Content

Published:

This is an archived release.

Property tax increases both in extent and in value

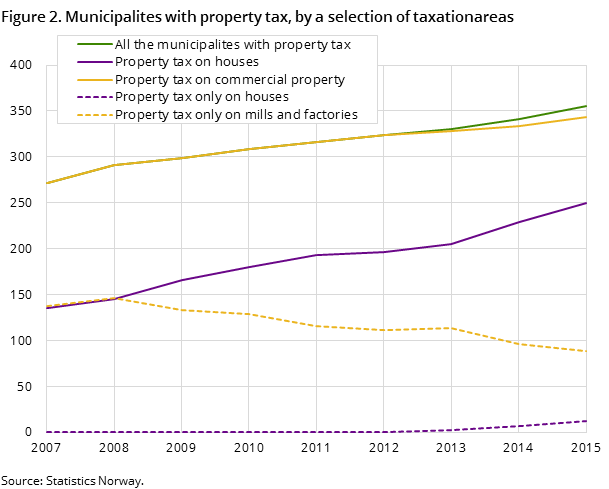

This year, property tax is a source of revenue for 355 municipalities. The municipalities had total revenues of NOK 9.6 billion from property tax in 2014, which corresponds to 2.5 per cent of the municipalities’ total gross operating revenues.

| 2014 | 2015 | Per cent | ||

|---|---|---|---|---|

| 2013 - 2014 | 2014 - 2015 | |||

| 1Figures for property tax accounts are published the year after the other figures concerning property tax. | ||||

| Municipalities with property tax | 341 | 355 | 3.3 | 4.1 |

| Municipalities with property tax on mills and factories | 96 | 88 | -15.0 | -8.3 |

| Municipalities with property tax on both mills and factories and areas built in | 12 | 10 | -14.3 | -16.7 |

| Municipalities with property tax in the municipalities as a whole | 199 | 221 | 12.4 | 11.1 |

| Property tax, total (NOK 1 000)1 | 9 626 585 | .. | 8.4 | .. |

| Property tax from commercial property (NOK 1 000)1 | 5 444 101 | .. | 5.0 | .. |

| Property tax from residential homes and holiday properties (NOK 1 000)1 | 4 182 484 | .. | 13.3 | .. |

| Property tax as a percentage of gross operating income1 | 2.5 | .. | 4.2 | .. |

The municipalities had total revenues of NOK 9.6 billion from property tax in 2014, compared to NOK 8.9 billion in 2013.

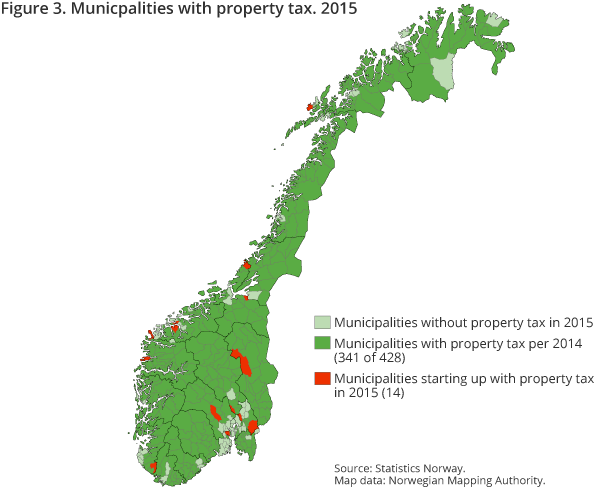

As per 2015, 355 municipalities have chosen to collect property tax as a source of income compared to 341 municipalities in 2014. Of this, 88 municipalities have imposed property tax on mills and factories, while 10 municipalities have chosen to collect property tax from the areas used for mills and factories as well as areas built with town-like features. A total of 221 municipalities have chosen to collect property tax in the municipality as a whole; an increase of 22 municipalities since 2014. There are thus 250 municipalities that have property tax on residential property compared to 229 in 2014. In total, 73 municipalities have responded that they are not imposing property tax in 2015.

Increased revenue from property tax

The municipalities’ income generated from property tax increased by about NOK 747 million from 2013 to 2014. Property tax accounted for 2.5 per cent of the total gross operating revenues. Income from property tax is divided into two categories; commercial property, and residential homes and holiday properties. In 2014, property tax from commercial property amounted to 56.6 per cent or about NOK 5.4 billion, while 43.4 per cent, or just about NOK 4.2 billion, was derived from residential homes and holiday properties.

Revenues from property tax as a percentage of gross operating income vary from 0.1 per cent to 38.3 per cent among the 341 municipalities that had imposed the tax in 2014. The variation arises mainly from whether they generate the revenues from property taxes charged from commercial property or from residential homes and holiday properties.

General tax rates, differentiated tax rates, basic deductions and exemptions for new houses

In 2015, the average tax rate is 5.7 per thousand; approximately the same as in 2014. The general tax rate is set to a minimum of 2 per thousand and a maximum of 7 per thousand. The municipalities can determine the level of tax rate payable themselves. A total of 101 municipalities have chosen to have a differentiated tax rate for residential homes and holiday properties. Ninety-nine municipalities have a basic tax deduction for residential homes and holiday properties, while 87 municipalities exempt new houses from property taxation.

RevenuesOpen and readClose

Figures for property tax accounts are published the year after the other figures concerning property tax.

Contact

-

Else Helena Bredeli

E-mail: else.bredeli@ssb.no

tel.: (+47) 40 90 26 53

-

Anne Brit Thorud

E-mail: anne.brit.thorud@ssb.no

tel.: (+47) 40 90 26 59