Content

Published:

This is an archived release.

Weak figures in manufacturing

According to Norwegian industrial managers, there was a levelling out in total output in the first quarter of 2015. Reduced activity among manufacturers of capital goods is one of the main reasons for the curb in output. Expectations for the second quarter of 2015 suggest a decline in the business cycle in manufacturing.

| 1st quarter 2015 | ||

|---|---|---|

| Changes from previous quarter | Expected changes in next quarter | |

| 1A diffusion index is compiled using the estimated percentages on "ups" and "same" according to the formula: (ups + 0,5 * same). The diffusion index has a turning point at 50. An index value above 50 indicates growth in the variable, and opposite for a value below 50. | ||

| Total volume of production | 49.5 | 50.1 |

| Average capacity utilisation | 49.4 | 50.5 |

| Average employment | 47.1 | 40.8 |

| New orders received from home markets | 46.4 | 47.1 |

| New orders received from export markets | 45.0 | 46.9 |

| Total stock of orders | 45.4 | 46.3 |

| Prices on products at home markets | 51.8 | 52.2 |

| Prices on products at export markets | 51.4 | 50.2 |

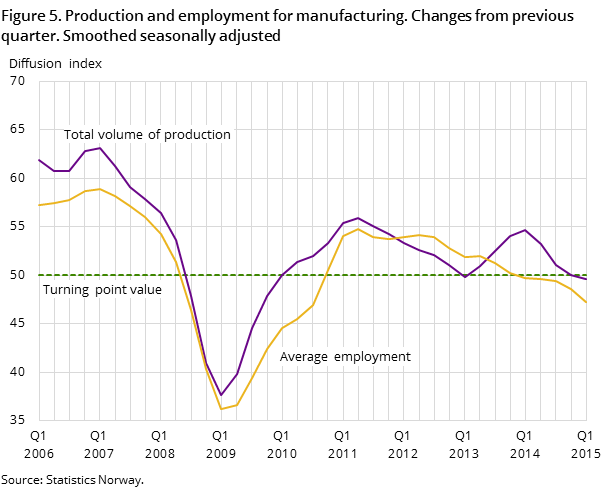

The business tendency survey for the first quarter of 2015 shows a levelling out in total production. Manufacturers of capital goods are experiencing a clear decline in production. This is explained in particular by a fall in the level of activity among suppliers to the oil and gas sector. Industries like machinery and equipment, construction of ships, boats and oil platforms, and in repair and installation of machinery all saw a decline in production. This decline in capital goods slowed down the overall development of production in manufacturing.

Within producers of intermediate goods and consumer goods the situation is somewhat different as the production volume increased in the first quarter of 2015. Among producers of intermediate goods, there was increased production in industries such as wood and wood products and in basic chemicals, while production declined in basic metals. The food and food products industry, the largest single manufacturing industry in Norway (article in Norwegian), is a significant contributor to the increase in production of consumer goods.

Industrial managers reported a decline in total employment in the first quarter of 2015. The decline comes from manufacturers of capital goods and consumer goods. The reduction in capital goods can be linked to lower levels of activity among suppliers to the oil and gas sector, while the decline in consumer goods is more related to centralisation and automation in the food industry. Producers of intermediate goods on the other hand have increased employment, therefore dampening the overall downturn in the industry.

