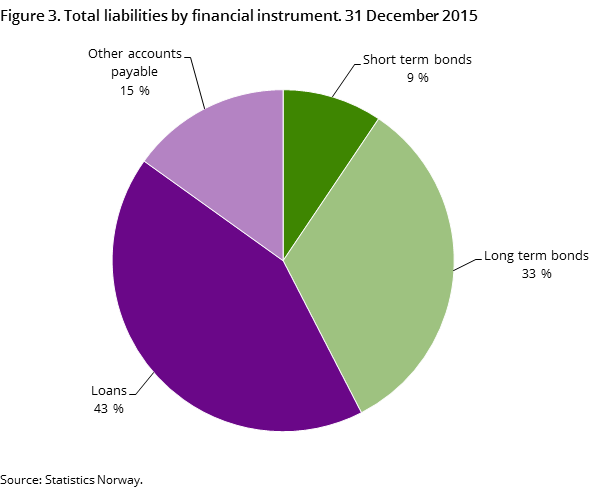

| TOTAL LIABILITIES | 1 044 | 182 | -6 | 1 219 |

| Bonds | 491 | 32 | -6 | 517 |

| Loans | 394 | 123 | 1 | 518 |

| Other accounts payable | 158 | 28 | -1 | 184 |

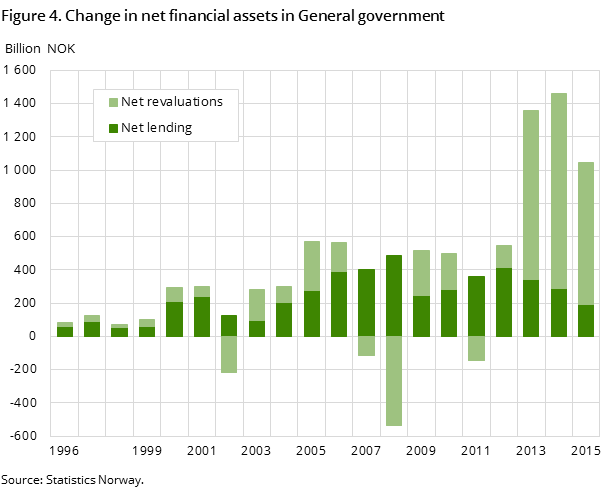

| NET FINANCIAL ASSETS | 7 831 | 190 | 855 | 8 876 |

Total liabilities have been adjusted upwards by NOK 22 billion and total assets have been adjusted upwards by NOK 18 billion. The adjustments combined represent about 0.04 per cent of net financial assets.

The main explanation for the adjustment of figures for 2015 is that Statistics Norway has implemented new data sources from the central government in the statistics. New sources for long-term bond liabilities have also caused revisions of total liabilities for the last four years.

Gross public debt at the end of 2015 has been adjusted from NOK 992 billion to NOK 997 billion.

For a more detailed description of general government assets and liabilities, see the previous article.

Liabilities connected to the Government Pension Fund GlobalOpen and readClose

Repurchase agreements and re-sale agreements in securities are frequently used instruments in the administration of the Government Pension Fund Global. The fund sells a portfolio of securities accompanied by a repurchase agreement. However, in the accounts, the portfolio remains on the asset side of the fund’s balance sheet, as does the cash received for the sale. The corresponding sales value is then entered as a loan from the buyer on the liability side of the balance sheet. The reverse situation is called a re-sale agreement or a reversed repo.

This page has been discontinued, see General government, financial assets and liabilities, Quarterly.

Additional information

Contact

-

Jostein Birkelund

E-mail: jostein.birkelund@ssb.no

tel.: (+47) 40 90 26 55

-

Achraf Bougroug

E-mail: achraf.bougroug@ssb.no

tel.: (+47) 40 90 26 15

-

Frode Borgås

E-mail: frode.borgas@ssb.no

tel.: (+47) 40 90 26 52