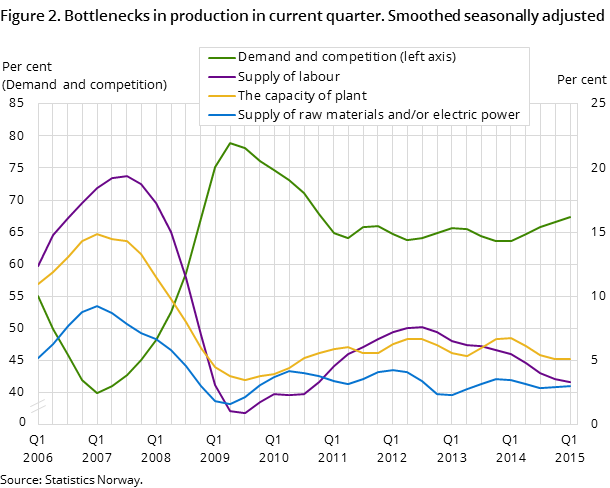

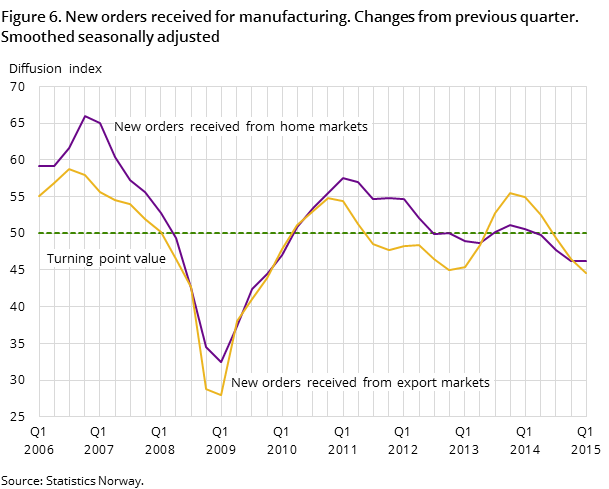

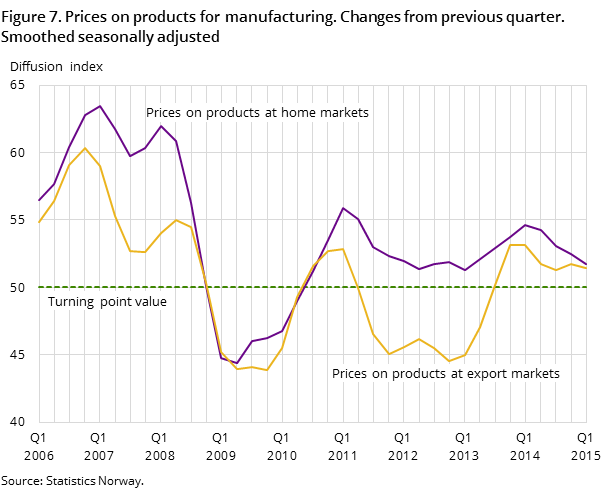

Lower level of new orders

There was an overall decline in new orders in the first quarter of 2015. The decline mainly stems from producers of capital goods where market conditions have weakened further in this quarter. There is a clear increase in the number of industrial managers pointing to weak demand and strong competition as factors that are limiting production. The decline in new orders was particularly evident in the construction of ships and oil platforms and in the machine industry. For manufacturers of intermediate goods the total stock of orders was practically unchanged. Within the export-oriented industry of non-ferrous metals prices have increased. Currency effects due to a weakened Norwegian krone contributed to this. The demand from the export market is low and the overall stock of orders is slightly down in this industry. Manufacturers of consumer goods had an increase in both orders and prices, where the food and food products industry in particular contributed to the increase.

Pending decline in second quarter of 2015

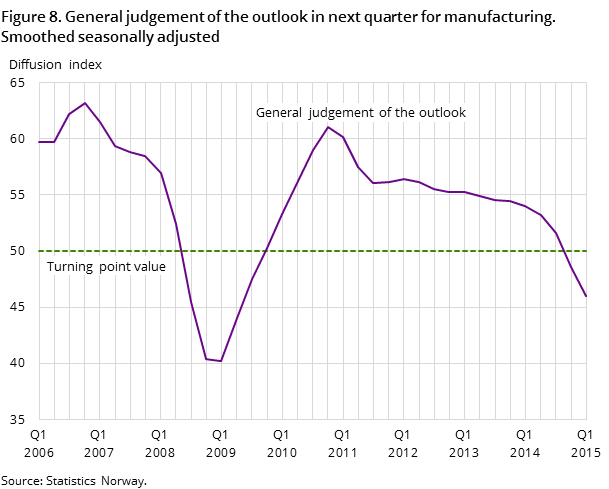

The general outlook for the second quarter of 2015 is negative, and is at its lowest level since the second quarter of 2009. Investment plans are adjusted downward and both employment and the stock of orders are expected to fall. This development is especially influenced by the producers of investment goods, who are negative with respect to the second quarter. This is partly due to the estimated drop in investments in oil and gas in 2015. Producers of intermediate goods and consumer goods are more optimistic about the future, but employment is expected to fall.

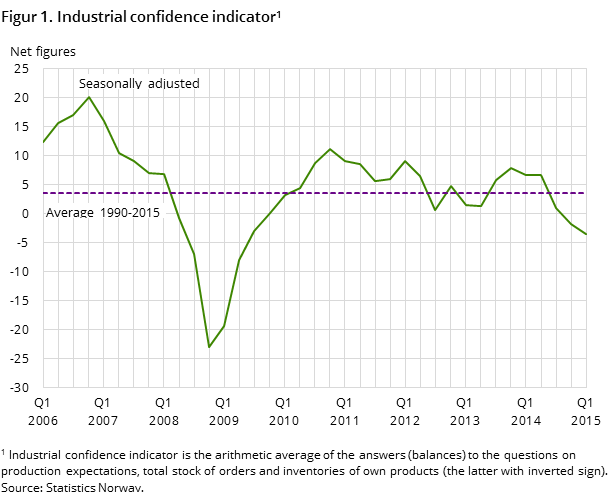

The industrial confidence indicator fell from - 2 to -3 (seasonally-adjusted net figures) in the first quarter of 2015 and was below the historical average. The decline was particularly strong for producers of capital goods, where lower stock of orders and the expected decline in production are the main reasons for the overall drop. Values above zero indicate that total output will grow, while values below zero indicate that total output will fall. International comparisons of the industrial confidence indicator are available from Eurostat (EU), The Swedish National Institute of Economic Research and Statistics Denmark.

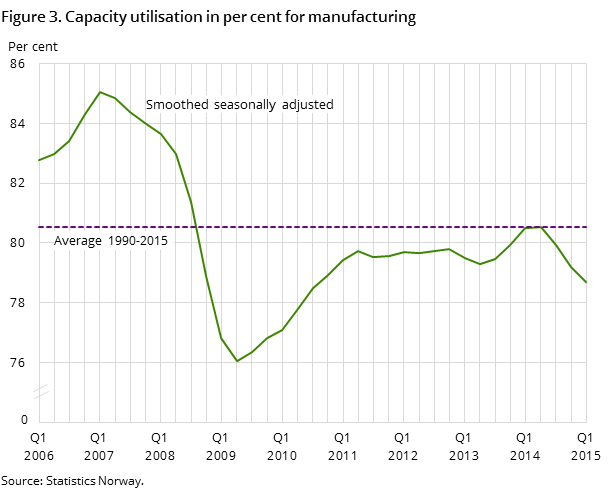

Declining capacity utilisation in manufacturing

Average capacity utilisation for Norwegian manufacturing was calculated to 78.7 per cent at the end of the first quarter of 2015. This is the lowest level recorded since the third quarter of 2010. The result is below the historical average. The decline in capacity utilisation was strongest among manufacturers of capital goods. International comparisons of average capacity utilisation are available from Eurostat (EU).

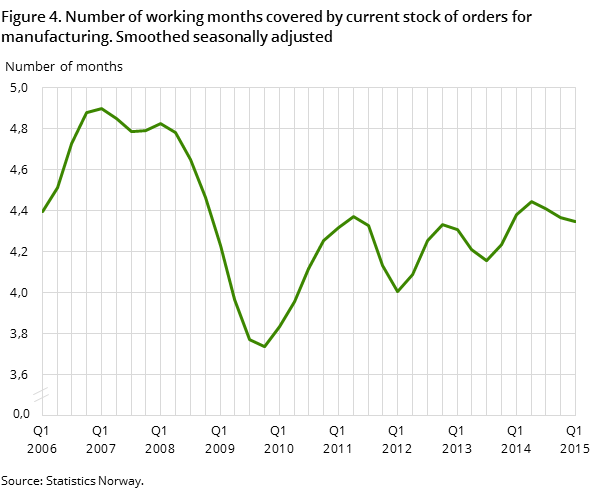

Average number of working months covered by the current stock of orders was in the first quarter slightly down from the previous quarter, but is still above the historical average. The indicator on resource shortage is down in the first quarter of 2015. An improvement in the shortage of labour supply and fewer with full capacity utilisation explain this.

The survey data was collected in the period from 10 March 2015 to 24 April 2015.

Assessment of industries in Q1 2015 and the short-term outlook¹:

1 An overall evaluation of the present situation and expected short-term developments. 2 Very good: ++, Good: +, Stable: ~, Poor: -, Very poor: --, Good, but with certain negative indications: +(-), A situation where the + and - factors even out: +/-, Poor, but with certain positive indications: -(+) | |

| Industry | Evaluation 2 |

| Food, beverages and tobacco | + |

| Wood and wood products | + |

| Paper and paper products | + |

| Basic chemicals | + |

| Non-ferrous metals | +(-) |

| Fabricated metal products | - |

| Computer and electrical equipment | -(+) |

| Machinery and equipment | -- |

| Ships, boats and oil platforms | -- |

| Repair, installation of machinery | - |

Additional information

The statistics provide current data on the business cycle for manufacturing, mining and quarrying by collecting business leaders’ assessments of the economic situation and the short term outlook.

Contact

-

Edvard Andreassen

E-mail: edvard.andreassen@ssb.no

tel.: (+47) 40 90 23 32

-

Ståle Mæland

E-mail: stale.maeland@ssb.no

tel.: (+47) 95 05 98 88